Alison Rozema

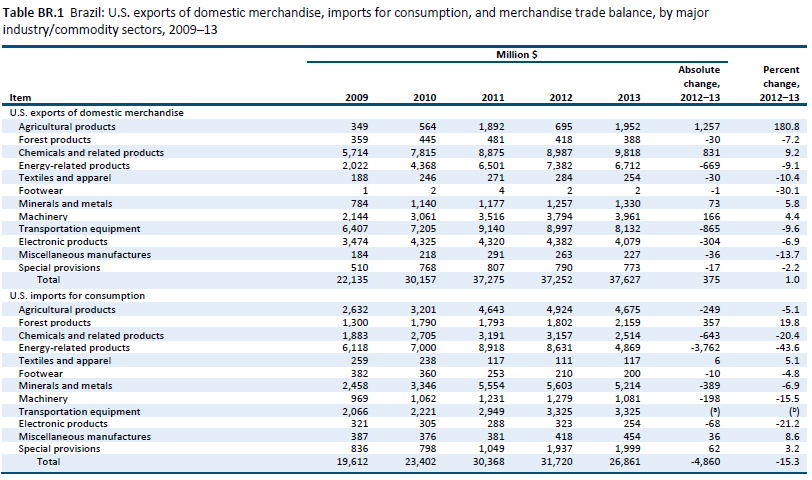

Change in 2013 from 2012:

- U.S. trade surplus: Increased by $5.2 billion (95 percent) to $10.8 billion

- U.S. exports: Increased by $375 million (1 percent) to $37.6 billion

- U.S. imports: Decreased by $4.9 billion (15 percent) to $26.9 billion

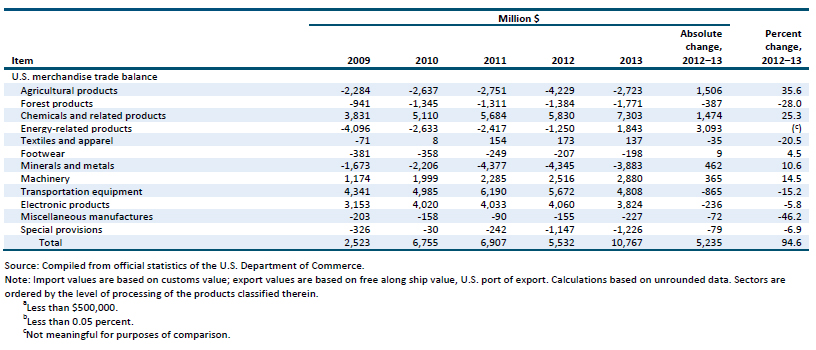

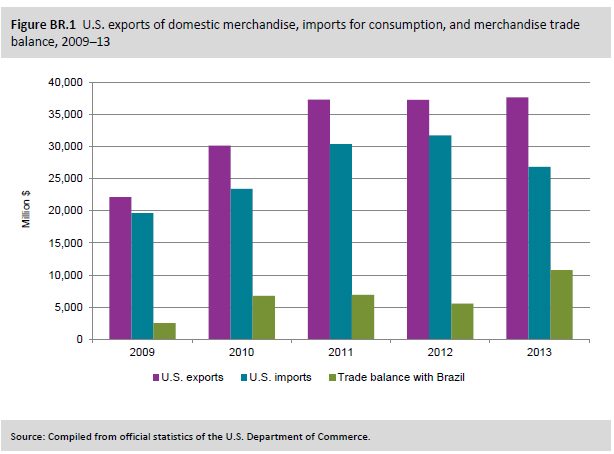

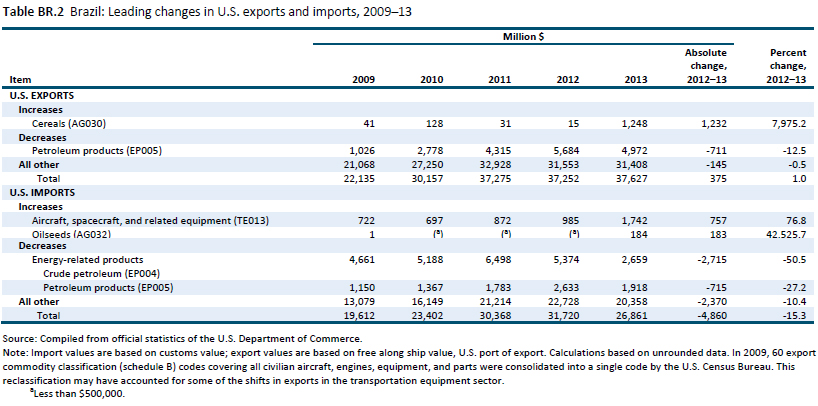

The U.S. trade surplus with Brazil increased by $5.2 billion in 2013 (95 percent), owing almost entirely to a $4.9 billion reduction in the value of U.S. imports (table BR.1 and figure BR.1). While four of the U.S. industry sectors reviewed in this report recorded a trade deficit with Brazil in 2013, substantial trade surpluses in chemicals and related products and energy-related products largely accounted for the overall increase in the United States’ trade surplus with Brazil. The main contributors to the growth in the trade surplus were the significant decline in the value of U.S. imports of energy-related products from Brazil coupled with the increase in U.S. exports of agricultural products to Brazil.

Brazil’s gross domestic product (GDP) rose 2.5 percent in 2013. The Brazilian economy is relatively stable, and changes in the U.S. trade balance with Brazil were not a result of movements in the Brazilian economy. Rather, the change was largely the result of falling global prices for energy-related products, which caused the value of U.S. imports from Brazil to drop significantly.

U.S. Exports

The value of U.S. exports to Brazil increased by just 1 percent (about $375 million) to $37.6 billion in 2013, with increased exports of agricultural products driving the growth. Agricultural product exports grew by $1.3 billion, fueled mostly by increases in cereals exports (table BR.2).

U.S. exports of cereals to Brazil grew by $1.2 billion (over 7,000 percent) in 2013. This sharp increase was driven by a surge in U.S. wheat exports. The United States exported almost 3.5 million metric tons (mmt) in 2013, the largest amount in 30 years, fueled by a spike in Brazilian demand and a record U.S. wheat crop. While Brazil, a large net wheat importer, generally purchases its wheat from neighboring Argentina, shortages in Argentine production drove up its wheat prices. The Argentine government imposed an export ban on wheat, leaving Brazilian consumers to find alternate sources of supply. While U.S. wheat is usually subject to a 10 percent import duty in Brazil, this common external tariff (CET) was waived through the summer of 2013 in order to lower the cost of imported wheat for Brazilian customers. Although Argentina’s export restriction on wheat is not permanent, the U.S. wheat industry views it as an opportunity for further export growth to Brazil in the future.

The increase in agricultural exports to Brazil was largely offset by export declines in several other sectors, including exports of energy-related products and transportation equipment, which fell by over $0.5 billion each (although these represented decreases of less than 10 percent from the previous year). In 2013, the quantity of U.S. exports of petroleum products to Brazil increased by 6 percent, from 60.7 million barrels in 2012 to 64.5 million barrels. However, the value of such exports decreased by 13 percent compared with 2012. This rise in volume but decline in value was caused by a drop in world prices of crude petroleum, the feedstock for the production of petroleum products. Average world prices for crude petroleum decreased by about 3 percent to $108 per barrel in 2013. Brazil’s refineries have a capacity of 1.9 million barrels per day of crude petroleum and are currently operating at full capacity. The refining industry in Brazil is not able to fully process the nation’s production of heavy crudes and, because of this capacity constraint, Brazil must import petroleum products to meet domestic demand.19 Brazil accounts for only about 5 percent of total U.S. petroleum product exports, with Argentina being Brazil’s primary source of these imports.

U.S. Imports

The value of U.S. imports from Brazil fell by $4.9 billion (15 percent) to $26.9 billion in 2013. This decline was driven by a large decrease (almost $3.8 billion) in both the value and the quantity of U.S. imports from Brazil of energy-related products.

U.S. imports of crude petroleum from Brazil decreased by 50 percent in value and by about 33 percent in terms of quantity. Although the United States is Brazil’s primary market for crude petroleum, Brazil is not a major supplier to the U.S. market, accounting for less than 2 percent of total U.S. crude petroleum imports. Most of Brazil’s crude production is heavy crude, which yields fewer of the higher-valued petroleum products than light crudes do. During 2013, U.S. production of crude petroleum increased, while consumption decreased as a result of economic conditions.

U.S. imports of petroleum products from Brazil dropped by about 28 percent in terms of value and by about 3 percent in terms of quantity. The United States is not a major importer of petroleum products, as the U.S. domestic industry refines lighter crudes to satisfy most U.S. demand for petroleum products. Brazil supplied only about 1 percent of total U.S. imports of petroleum products in 2013.

Though energy-related products drove the overall decrease in U.S. imports from Brazil, U.S. imports of several product categories notably increased. U.S. imports of aircraft, spacecraft, and related equipment from Brazil increased by over $750 billion (77 percent) to about $1.7 billion. This growth reflected U.S. airlines’ and business jet operators’ investments in new regional jets and single-aisle aircraft produced by Embraer in Brazil.20 Embraer also increased production of its small Phenom jet at its facility in Melbourne, Florida, which uses many parts produced in Brazil.

Additionally, the United States imported oilseeds valued at $184 million from Brazil in 2013, compared to less than $0.5 million worth in 2012. U.S. imports of soybeans constituted most of this increase. The United States usually imports only a small amount of soybeans and was a large net exporter to the world in 2013. However, in 2012, the Midwestern states experienced a drought, while global demand for soybeans remained high. The United States and Brazil are generally able to satisfy global demand for soybeans, but delays and problems at Brazilian ports limited Brazil’s ability to export soybeans, and as a result the United States exported for a longer time period than usual. U.S. soybean processors still needed to maintain their crush rate (the share of soybeans that are crushed) in order to provide soy oil and meal to consumers, and U.S. domestic stocks were getting smaller and more expensive. By the summer of 2013, the price difference between domestically produced soybeans and imported soybeans from Brazil was so low that many U.S. processors chose to import the oilseed from Brazil.