Cynthia B. Foreso

(202) 205-3348

cynthia.foreso@usitc.gov

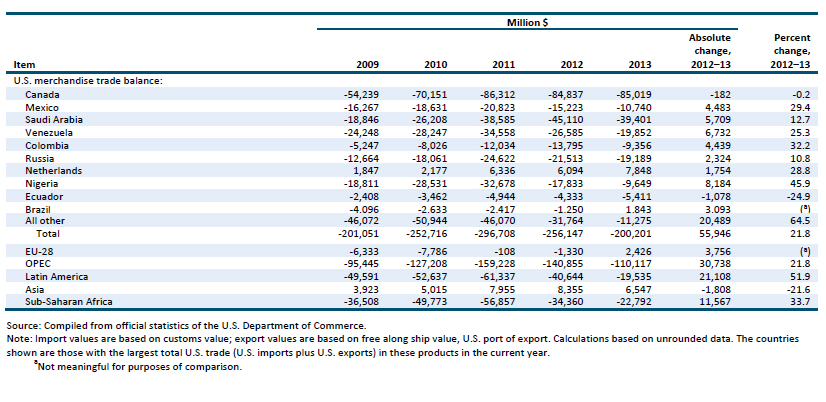

Change in 2013 from 2012:

- U.S. trade deficit: Decreased by $55.9 billion (22 percent) to $200.2 billion

- U.S. exports: Increased by $10.4 billion (7 percent) to $152.7 billion

- U.S. imports: Decreased by $45.6 billion (11 percent) to $352.9 billion

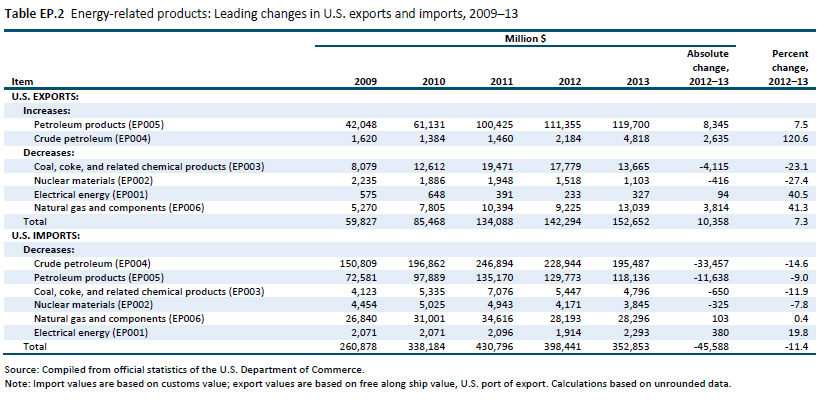

The U.S. trade deficit in the energy-related products sector fell by 22 percent (table EP.1) in 2013, continuing the 13 percent decline experienced in 2012. Crude petroleum is the primary energy product in this sector, accounting for 95 percent of the total U.S. trade deficit in energy-related products in 2013. However, the trade deficit in crude petroleum decreased in 2013 (by 16 percent), reaching its lowest level since 2009. This decrease was due to falling U.S. imports resulting from higher domestic production coupled with reduced U.S. consumption. Also, U.S. exports of petroleum products (particularly distillate and residual fuel oils) and natural gas (primarily from oil shale deposits in the Bakken formation) continued to increase in 2013, more than offsetting a drop in U.S. exports of coal (figure EP.1 and table EP.2).

In addition to changes in U.S. supply and demand for energy products, global price changes also impacted U.S. trade, albeit to a much smaller extent. During 2012–13, prices for most energy-related products followed the trends in crude petroleum prices, increasing by an average of 4 percent except for coal, which declined slightly by 2 percent (figure EP.2). The world benchmark price for a barrel of crude petroleum increased slightly in 2013 in response to rising global consumption (particularly in China) and supply disruptions in certain members of the Organization of Petroleum Exporting Countries (OPEC). U.S. natural gas prices increased in 2013 as production from less profitable wells decreased. Global coal prices declined in 2013 as electric utilities (which have been the primary consumers of coal) continued switching to cleaner-burning natural gas.

U.S. Exports

U.S. exports of energy-related products increased by 7 percent to $152.7 billion in 2013, with the largest growth seen in exports to Canada, Colombia, and Nigeria. The dominant energy-related goods exported from the United States in 2013 continued to be petroleum products. Natural gas, coal, and crude petroleum were also exported, but with much smaller values.

Petroleum Products

The value of U.S. exports of petroleum products increased by 7.5 percent ($8.3 billion) to $119.7 billion in 2013 as exports continued to surge. In 2012, for the first time in over 60 years, the United States exported a larger volume of petroleum products than it imported. In 2013, export volumes rose again, increasing by about 9 percent over 2012 levels to 1.3 billion barrels.

While distillate and residual fuels continued to be the leading petroleum exports (with the EU-28 being the primary market), the product mix changed from the previous year, as it normally does.128 Most of the increase in the quantity of U.S. exports of petroleum products is attributed to the following factors: (1) reduced domestic demand for motor fuels, due in part to a still-lagging economy and more fuel-efficient cars; (2) increased U.S. production of crude petroleum (the feedstock for petroleum products), particularly increased supplies of crude petroleum from North Dakota’s Bakken formation; and (3) high demand for distillate and residual fuel oils on the world market.

Particularly strong increases were seen in U.S. exports of petroleum products to France, Colombia, and Nigeria. U.S. exports to France increased by 47 percent to $4.8 billion in 2013This increase was due to the multiweek shutdown of all three of Total’s129 refineries (caused by a workers’ strike that began in early 2013), along with maintenance problems. The shutdown resulted in the removal of about 1.2 million barrels per day of distillation capacity during the third quarter of 2013, and much of the fourth quarter as well. U.S. exports to Colombia increased by 56 percent to $5.6 billion because of refining declines at the largest Colombian oil refiner, Cartagena Oil Refinery, caused by worker strikes, which began in September 2012 and lasted through most of 2013. Exports to Nigeria experienced the largest increase, as U.S. exports of fuel oils increased to meet demand. Although Nigeria has four refineries, their capacity utilization rates hover around 16–18 percent due to operational failures, fires, and sabotage, mainly on pipelines leading from the wellhead to the refineries. As a result, the four refineries cannot meet domestic demand.

Coal, Coke, and Other Carbonaceous Materials

In 2013, U.S. exports of coal, coke, and other related products decreased in value by 23 percent to $13.7 billion and in quantity by 6 percent to 117.7 million short tons. The decline in U.S. exports is attributed to the continued economic downturn in the EU-28, the largest regional importer of U.S. coal; decreased Asian demand; and increased coal production in other coal-exporting countries (primarily Australia, which has now fully recovered mining operations following the Queensland floods of 2011–12). In addition, there has been a growing international interest in moving away from coal in favor of cleaner-burning energy sources such as natural gas and certain renewable fuels.

Natural Gas and Components

The quantity of U.S. natural gas exports (in gaseous form) decreased by 10 percent to 1.5 trillion cubic feet in 2013, but the value increased by 34 percent to $5.8 billion owing to the rise in natural gas prices. U.S. exports of natural gas in gaseous form are transported via pipeline, and the United States’ NAFTA partners, Canada and Mexico, are the only U.S. markets. Trade generally fluctuates from year to year based on market size along the pipeline. The price of U.S. exports of pipeline natural gas increased from $2.79 per thousand cubic feet in 2012 to $3.94 per thousand cubic feet in 2013, a 41 percent rise.

The volume of U.S. exports of liquefied natural gas (LNG) continued to decrease, dropping from 28.3 billion cubic feet in 2012 to about 7.3 billion cubic feet in 2013 primarily as a result of increased consumption of natural gas in the United States and decreased exports to Japan. U.S. exports of LNG to Japan fell from 14.0 billion cubic feet in 2012 to 4.3 billion cubic feet in 2013. The decline occurred primarily because Japanese power plants that use natural gas as their fuel source were still operating well below capacity, if at all, due to damage from the March 2011 earthquake and tsunami. Also, during 2013, there was a limited U.S. supply of natural gas from the mature North Cook Inlet gas field, which is liquefied in Kenai, Alaska, solely for export to Japan.

In 2012, for the first time, the United States became a net exporter of liquefied petroleum gases (LPGs), and these exports further increased by 69 percent to 121 million barrels in 2013. In terms of value, U.S. exports of LPGs rose by 78 percent to $4.9 billion, with the strongest export growth to the Netherlands, Brazil, and Japan. This increase was the result of increased production from shale deposits in the Marcellus formation and other areas producing shale gas and tight crude. The U.S. supply of propane and other LPGs is expected to increase as pipeline infrastructure from these shale areas to refineries and natural gas processing plants is built.

U.S. Imports

In 2013, U.S. imports of energy-related products decreased by 11 percent to $352.9 billion. Canada remained the leading source of U.S. imports of energy-related products, with Saudi Arabia, Mexico, Venezuela, Russia, and Nigeria being the other major U.S. import suppliers. However, there were significant shifts in importance among the suppliers; in particular, imports of crude petroleum from Nigeria, Venezuela, Mexico, and Saudi Arabia registered large declines, while Canada was the only supplier to see increased imports. Crude petroleum continued to be the primary energy product the United States imported in 2013, accounting for 55 percent of the total value of sector imports; petroleum products accounted for 33 percent, and natural gas for 8 percent. However, U.S. imports of crude petroleum and petroleum products saw significant declines, while imports of natural gas remained essentially unchanged.

Crude Petroleum

The United States is the second-largest world importer of crude petroleum, being outpaced only by China in 2013. However, the value of U.S. imports of crude petroleum declined by 15 percent to $195.5 billion in 2013, and the quantity declined by 10 percent to 2.8 billion barrels as U.S. production increased by 15 percent to its highest level since 1990. At the same time, U.S. consumption remained at about 2012 levels.

Canada has been the leading U.S. import source of crude petroleum for decades and continued to be so in 2013. U.S. crude imports from Canada increased to 887.7 million barrels valued at $74 billion in 2013, or by 6.5 percent for both quantity and value. Large multinational energy companies operate in both countries and exchange crude and petroleum products across the border. An integrated system of shared pipelines crossing the U.S.-Canada border makes it easy and cost efficient to transport crude petroleum from the wellhead to refineries.

U.S. imports of crude petroleum from all other major sources declined in 2013. Crude petroleum from OPEC, which accounted for 46 percent of the total quantity (33 percent of the value) of crude petroleum imported, declined in 2013 as the share of the U.S. market accounted for by Saudi Arabia, Venezuela, and Nigeria fell. U.S. imports from OPEC declined by 13 percent in quantity to 1.3 billion barrels in 2013. The decreases in imports of crude are due to increased U.S. production, stagnant U.S. demand, and supply disruptions in both Venezuela and Nigeria.

With respect to Nigeria, U.S. imports of crude declined by 37 percent in 2013 to a recent low of 102.6 million barrels. Some of this decline can be attributed to the growth in U.S. crude petroleum production from the Bakken and Eagle Ford shale formations, both of which produce crude similar in quality to Nigeria’s crude.139 U.S. imports of Nigeria crude as a share of U.S. imports have also fallen as a result of the idling of two U.S. East Coast refineries in late 2011 and early 2012 that were significant purchasers of Nigerian crude; the two refineries reopened in 2013, but are primarily refining domestically produced crude petroleum.

Petroleum Products

The value of U.S. petroleum product imports fell by 9 percent in 2013, while the quantity fell by about 1 percent to 753.0 million barrels. This decrease was due primarily to a small reduction in demand for residual fuel oils, which are used to generate electricity for large industrial complexes; many of these consumers have switched to natural gas, as it is a cleaner-burning and less expensive fuel. Additionally, U.S. refineries, which generally satisfy over 90 percent of domestic consumption, increased their capacity utilization rates in 2013, further reducing demand for imports.

Non-OPEC import sources continue to be the primary suppliers of petroleum products to the United States, accounting for 90 percent of total U.S. imports in 2013. Canada remained the primary source of U.S. imports of petroleum products; imports from Canada increased by 6 percent to 203.1 million barrels in 2013 and accounted for 50 percent of total U.S. imports of these products. Imports from Mexico increased by 13 percent and accounted for 8 percent of total U.S. imports. Imports from most other sources declined, including those from OPEC, which declined 10 percent. Among OPEC countries, imports from Venezuela continued to decline from the low levels witnessed in 2012 because of the massive gas explosion that occurred in August 2012 at the Paraguaná refinery, which resulted in its total closure; the refinery is still not fully operational. Also, U.S. imports of petroleum products from Brazil decreased by about 28 percent in terms of value and by about 3 percent in terms of quantity. Brazil’s refineries are already operating at full capacity and cannot meet their own domestic demand; as a result, Brazil nearly ceased all exports of petroleum products in 2013.

Natural Gas and Components

The value of U.S. imports of natural gas increased by 0.4 percent to $28.3 billion in 2013, while the volume of imports fell by 10 percent to 2.6 trillion cubic feet. The increased value of natural gas imports resulted from higher prices for both pipeline natural gas and LNG. Canada remains the primary U.S. supplier, accounting for 99 percent of pipeline natural gas imports, which decreased by 6 percent to 2.8 trillion cubic feet in 2013. This quantity decrease is due to two main factors: (1) a 4 percent increase in U.S. natural gas production, and (2) normal trade fluctuations that occur regularly between the United States and Canada based on changes in market supply and demand along the pipelines.

The quantity of U.S. imports of LNG also declined in 2013, falling by 45 percent to 96.9 million cubic feet, largely due to reduced imports of LNG from Trinidad and Tobago. One reason for the decline was that the price of LNG from Trinidad and Tobago was more than double the price of natural gas imported via pipeline from Canada or produced in the United States. Trinidad and Tobago also diversified export markets for LNG, including entering into long-term contracts with certain Latin American and Caribbean countries. In 2013, the United States fell from being the primary market for LNG from Trinidad and Tobago to ranking as the fourth-largest market behind Spain, Chile, and Argentina.