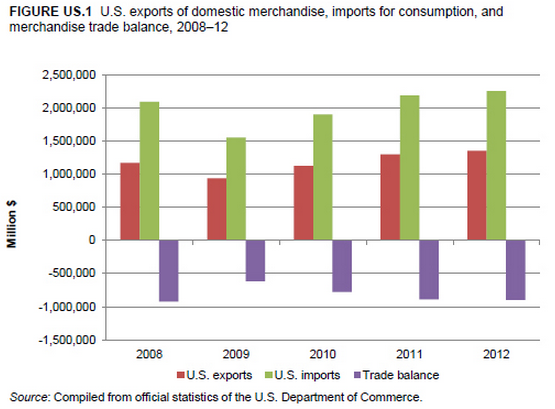

Trade Shifts from 2011 to 2012

- U.S. trade deficit : Increased by $10.0 billion (1 percent) to $897.8 billion

- U.S. exports: Increased by $54.0 billion (4 percent) to $1,353.2 billion

- U.S. imports: Increased by $64.1 billion (3 percent) to $2,251.0 billion

U.S. Trade Balance:

In 2012, seven of the nine U.S. merchandise sectors addressed in this report all except the agricultural and forest products sectors registered trade deficits, contributing to a 1 percent increase in the overall merchandise trade deficit to $897.8 billion (figure US.1). The most significant deficit expansions occurred in the transportation equipment ($23.6 billion increase) and electronic products sectors ($10.7 billion increase), while significant reductions in the deficits of the energy-related ($40.6 billion reduction) and chemicals and related products ($5.5 billion) sectors prevented further expansion of the overall trade deficit.

The sharp increase in the trade deficit for the transportation equipment sector in 2012 reflected the continuing U.S. economic recovery and greater availability of credit, which stimulated demand for motor vehicles in particular. Electronic products recorded the second-largest deficit ($246.8 billion), as well as the second-largest absolute deficit increase of $10.7 billion. One reason for the trade deficit expansion in this sector was heightened consumer demand for smartphones and mobile computing devices, the majority of which are manufactured in China. In contrast, the energy-related products sector witnessed the largest percentage reduction of its trade deficit in more than 10 years amid stable energy prices, increased U.S. production and exports of petroleum products, and reduced domestic imports of key commodities in this sector, especially crude petroleum and petroleumrelated products.

U.S. Exports

In 2012, U.S. exports increased by $54.0 billion (4.2 percent) to $1.352.2 billion, as exports in seven of the nine sectors reviewed in this report increased. The greatest absolute increase occurred in the transportation equipment sector, where exports rose by $28.1 billion (11 percent). Increased exports of aircraft equipment and motor vehicles accounted for $20 billion of this increase (table US.2). Higher foreign demand for commercial aircraft and motor vehicles from key markets such as Canada, Mexico, and China translated into significant expanded exports of transportation equipment.

The second-highest absolute increase in exports was in the energy-related products sector, which grew by $8.2 billion (6 percent) to $142.3 billion in 2012. Growth in this sector reflected an increase in the quantity of U.S. exports of petroleum products and coal, coke and other carbonaceous materials. Reduced domestic consumption of petroleum products, coupled with heightened U.S. production of these commodities and strong global demand for distillate fuel oils in 2012, influenced the expansion of U.S. petroleum products exports. Similarly, greater U.S. exports of coal owed to heightened foreign demand for coking coals, in particular, which are considered to be among the highest-quality coals used for steelmaking.

U.S. exports of machinery, which recorded the third-largest export shift by sector, rose by $7.2 billion to $122.4 billion in 2012 and reflected heightened demand for farm and garden machinery in Canada, Australian, and Brazil, respectively. The average depreciation of the U.S. dollar relative to these countries' currencies rendered these goods more competitive within these markets.

U.S. Imports

In 2012, the value of total U.S. imports rose by 3 percent to $2,251.0 billion, with the largest absolute shifts occurring in the transportation equipment sector (up $51.8 billion to $358.4 billion), energy-related products (down $32.4 billion to $398.4 billion), and electronic products (up $13.2 billion to $413.8 billion). As noted above, increased U.S. imports of transportation equipment especially motor vehicles principally stemmed from the continuing U.S. economic recovery in 2012, which translated into greater consumer access to financing for durable consumer goods, such as passenger vehicles. Canada, Japan, and Mexico remained the largest suppliers of these goods to the U.S. market, together accounting for more than one-third of all U.S. imports of transportation equipment. As noted earlier, import growth was buoyed by the 2.7 percent increase average trade-weighted value of the U.S. dollar relative to leading market currencies during 2012.

The increase in U.S. imports of electronic products owed much to the strong market for telecommunications equipment, imports of which grew by $4.1 billion (5.1 percent) (table US.2). More specifically, strong U.S. consumer demand for Internet-enabled smart cellphones such as the Apple iPhone 5 accounted for half of all telecommunications equipment imports in 2012. China accounted for 60 percent of U.S. telecommunications imports and remained the largest supplier of these goods to the U.S. market.

As noted earlier, overall U.S. import growth was somewhat attenuated by significant reductions in imports of energy-related products. Reduced imports in this sector principally reflected lower domestic consumption of crude petroleum and higher U.S. production of this commodity. Canada remained the leading U.S. supplier of crude petroleum, representing 20 percent of the total value and 28 percent of the total volume of crude petroleum imports.

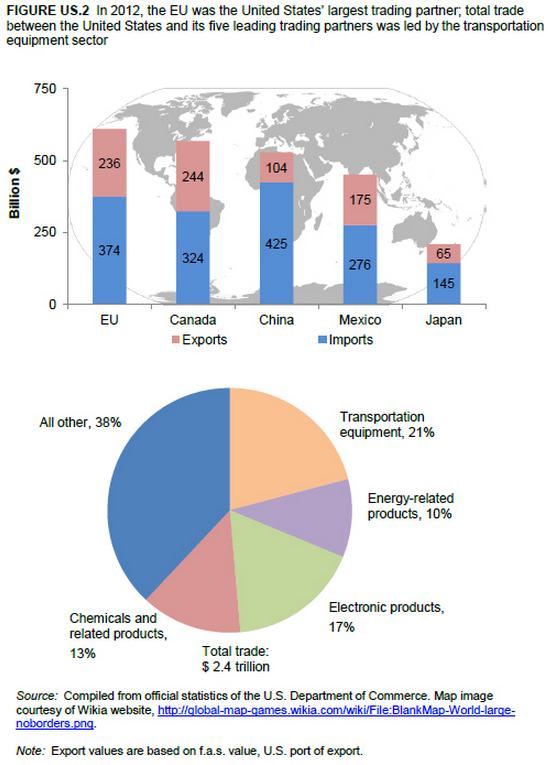

Shifts in U.S. Bilateral/Multilateral Trade among Leading Trading Partners

As mentioned earlier, in 2012 the United States top five trading partners were the EU, Canada, China, Mexico, and Japan, with total trade largely driven by transportation equipment (figure US.2). Among these economies, the United States witnessed bilateral deficit increases with the EU (up $17.2 billion to $138.5 billion), China (up $19.8 billion to $321.4 billion), and Japan (up $13.4 billion to $79.9 billion) in 2012 (table US.3). However, it registered deficit reductions with Canada (down $2.9 billion to $79.7 billion) and Mexico (down $1.5 billion to $101.2 billion) (table US.3). Together, these trading partners accounted for 80 percent of the total U.S. trade deficit and 66 percent of total trade between the U.S. and the world.

The expanding U.S. trade deficits with the EU and Japan were principally caused by greater U.S. imports of transportation equipment especially motor vehicles. As previously stated, U.S. demand for motor vehicles grew significantly during 2012 amid a favorable lending climate and improvements in the U.S. economy. EU automobile producers benefited from increased U.S. demand for new car models with high fuel economy, while Japan retained its status as a leading supplier of motor vehicles to the United States in 2012.

China remained the United States' single largest source of imports by value, expanding the United States' already sizable trade deficit by $19.8 billion to $321.4 billion the United States' largest bilateral deficit with any trading partner in 2012. Electronic products accounted for 40 percent of U.S. merchandise imports from China, reflecting that country's status as one of the principal manufacturers of computers, peripherals, and telecommunications equipment.

In contrast, during 2012, heightened demand for motor vehicles and associated parts in Canada and Mexico fueled U.S. exports of transportation equipment, resulting in a modest reduction in U.S. bilateral trade deficits with these two economies. Canada, Mexico, and United States have a highly integrated automobile industry due to their collective participation in the North American Free Trade Agreement (NAFTA), which provides duty-free access to parts and finished vehicles throughout these three economies. Multinational vehicle manufacturers with production facilities in Mexico commonly source parts duty-free from the United States, produce vehicles in Mexico to take advantage of lower production costs and then export duty-free into the United States and Canada.