Cynthia B. Foreso

(202) 205-3348

cynthia.foreso@usitc.gov

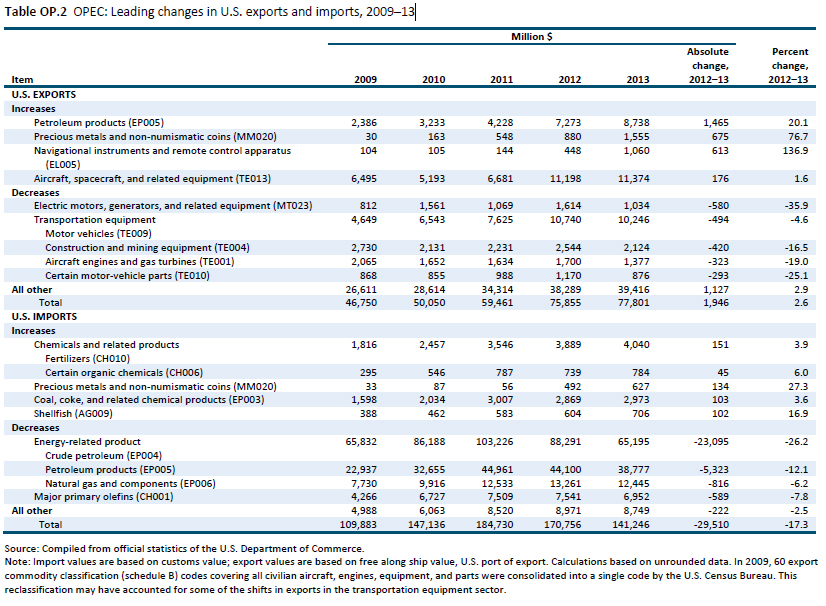

Change in 2013 from 2012:

- U.S. trade deficit: Decreased by $31.4 billion (33 percent) to $63.4 billion

- U.S. exports: Increased by $1.9 billion (3 percent) to $77.8 billion

- U.S. imports: Decreased by $29.5 billion (17 percent) to $141.2 billion

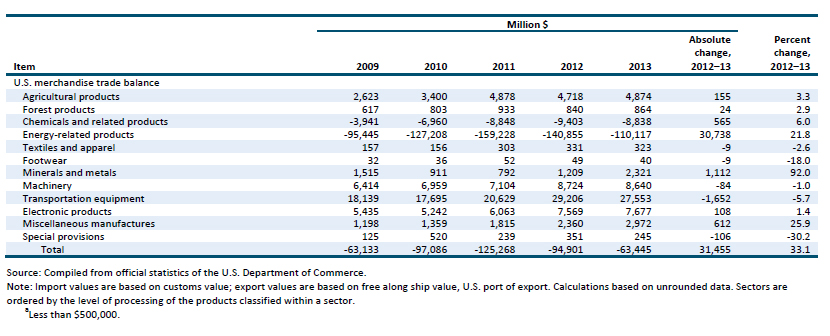

The OPEC countries collectively accounted for 7 percent of the total U.S. trade deficit in 2013 (table OP.1). Energy-related products accounted for 85 percent of U.S. imports from OPEC member countries in 2013. Crude petroleum imports from OPEC countries declined from $88.3 billion in 2012 to $65.2 billion in 2013, due principally to flat U.S. consumption and increasing U.S. production.

OPEC member countries coordinate and unify their petroleum policies with a view to ensuring the stability of prices in international oil markets. OPEC collectively accounted for 73 percent of the world’s reserves of crude petroleum and 41 percent of the world’s total production in 2013.55 Saudi Arabia supplied 31 percent of OPEC’s crude production in 2013, followed by Venezuela (8 percent) and Nigeria (6 percent).

U.S. Exports

In 2013, U.S. exports of goods to the OPEC member countries accounted for only 6 percent of total U.S. exports. The primary products exported included transportation equipment, energy-related products, and certain drilling equipment.

There was a major shift in U.S. exports of energy-related products to OPEC countries, which rose by 21 percent in 2013 (table OP.2). The increase is accounted for by rising prices of petroleum products, primarily jet fuels to Nigeria and distillate and residual fuel oils to Ecuador, Venezuela, and Nigeria. Although Nigeria has four refineries, their capacity utilization rates hover around 16–18 percent due to operational failures, fires, and sabotage (mainly of pipelines leading from the wellhead to the refineries). As a result, the four refineries do not meet domestic demand. Ecuador is a net importer of petroleum products, and its three refineries, which are small and operate well below capacity, likewise do not meet domestic demand. Most of Venezuela’s crude petroleum is refined outside of the country; 40 percent is refined along the U.S. Gulf Coast and is dedicated to the U.S. market. During 2013, Venezuela was unable to meet its domestic demand for distillate and residual oils because its domestic refineries were operating at about 50 percent capacity, and much of that capacity was slated for export to neighboring countries under long-term contracts. As a result, Venezuela imported distillate and residual fuel oils from U.S. refineries.

Transportation equipment was the largest U.S. export to the OPEC countries in 2013, accounting for 36 percent of the total. U.S. exports of ships, tugs, and pleasure boats increased by nearly 183 percent to $113 million in 2013, while exports of construction and mining equipment more than doubled, reaching $14.2 million. The United Arab Emirates is a major market for U.S. exports of these products and acts as a regional entry point for U.S. firms seeking access to the Middle East’s markets. In addition, the country is rapidly adding to its stock of civil aircraft and undertaking significant infrastructure projects, which boosted import demand for construction equipment in 2013.

U.S. Imports

U.S. imports of energy-related products from OPEC countries decreased by 20 percent to $119.4 billion between 2012 and 2013, with Saudi Arabia, Venezuela, and Nigeria being the principal OPEC sources. Energy-related products accounted for nearly the entire shift in U.S. imports from OPEC countries in 2013 and accounted for 85 percent of total U.S. imports from these countries. Crude petroleum was the largest import category in 2013, accounting for about 46 percent of the total value of U.S. imports from OPEC, followed by petroleum products (27 percent). The United States imports very little natural gas and coal from OPEC countries.

The quantity of U.S. imports of crude petroleum from OPEC declined by 14 percent to 1.4 billion barrels in 2013. The drop in imports of crude resulted from increased U.S. production, stagnant U.S. demand, and supply disruptions in both Venezuela and Nigeria.

U.S. imports of crude petroleum from Saudi Arabia declined by 3 percent to 484.8 million barrels in 2013, while imports from Venezuela declined by 17 percent to 291.0 million barrels. While Venezuela has been decreasing its exports to the United States in recent years in an effort to diversify its markets, the United States remains Venezuela’s primary market. Venezuela exports heavy crude, which can be refined into petroleum products in refineries on the U.S. Gulf Coast that were specifically designed for this type of crude. Other markets for Venezuela’s crude include China, the Caribbean, and the European Union.

The quantity and the share of U.S. imports from Nigeria have fallen substantially during the past few years. Such imports declined by 37 percent in 2013 to a new low of 102.6 million barrels. Some of this decline can be attributed to the growth in U.S. crude petroleum production from the Bakken and Eagle Ford formations, both of which are of similar quality and as a result partially displaced Nigeria’s crude. Also, Nigerian crude as a share of U.S. imports has fallen as a result of the idling of two U.S. East Coast refineries in late 2011 and early 2012 that were significant purchasers of Nigerian crude; the two refineries reopened in 2013, but are primarily refining domestically produced crude.

U.S. imports of petroleum products from OPEC also declined in 2013, by $5.3 billion (12 percent) to $38.8 billion. In terms of quantity, these imports declined from 87.8 million barrels to 79.3 million barrels (or by 10 percent). The decline is largely attributed to lower U.S. demand for these products. Also, U.S. refineries, which generally satisfy over 90 percent of domestic consumption, increased their capacity utilization rates in 2013 and thereby domestic production,62 further reducing demand for imports. OPEC accounted for 10 percent of total U.S. imports of petroleum products in 2013, with Algeria (4 percent), Venezuela (2 percent), and Saudi Arabia (less than 1 percent) being the leading OPEC sources.

The primary petroleum products imported from Algeria include distillate and residual fuel oils shipped to the U.S. northeastern states. Algeria’s three coastal refineries produce a surplus of petroleum products, and the United States is the market for about 50 percent of this surplus. U.S. imports of petroleum products from Venezuela continued to decline from the low levels witnessed in 2012. The drop in 2012 was due to the massive gas explosion that occurred at the Paraguaná refinery in August of that year, which resulted in its total closure; the refinery is still not fully operational. U.S. imports of petroleum products from Saudi Arabia tend to be specialty naphthas, which have a high unit value. These imports fluctuate, entering the U.S. market in response to refinery maintenance needs.