Laura V. Rodriguez

(202) 205-3499

laura.rodriguez@usitc.gov

Change in 2013 from 2012:

- U.S. trade deficit: Increased by $3.2 billion (3 percent) to $97.5 billion

- U.S. exports: Increased by $543 million (3 percent) to $19.8 billion

- U.S. imports: Increased by $3.7 billion (3 percent) to $117.2 billion

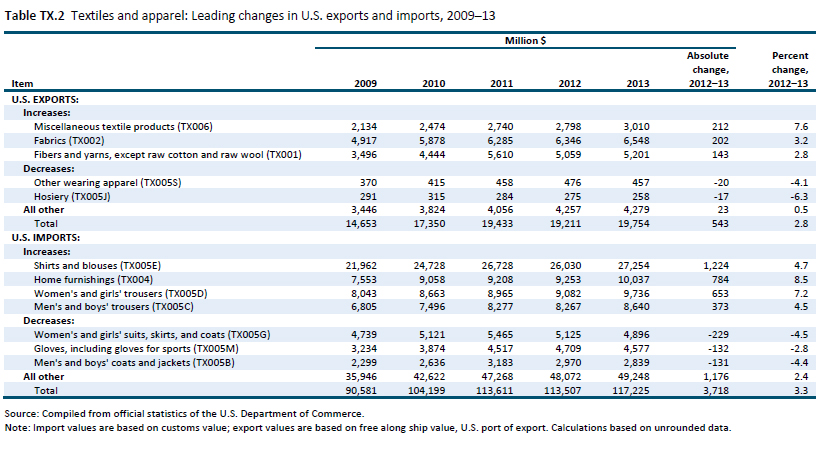

In 2013, the U.S. trade deficit in textiles and apparel rose to $97.5 billion, the result of a substantial ($3.7 billion) increase in U.S. imports that outweighed the small increase in U.S. exports (table TX.1). Imports supplied about 98 percent of U.S. consumer demand for textiles and apparel in 2013. Compared to the small decline in U.S. imports in 2012, the significant growth in U.S. imports in 2013 reflected the strengthening U.S. economy.Imports in four categories—shirts and blouses, home furnishings, women’s and girls’ trousers, and men’s and boys’ trousers—together accounted for 48 percent of U.S. imports of textiles and apparel in 2013 (table TX.2). U.S. exports of fabrics continued to lead sector exports, rising 3 percent to $6.5 billion. These exports were followed by U.S. exports of fibers and yarns (excluding raw cotton and raw wool), which also rose 3 percent to $5.2 billion.

The United States continued to register a trade deficit in textiles and apparel with several of its top trading partners. The largest trade deficit increases were with China ($1.1 billion), Vietnam ($1.1 billion), and India ($480 million). Continuing a trend that began in 2009, the U.S. trade deficit with Mexico shrank in 2013, falling by $214 million (13 percent) to $1.4 billion as the $258 million increase in U.S. exports to Mexico outpaced the $43 million increase in U.S. imports from that country. China remained the largest supplier of U.S. imports of textiles and apparel in 2013, accounting for almost 40 percent of U.S. imports of these products.

U.S. Exports

U.S. exports of textiles and apparel rose by $543 million (3 percent) to $19.8 billion in 2013. U.S. exports in this sector are largely composed of textile articles, which accounted for 83 percent of all U.S. exports of textiles and apparel in 2013. Of these textile articles, fibers and yarns (excluding raw cotton and raw wool) were the second-largest export group (table TX.2). Exports of these products are used primarily as intermediate inputs for finished products manufactured abroad, which are then imported back into the United States. In 2013, the top U.S. export markets for textile inputs continued to be Mexico and Canada—partner countries in NAFTA—and Honduras, a partner country in the Dominican Republic-Central America-United States Free Trade Agreement (CAFTA-DR). These countries collectively accounted for almost half (48 percent) of U.S. exports of textile inputs in 2013.

U.S. Imports

U.S. imports of textiles and apparel rebounded from a modest decline in 2012, rising by $3.7 billion (3 percent) in 2013. The recovery in U.S. sector imports likely reflects a strengthening of the U.S. economy and a rise in U.S. consumers’ confidence in the economy in 2013. Although consumers reportedly were more frugal in purchasing clothing relative to expenditures on other goods or services in 2013, the value of U.S. apparel retail sales grew by almost 3 percent, reflecting growth of $6.9 billion in consumer spending on garments.

U.S. imports of textiles and apparel are principally composed of apparel, which represented slightly more than three-fourths of all U.S. sector imports by value in 2013. By quantity, total U.S. apparel imports rose by 5 percent between 2012 and 2013. This increase was largely driven by a 5 percent growth in U.S. imports of manmade-fiber apparel, which outpaced the 2 percent growth in U.S. imports of cotton apparel. The continued rise in demand for products made of manmade fibers reflects consumers’ growing preference for the functional and performance properties (i.e., moisture management, wearing comfort, elasticity, and recovery) that manmade fibers offer that natural fibers do not.

U.S. imports from Asia, the largest regional supplier—accounting for three-quarters of all sector imports—rose by $3.4 billion (4 percent) to $88.1 billion. A significant share of the increase in U.S. imports of textiles and apparel in 2013 was accounted for by a $1.3 billion increase in imports from China, by far the leading supplier of textiles and apparel to the United States. Almost as substantial was the $1.1 billion growth (14 percent) in imports from Vietnam, the second-leading supplier of these products to the United States.

Despite stated efforts in recent years by U.S. retailers to diversify their supply chains, China still dominates as a supplier of textiles and apparel to the United States and is expected to remain the leading sourcing country. Although China’s textile and apparel production costs have been rising, industry sources report such costs have been offset by gains in productivity. China maintains significant advantages over other suppliers in economies of scale, infrastructure, efficiency, expertise, and stability. China’s share of U.S. imports of textiles and apparel by quantity grew to 48 percent of the total in 2013, up from 47 percent in 2012. This exceeded by more than seven times the volume of imports from India, the next leading supplier of textiles and apparel to the United States.

In 2013, U.S. imports of textiles and apparel from Vietnam grew by 14 percent to $8.6 billion. Led by cotton and manmade-fiber knit shirts/blouses and slacks/pants, these imports have grown rapidly in recent years. Reasons for this trend include the country’s relatively low labor costs; the industry’s focus on specialization, modernization, and increasing added value; and the government of Vietnam’s incentives to attract foreign investment for development. In 2013, several new textile and garment plants began production in Vietnam. In addition, the anticipation of the proposed Trans-Pacific Partnership (TPP) reportedly prompted the implementation of numerous fiber and textile projects to prepare for the possibility of greater market access. Also in 2013, significant investments were made to build several new textile and apparel facilities, including a $40 million factory to produce cotton yarn in Vietnam’s southern province of Binh Doung, a new spandex production facility in the province of Dong Nai, and a $100 million denim plant in the northeastern province of Quang Nkinh.

U.S. imports from South Asian suppliers Bangladesh and India also experienced significant growth, rising by $473 million (10 percent) and $468 million (7 percent), respectively, in 2013. Despite political uncertainty, factory safety problems, and labor disturbances in 2013, U.S. imports from Bangladesh continued to grow because the country’s low labor costs help it to meet the global market’s demand for competitively priced apparel. As a result, the Bangladesh textiles and apparel sector has been attracting business from international apparel brands and retailers such as Wal-Mart, JC Penney, the Gap, and others. The growth in U.S. sector imports from India likely reflects the industry in India’s efforts to upgrade its technology, focus on innovation in product and design, and improve training.