Sharon Ford

(202) 205-3084

sharon.ford@usitc.gov

Change in 2013 from 2012:

- U.S. trade deficit: Increased by $3.5 billion (1 percent) to $250.3 billion

- U.S. exports: Decreased by $27 million (less than 0.1 percent) to $167.0 billion

- U.S. imports: Increased by $3.5 billion (1 percent) to $417.2 billion

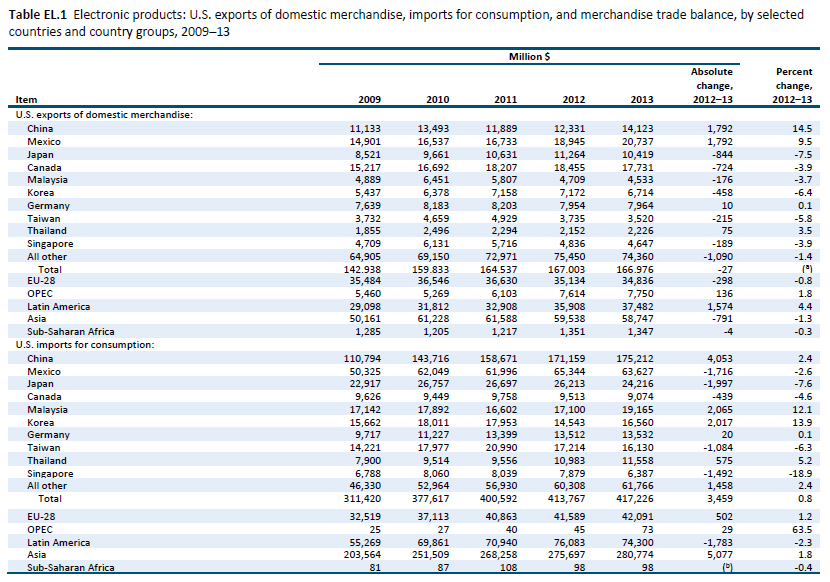

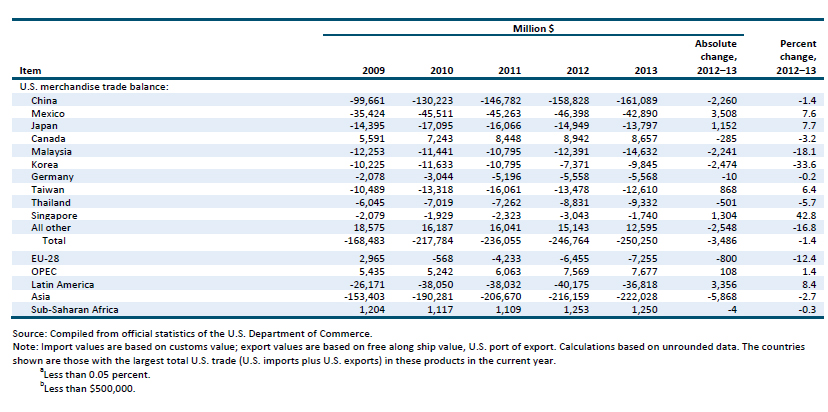

The U.S. trade deficit in electronic products rose by $3.5 billion to $250.3 billion in 2013 (1 percent). The slight increase was driven by growing deficits in telecommunications equipment as well as circuit apparatus assemblies. U.S. exports of electronic products declined marginally, by less than 0.1 percent, while imports increased by 0.8 percent.

China continued to be the largest contributor to the U.S. deficit in electronic products trade; China’s share of the deficit was $161.1 billion in 2013 (table EL.1). China is a leading producer of semiconductors and computers (the former being an input for the latter) as well as peripheral products. Along with the emerging economies of Malaysia and Thailand, China has benefited from the shift of production capacity away from countries with high manufacturing costs, such as the United States and Japan.

U.S. Exports

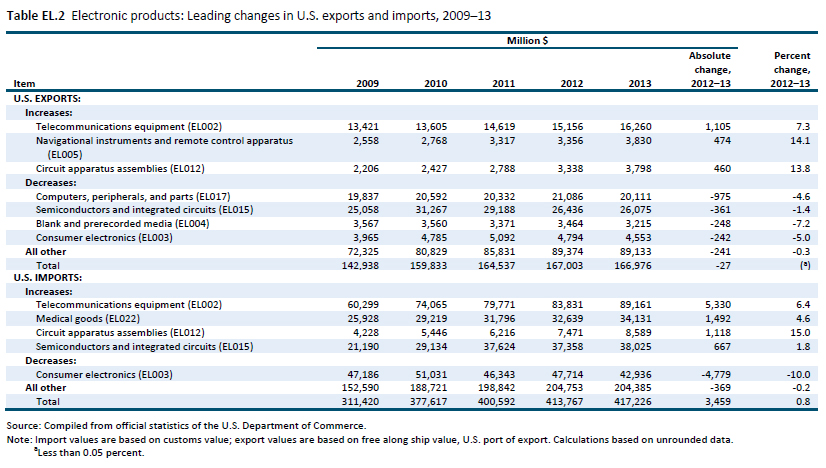

U.S. exports of electronic products decreased by $27 million (less than 0.1 percent) in 2013, against the backdrop of a sluggish global economy. Despite this overall decline, U.S. exports increased in a number of subsectors, namely telecommunications equipment, navigational instruments and remote control apparatus, and circuit apparatus assemblies. The leading destinations for U.S. exports of electronic products were the United States’ NAFTA partners, Mexico ($20.7 billion) and Canada ($17.7 billion). Together, Mexico and Canada accounted for 23 percent of sector exports. They were followed by China ($14.1 billion) and Japan ($10.4 billion), which together accounted for 15 percent of U.S. exports in this sector. In 2013, exports increased to 4 of the United States’ top 10 export destinations but declined to the remaining six.

In 2013, the major markets for U.S. telecommunications equipment exports, which totaled $16.3 billion, were Mexico, Canada, and Hong Kong. U.S. exports of telecommunications equipment rose by $1.1 million (7 percent) in 2013 (table EL.2). This increase was driven by a number of factors, including growing reliance worldwide on communications networks, expanding 4G/LTE networks, increasing mobile broadband access in developing countries, and the continuing attempt by operators to capture revenue from services and content delivered over their own networks. U.S. exports of navigational instruments and remote control devices continued their steady rise, growing from $3.4 billion in 2012 to $3.8 billion (14 percent) in 2013. As the economy has gradually improved, increases in research and development budgets have led to advances in both navigational instruments and remote control devices. The new products (e.g., electricity measuring and testing instruments and medical and bioscience diagnostic equipment) have enabled the U.S. industry to remain competitive amid rising foreign competition and changing demand in downstream markets. Additionally, growth in customer industries such as aircraft manufacturing, shipbuilding, and construction has provided strong demand for various instruments and devices. The leading markets for U.S. exports of various related instruments and devices were the United Arab Emirates (accounting for 24 percent of U.S. exports), Japan (11 percent), and Canada (10 percent).

Exports of circuit apparatus assemblies have increased in each of the past five years, growing from $2.2 billion in 2009 to $3.8 billion in 2013, and by $460 million (14 percent) from 2012 to 2013. The rise reflects continuing growth in global demand for downstream products, such as telecommunications equipment and measuring, testing, and controlling instruments. Growing demand for telecommunications equipment was driven by the continuing expansion of 4G/LTE: the number of commercial networks increased from 49 in 29 countries in January 2012 to 260 in 93 countries by the end of 2013. Global demand for measuring, testing, and controlling instruments rose due to requirements for higher-precision instruments with stricter quality, safety, and environmental standards. The Canadian Environmental Assessment Act of 2012, for example, strengthens assessments related to nuclear safety, energy, and the environment. The leading markets for U.S. exports of circuit apparatus assemblies were Canada (23 percent), Mexico (15 percent), and China (9 percent).

U.S. exports of computers, peripherals, and parts as well as semiconductors declined in 2013. The $975 million (5 percent) decrease in computers, peripherals, and parts exports was caused by the slow economic recovery in foreign markets. Exports of semiconductors and integrated circuits decreased $361 million (1 percent), marking the third consecutive year of declines. Semiconductor fabrication operations continued to expand in Asia, where 9 of the top 10 semiconductor production foundries are located. Likewise, the Pacific Rim trading partners, especially Taiwan, have seen their chip foundry businesses grow steadily.

U.S. exports of blank and prerecorded media also decreased in 2013, from $3.5 billion to $3.2 billion (7 percent), largely as an indirect result of cloud computing. The popularity of readily accessible and cost-effective online operating and application services (software-as-a-service) is increasingly leading companies and individuals to forego purchasing compact discs. Instead, they are accessing software online. In addition, exports of consumer electronics fell $242 million (5 percent) in 2013, while exports of television receivers and monitors fell $160 million (11.6 percent). The declines—a continuation of a trend for both types of products that commenced in 2010—reflect the evolving role of mobile devices and personal computers in accessing music, television programming, and other media content for global consumers. Mobile devices, which were initially restricted to telephony and short text messaging, are increasingly powerful. Although they remain slower than computers in connecting to and transmitting information over the Internet, “apps” enable such devices to access a wide range of movies, television shows, music, games, and sports.

U.S. Imports

U.S. imports of electronic products increased marginally by $3.5 billion (1 percent) to reach a record $417.2 billion in 2013. As has been the case since 2009, the leading supplying countries were China and Mexico. U.S. imports from China reached $175.2 billion, and were more than double the value of imports of the next largest supplier, Mexico ($63.6 billion). The largest increases in U.S. imports came from Korea (up 14 percent) and Malaysia (up 12 percent). Korea had the largest gains in printing and related machinery, while Malaysia had the largest gains in computers, peripherals, and parts; and electrical sound and visual signaling apparatus.

U.S. imports of telecommunications equipment and medical goods registered the largest increases by value in 2013. U.S. imports of telecommunications equipment rose from $83.8 billion to $89.2 billion (6 percent), with China and Korea posting the greatest increases of 9 percent and 8 percent, respectively. This growth was driven by the introduction of new products with increased functionality, very few of which are produced in the United States. For example, increasingly sophisticated mobile devices are replacing stereos, televisions, and other entertainment electronics, resulting in increased imports of computers and telecommunications equipment and decreased imports of consumer electronics. The personal computer, in particular, is becoming a hub for a wide array of consumer electronic devices, ranging from mobile phones and digital music players to cameras and smartphones.

U.S. imports of medical goods in 2013 increased from $32.6 billion to $34.1 billion (5 percent). The aging Baby Boom population, with an increasing need for medical goods, drove this increase, along with the introduction of new cardiovascular and neurological devices. The largest increases occurred with respect to imports from Ireland and China (up by 9 percent from each country); these countries remained the United States’ second- and fourth-largest suppliers of medical devices in 2013. Ireland is a global leader in the production of various cardiac devices, and growing U.S. demand for these goods reflects the high rate of U.S. heart-related afflictions. Imports from China were mostly hospital supplies, instruments, and other low-value-added, low-cost devices.