Jeff Okun-Kozlowicki

(202) 205-3366

jeff.okun.kozlowicki@usitc.gov

Change in 2013 from 2012:

- U.S. trade deficit: Increased by $3.0 billion (7 percent) to $46.8 billion

- U.S. exports: Decreased by $0.1 billion (0.1 percent) to $122.3 billion

- U.S. imports: Increased by $2.9 billion (2 percent) to $169.1 billion

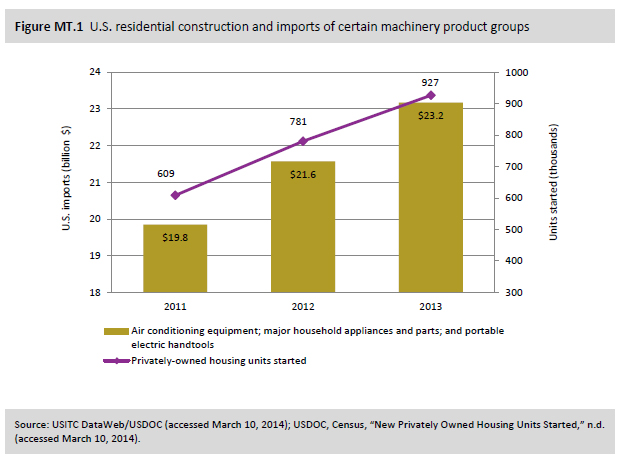

In 2013, the U.S. merchandise trade deficit for machinery rose by $3.0 billion to $46.8 billion, a 7 percent increase. Higher U.S. imports of machinery were attributable in part to increased residential and commercial construction in the United States, which boosted demand for several machinery product groups (figure MT.1).

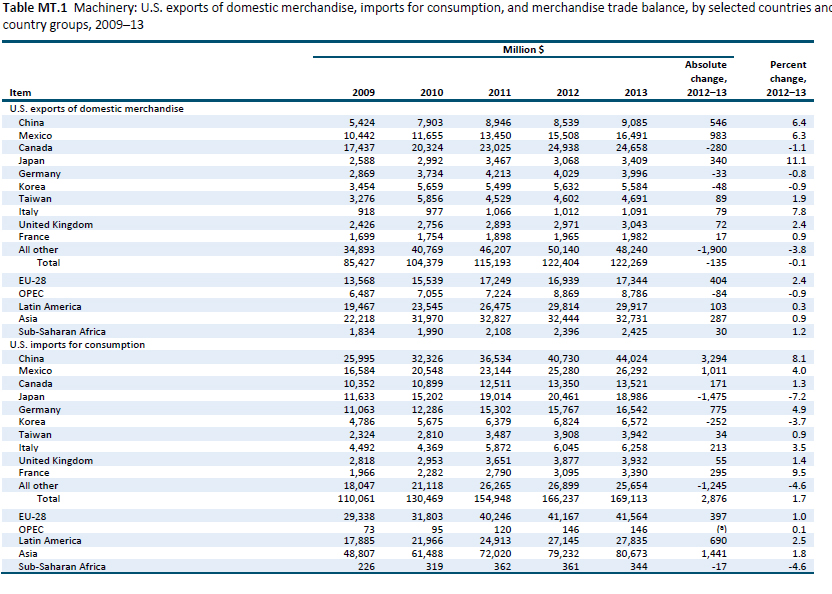

The United States maintained trade deficits for machinery with most major trading partners except for Canada, Taiwan, and Brazil (table MT.1). In 2013, the machinery trade deficit with China increased by $2.7 billion (9 percent) to $34.9 billion, while the deficit with Japan decreased by $1.8 billion (10 percent) to $15.6 billion.

U.S. Exports

U.S. exports of machinery decreased slightly, falling by $135 million (0.1 percent) to $122.3 billion in 2013. Major shifts occurred in taps, cocks, valves, and similar devices; farm and garden machinery and equipment; electric motors and generators; and metal rolling mills (table MT.2). By destination, Mexico, China, and Japan accounted for the largest increases in the value of U.S. exports of machinery (table MT.1). The largest decline in U.S. exports was to Canada.

The largest absolute increase in machinery exports occurred in exports of taps, cocks, valves, and similar devices, which increased by $1.2 billion (13 percent) to $10.2 billion in 2013. Global demand for this product group—which is often used in oil and gas applications—has expanded steadily since 2010, as the petroleum refining and pipeline industries have rebounded following the economic recession. Increased exports to Korea, China, Mexico, and Singapore accounted for 55 percent of the total increase in U.S. exports in 2013.

The largest absolute decrease in machinery exports was in farm and garden machinery, exports of which decreased by $1.5 billion (11 percent) to $11.6 billion. Following a surge in exports in 2011 and 2012 resulting from strong farm incomes, high food prices, and a weak U.S. dollar, exports decreased in 2013 to all major markets except Canada. Slower economic growth, falling food prices, and a stronger U.S. dollar contributed to export declines to several leading markets, such as Brazil, Russia, and South Africa. The export decline to Australia may be attributable to Australian farmers’ struggles with serious drought and a strong Australian dollar, which hurt demand for Australian farm exports.1The largest decrease in this product group occurred in track-laying tractors, exports of which fell by 54 percent to $805 million in 2013. U.S. exports of this product group to Canada, on the other hand, increased by $330 million (9 percent) to $4.2 billion in 2013. North American farmers were reportedly in a financial position that allowed them to upgrade their equipment.

U.S. exports of motors, generators, and related equipment fell by $1.0 billion (11 percent) to $8.3 billion in 2013. This primarily reflects an $811 million (35 percent) decline in exports of other generating sets, with the largest decline in exports to Venezuela and Australia. There are significant annual fluctuations in U.S. exports of these products, with export volumes and destinations often correlated with orders for individual power plants.

U.S. exports of metal rolling mills declined by $83 million (19 percent) to $347 million in 2013. Exports to China of this product group decreased by $41 million (29 percent) to $101 million in 2013, the lowest level of such exports in recent years. Most of the decline was in exports of parts for rolling mills. The decrease may have been due to improved capabilities of the Chinese industry to manufacture its own rolling mills and parts.

U.S. Imports

In 2013, U.S. imports of machinery increased by $2.9 billion (2 percent) to $169.1 billion. Major shifts occurred in household appliances; air conditioning equipment and parts; portable electric hand tools; boilers, turbines, and related machinery; metal rolling mills; semiconductor manufacturing equipment; electric motors, generators, and related equipment; metal cutting machine tools; and pulp, paper, and paperboard machinery. By origin, China, Mexico, and Germany accounted for the largest increases, while Japan accounted for the largest decrease in the value of U.S. machinery imports.

The largest absolute increase in machinery imports in 2013 came from imports of household appliances, which increased $1.2 billion (6 percent) to $22.8 billion. The increase was largely composed of greater imports of combined refrigerator-freezers from China and Mexico (up by $399 million), along with food processors (up by $200 million) and other motorized appliances. The increase in imports is attributable to growth in residential construction, which is one of the largest drivers of demand for household appliances.178 Imports of household appliances from China rose by $1.4 billion in 2013; such imports have grown every year since 2010, as more companies have located their overseas facilities in China to access low labor costs.

The second-largest absolute increase involved imports of air-conditioning equipment and parts, which increased by $932 million (7 percent) to $15.0 billion. The import growth largely came from Mexico (up by $618 million), China ($183 million), and Korea ($105 million). Growth in residential and commercial construction and home improvements spurred demand for this product group, which is increasingly produced overseas. The increase in imports is part of a trend since 2010, as manufacturers moved some of their facilities for this product group to Mexico, China, and other markets during the economic recession.

The largest absolute decrease in U.S. imports came in semiconductor manufacturing equipment and robotics, which fell by $1.2 billion (10 percent) to $11.5 billion in 2013. The decrease in 2013 followed a $1.1 billion decrease in 2012. The decline was driven primarily by a $1.3 billion decline in U.S. imports of machines and apparatus for the manufacture of semiconductor devices or electronic integrated circuits. Imports from the top five U.S. partners for these products—Japan, the Netherlands, Singapore, Korea, and Germany—fell by $1.3 billion in 2013 (figure MT.2). The decrease in 2013 likely indicates a shift away from demand for larger, high-capital machinery investments, as the construction of a number of large new semiconductor wafer fabrication facilities concluded in the United States. However, despite the fall in import values, U.S. import quantities of semiconductor manufacturing equipment more than doubled in 2013, indicating an increase in imports of lower-value parts, components, and machinery. Import values for semiconductor manufacturing equipment have fluctuated frequently over the past decade due to changes in the capacity needs of the domestic semiconductor manufacturing industry.

U.S. imports of electric motors, generators, and related equipment fell $1.1 billion (8 percent) to $12.1 billion in 2013. The decline was likely due to decreased wind turbine demand linked to the expected expiration of a long-standing production tax credit (PTC)—the main tax credit for the wind sector—at the end of 2012. While the PTC was ultimately renewed, the late timing of the renewal motivated managers to schedule project activities for 2012 that might otherwise have been left for 2013; the uncertainty also limited project development activity going into 2013. As a result, U.S. wind turbine installations declined from 13,131 megawatts (MW) in 2012 to 1,084 MW in 2013. This led to a $952 million decline in U.S. imports of wind-powered generating sets, a $159 million decline in imports of generators for wind turbines, and a $95 million decline in imports of parts of wind turbine generators.

Imports of metal-cutting machine tools decreased by $716 million (12 percent) to $5.1 billion in 2013. Much of the decline came in the form of reduced imports of machining centers and lathes, which are widely used in the motor vehicle, aerospace, and medical devices industries. U.S. consumers of machine tools tend to purchase these large capital machines every three to five years. The decrease in 2013 thus reflects typical industry trends, as imports of this product group increased by $3.3 billion from 2010 to 2012. By market, imports from Japan fell by $362 million (15 percent) in 2013, followed by those from Taiwan ($129 million, or 25 percent), Germany ($119 million, or 12 percent), and Korea ($115 million, or 25 percent). The drop in imports from Japan was due to Japanese companies increasing their U.S.-based production beginning in late 2012: one producer opened a new U.S factory in 2013, and another expanded its existing U.S. operations.