Dennis Fravel

(202) 205-3404

dennis.fravel@usitc.gov

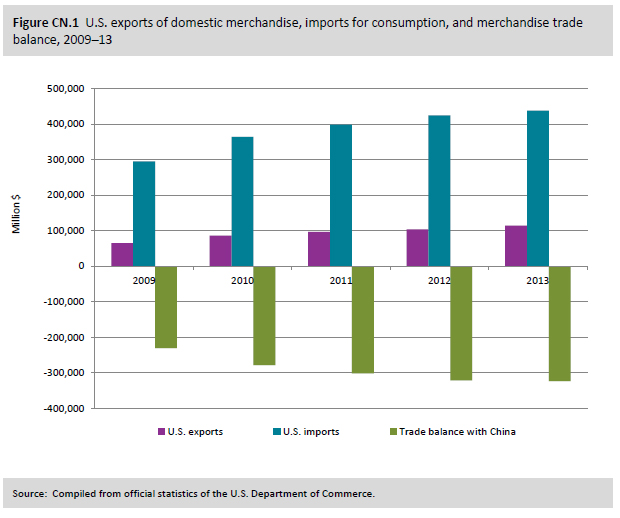

Change in 2013 from 2012:

- U.S. trade deficit: Increased by $2.5 billion (1 percent) to $323.8 billion

- U.S. exports: Increased by $10.8 billion (10 percent) to $114.3 billion

- U.S. imports: Increased by $13.3 billion (3 percent) to $438.1 billion

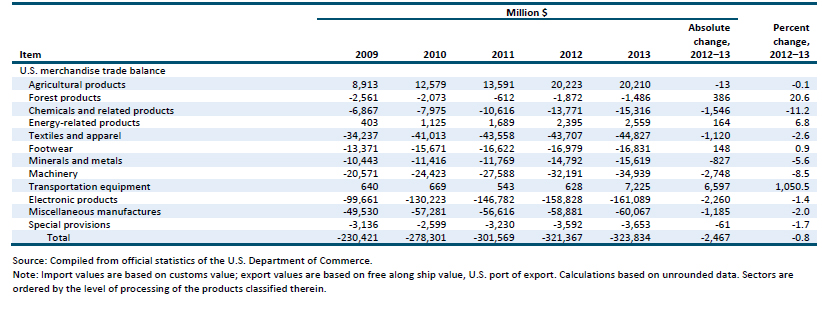

The U.S. trade deficit with China increased by $2.5 billion (1 percent) in 2013, as U.S. exports to China rose by $10.8 billion and U.S. imports rose by $13.3 billion (figure CN.1 and table CN.1). The increasing trade deficit resulted from rising deficits with China in machinery (up by $2.7 billion), electronic products (up by $2.3 billion), chemicals and related products (up by $1.5 billion), and textiles and apparel (up by $1.1 billion). Growth in the U.S. trade deficit with China was limited by a higher U.S. trade surplus in transportation equipment (up by $6.6 billion). Two other U.S. industry sectors that had trade surpluses with China in 2013 were agricultural products and energy-related products. China’s real GDP grew by 7.7 percent in both 2012 and 2013.

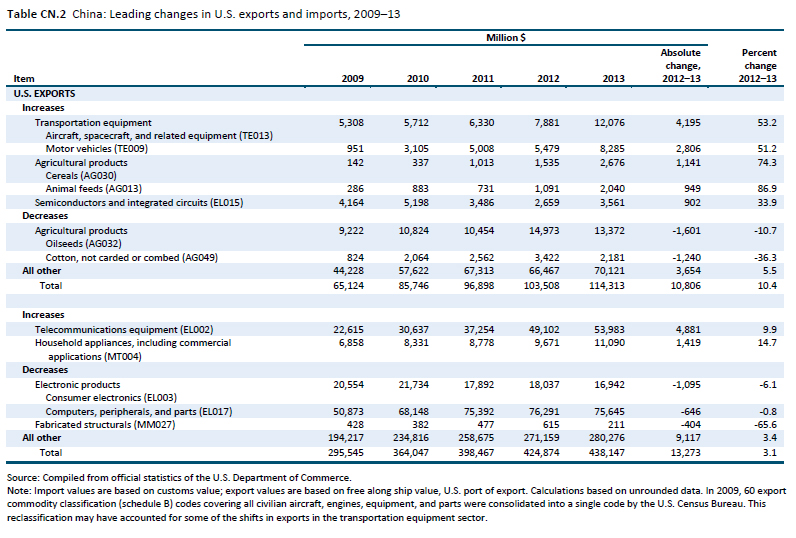

U.S. Exports

U.S. merchandise exports to China increased by $10.8 billion (or 10 percent) to $114.3 billion in 2013. The four sectors that contributed the most to the growth of U.S. merchandise exports to China in 2013 were transportation equipment (up by $7.6 billion), electronic products (up by $1.8 billion), forest products (up by $583 million), and machinery (up by $546 million) (table CN.1).

The transportation equipment sector accounted for the second-largest share (22 percent) of all U.S. merchandise exports to China in 2013, but represented the largest increase in U.S. exports to China (figure CN.2). Sector exports rose because of significant increases in 2013 of U.S. exports of aircraft, spacecraft, and related equipment (up by 53 percent, or $4.2 billion) and motor vehicles (up by 51 percent, or $2.8 billion) (table CN.2).

In 2013, China was the largest single-country market for U.S. exports of aircraft, spacecraft, and related equipment, accounting for almost 12 percent of such exports. In 2013, China was a significant market for commercial aircraft. The growth in U.S. exports of these products in 2013 was most likely due to deliveries of commercial aircraft and spare parts for Boeing aircraft. In 2013, Boeing delivered 143 planes to China, and expects to deliver a similar number there in 2014.

Industry foresees significant potential for the business jet market. Although it felt that Chinese airspace regulations prevented the sharp rise in deliveries originally anticipated for 2013, the U.S. industry expects Chinese aviation and other regulatory authorities to expand Chinese airspace to accommodate more business jets in 2014.

Transportation equipment exports to China also rose because of an increase in U.S. exports of motor vehicles to China in 2013 (table CN.2). Comprising passenger automobiles, tractors, trucks, and motorcycles, these exports rose from 167,251 units in 2012 to 247,976 in 2013, or from $5.5 billion to $8.3 billion. In addition, U.S. exports of certain motor-vehicle parts to China rose in value by $623 million to almost $1.4 billion in 2013.

The increase in U.S. motor vehicle exports was driven primarily by exports of passenger automobiles. Since 2010, China has become the largest export market for U.S. passenger automobiles. Although the market is largely served by Chinese production, relatively competitive cost structures have enabled U.S.- and foreign-owned automobile manufacturers to export from their U.S. manufacturing operations.

The second-largest sectoral increase in exports to China was in electronic products. The increase occurred chiefly in exports of semiconductors and integrated circuits (up $902 million to $3.6 billion) that are incorporated into electronic products assembled or manufactured in China. U.S. exports of measuring, testing, and controlling instruments (up $516 million to $3.8 billion)—principally instruments and apparatus for measuring or checking electrical quantities specially designed for telecommunications—also contributed to the rise in these sectoral exports.

U.S. exports of agricultural products, which experienced the largest sector increase from 2011 to 2012, showed a minor decrease in 2013. Nonetheless, agricultural products remained the largest U.S. export sector to China in 2013, valued at $27.2 billion and accounting for almost 24 percent of U.S. exports to China. In 2013, U.S. exports to China of cereals rose $1.1 billion, while exports of animal feeds rose $949 million. Such increases, however, were offset by declines in exports of oilseeds (down $1.6 billion) and cotton, not carded or combed (down $1.2 billion), as shown in table CN.2.

U.S. Imports

In 2013, U.S. imports of merchandise from China increased by $13.2 billion, or 3 percent, over 2012. The increase in U.S. imports from China was principally driven by the electronic products sector, although the machinery and chemicals and related products sectors also registered high import growth (table CN.1).

The electronic products sector accounted for 40 percent of total U.S. imports from China in 2013. Imports in this sector rose by $4.1 billion (2 percent), a much slower rate of increase than during 2011–12 (8 percent). Computers, peripherals, and parts accounted for 43 percent of imports in this sector, followed by telecommunications equipment (31 percent), consumer electronics (10 percent), and other industries, such as medical goods and semiconductors and integrated circuits (16 percent).

The largest increase in imports of electronic products was in the telecommunications equipment group. The majority of these imports were cellphones manufactured in China, U.S. imports of which rose by $3.8 billion to reach $36.6 billion in 2013 (table CN.1). In 2013, China remained the largest supplier of U.S. imports in the telecommunications equipment industry, accounting for almost 61 percent of total U.S. imports from all sources in this industry.

The large increase in imports of telecommunications equipment from China was partially offset by a decline in imports of computers, peripherals, and parts, which fell by $646 million (almost 1 percent) to $75.6 billion in 2013. The decline was due to falling demand from consumers and corporations for personal computers and servers, as consumers shifted towards mobile devices. There was also a decline in imports of consumer electronics from China, which fell by $1.1 billion (6 percent) to $16.9 billion in 2013, as U.S. consumers reduced spending on these consumer electronics, particularly television cameras and camcorders, and radios.

Machinery sector imports from China rose in 2013, principally due to increased imports of household appliances, up $1.4 billion (15 percent) to $11.1 billion in 2013. Within the group of household appliances, imports of washing machines from China rose by $553 million. One possible reason for the increase in U.S. imports of washing machines was a shift in production of these goods to China following issuance of antidumping duty orders on imports of large residential washers from the Republic of Korea (Korea) and Mexico and a countervailing duty order on large residential washers from Korea, issued in February 2013. Imports from China of small household appliances, such as food processors and vacuum cleaners, also rose in 2013. Other groups in the machinery sector that had import increases from China in 2013 were the electrical transformers, static converters, and inverters category, as well as nonautomotive insulated electrical wire and related equipment.

The fourth-largest increase in sector imports from China occurred in chemicals and related products. Imports in this sector were up by almost $1.5 billion (5 percent) in 2013. Imports of miscellaneous plastic products, tires and tubes, and organic chemicals registered significant increases in 2013.

The United States imposed trade remedies in 2012 and 2013 on two types of renewable energy products from China. U.S. imports of utility-scale wind towers for wind turbines from China declined by $404 million in 2013. This followed the imposition of U.S. antidumping and countervailing duty orders in February 2013. The U.S. Department of Commerce also issued antidumping and countervailing duty orders in December 2012 on certain crystalline silicon photovoltaic solar panels from China. The Harmonized Tariff Schedule of the United States (HTS) categorizes this type of solar photovoltaic product under the semiconductors and integrated circuits subheading. The trade figures for this subheading show a decline of $342 million in U.S. imports from China in 2013.