Philip Stone

(202) 205-3424

philip.stone@usitc.gov

Change in 2013 from 2012:

- U.S. trade deficit: Decreased by $2.3 billion (6.6 percent) to $32.4 billion

- U.S. exports: Increased by $626 million (0.3 percent) to $218.1 billion

- U.S. imports: Decreased by $1.7 billion (1 percent) to $250.5 billion

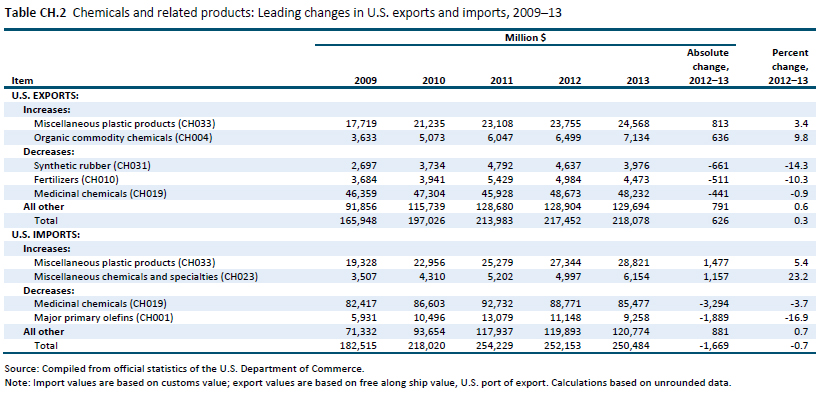

The U.S. trade deficit in chemicals and related products decreased by $2.3 billion (6.6 percent) to $32.4 billion in 2013. U.S. exports remained relatively flat compared to 2012, increasing by only $626 million (0.3 percent) in 2013, while U.S. imports decreased by $1.7 billion (0.7 percent). Medicinal chemicals accounted for the largest share of trade in this sector, with $85.5 billion in U.S. imports and $48.2 billion in U.S. exports in 2013. The largest change in value for U.S. exports in this sector was for miscellaneous plastic products, for which U.S. exports increased by $813 million. Medicinal chemicals recorded the largest change in U.S. imports, decreasing by $3.9 billion.

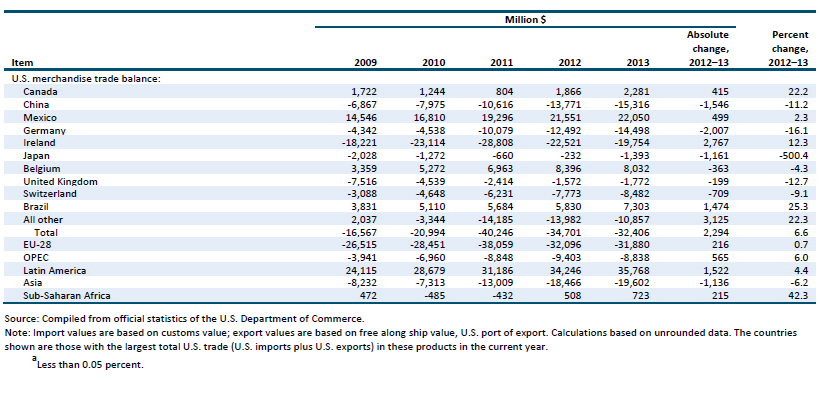

The EU-28 and Canada are the largest trading partners for the United States in the chemicals sector (table CH.1). In 2013, U.S. exports of chemicals and related products to the EU-28 and Canada totaled $54 billion and $36 billion respectively. U.S. trade with both trading partners remained relatively unchanged compared to 2012. U.S. exports to the EU-28 decreased by $76 million (0.1 percent) but increased to Canada by $16 million (less than 0.1 percent). U.S. imports from the EU-28 totaled $86 billion in 2013, a decrease of $292 million (0.3 percent) from 2012. U.S. imports from Canada totaled $34 billion in 2013, a decrease of $399 million (1 percent) from 2012.

U.S. Exports

U.S. exports of chemicals and related products remained relatively level, growing by only $626 million (0.3 percent) in 2013. The largest increases in U.S. exports were of miscellaneous plastic products and commodity organic chemicals. U.S. exports of miscellaneous plastic products rose by $0.8 billion (3 percent), owing to increased exports of plastic boxes, cases, crates, and similar articles and plastic articles not elsewhere specified or included (table CH.2). Among commodity organic chemicals, U.S. exports of styrene showed the highest growth, fueled by rising demand in Latin America as well as by global production problems, including an unplanned shutdown of Shell’s styrene monomer plant in Alberta, Canada.

U.S. exports of synthetic rubber decreased by $661 million in 2013. The decline in the value of synthetic rubber exports was largely the result of high stocks and low prices of natural rubber, a substitute for synthetic rubber used in the production of vehicle tires and other products. Additionally, new synthetic rubber production facilities began operations in China in 2013, further reducing demand for U.S. exports of synthetic rubber.

U.S. exports of fertilizers decreased by $511 million in 2013. U.S. fertilizer exports dropped, in part, due to lower exports of certain phosphate fertilizers to India. India started 2013 with high stocks of these fertilizers and consumed less throughout the year because of decreased and delayed subsidy payments to farmers, as well as a weaker rupee that made U.S fertilizers more expensive.

U.S. Imports

U.S. imports decreased by $1.7 billion in 2013, largely because of declines in imports of pharmaceuticals and primary olefins. The value of pharmaceuticals imported in 2013 fell by $3.3 billion compared to 2012. The decrease in value of pharmaceutical imports likely stemmed from the replacement of high-cost brand-name medicines by cheaper generic medicines, as patent terms expired for blockbuster drugs such as atorvastatin (brand name Lipitor) and clopidogrel (brand name Plavix). U.S. imports of primary olefins decreased by $1.9 billion because of increases in domestic production of olefins such as ethylene and propylene.

U.S. imports of miscellaneous plastic products and miscellaneous chemicals and specialties increased in 2013. U.S. imports of miscellaneous plastic products grew by $1.5 billion, in part because of increased imports of plastic floor tiles and plastic tubes, which are used in new-home construction. U.S. imports of miscellaneous chemicals and specialties increased by $1.2 billion, primarily the result of increased imports of biodiesel from Argentina and Indonesia. Argentine and Indonesian exporters of biodiesel were seeking new markets after the EU-28 imposed antidumping duties on biodiesel from these countries in 2013. At the same time, the United States government reinstated the $1 per gallon tax credit for biodiesel through the end of 2013, increasing demand for biodiesel in the U.S. market.