Vincent Honnold

(202) 205-3314

vincent.honnold@usitc.gov

Change in 2013 from 2012:

- U.S. trade balance: Decreased by $1.9 billion to a deficit of $0.7 billion

- U.S. exports: Increased by $0.9 billion (2 percent) to $39.2 billion

- U.S. imports: Increased by $2.9 billion (8 percent) to $40.0 billion

After three consecutive years of trade surpluses in the forest products sector, the United States swung into a trade deficit in 2013 as a small increase in exports was more than offset by a significant increase in imports. Continued recovery in the U.S. housing market during 2013 drove an increase in demand for imports of wood products such as lumber, wood veneer and wood panels, and moldings, millwork, and joinery. Strengthening construction markets in China led to greater demand for U.S. exports of wood building products.

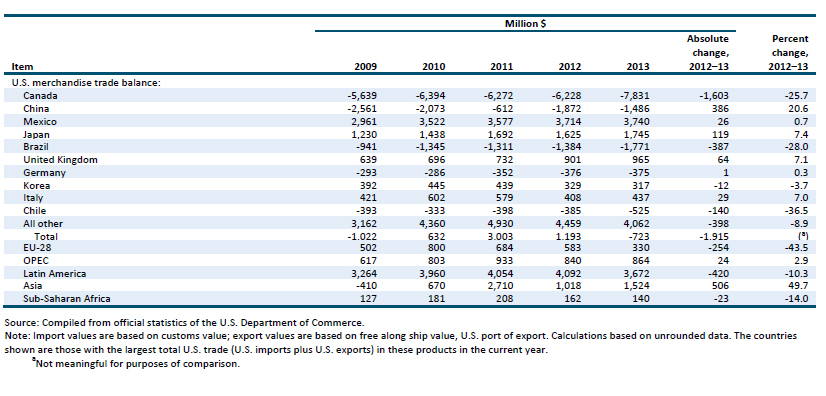

With an abundance of forest resources, proximity to the United States, and a long-established forest products industry, Canada has traditionally been the largest trading partner of the United States in forest products. In 2013, Canada accounted for 26 percent of the value of U.S. forest products exports and 45 percent of the value of U.S. imports (table FP.1). The U.S. trade deficit with Canada in forest products increased irregularly between 2009 and 2013, from $5.6 billion to $7.8 billion. China is the second-largest trading partner of the United States in this sector and in 2013 accounted for 17 percent of the value of U.S. forest products exports and 21 percent of the value of U.S. imports. The U.S. trade deficit with China in forest products, while fluctuating, has decreased overall from $2.6 billion in 2009 to $1.5 billion in 2013. Other large trading partners of the United States in forest products include Mexico, Japan, and Brazil.

U.S. Exports

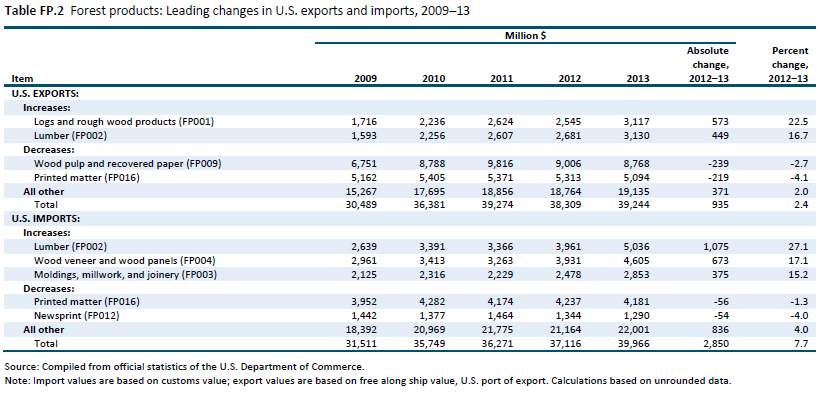

U.S. exports of forest products rose by 2 percent between 2012 and 2013, from $38.3 billion to $39.2 billion. Most of this increase was accounted for by growth in U.S. exports of logs and rough wood products and lumber, primarily to China (table FP.2). U.S. exports of logs and rough wood products to China rose from $819 million in 2012 to $1.2 billion in 2013, and U.S. exports of lumber to China grew from $743 million in 2012 to $1.0 billion in 2013. Strong construction markets in China increased both demand and prices in these two product categories. Export prices for two commodity grades of U.S. logs increased by 11 percent and 16 percent in 2013 over 2012 levels. The average unit value of U.S. lumber exports to China rose by 3 percent between 2012 and 2013.

U.S. Imports

U.S. imports of forest products grew by 8 percent, from $37.1 billion in 2012 to $40.0 billion in 2013. U.S. imports of lumber, wood veneer and wood panels, and moldings, millwork, and joinery accounted for most of this increase, and within these three product categories, imports from Canada accounted for most of the growth. Imports from Brazil of wood veneer and wood panels and moldings, millwork, and joinery accounted for a smaller portion of this growth. During 2013, the continued recovery in the U.S. housing market strengthened demand and prices for these products. Canadian and Brazilian suppliers participated in this recovery, as did Chinese and Mexican suppliers, to a lesser extent.

U.S. imports of lumber increased by more than $1 billion (27 percent) in 2013 compared to 2012, largely because of demand for single-family housing units. U.S. housing starts increased by 18 percent between 2012 and 2013, from 781,000 starts to 923,000 starts. U.S. housing starts in 2013 were 67 percent higher than during the 2009 trough, when housing starts bottomed out as a result of the financial crisis and subsequent recession.167 In 2013, U.S. housing starts reached their highest level since 2008. The largest category within U.S. housing starts, single-family starts, experienced a 15 percent gain between 2012 and 2013.168 Single-family starts consume a higher proportion of lumber to total building materials than multi-family starts.169 Strong U.S. demand in 2013 pushed up prices for commodity grades of lumber by more than 10 percent over 2012.

Demand for Canadian and Brazilian wood veneer and wood panels and moldings, millwork, and joinery also increased because of U.S. housing starts. Prices for many of these products increased, too. For example, prices for a commodity grade of medium-density fiberboard rose by 7 percent in 2013 over 2012.