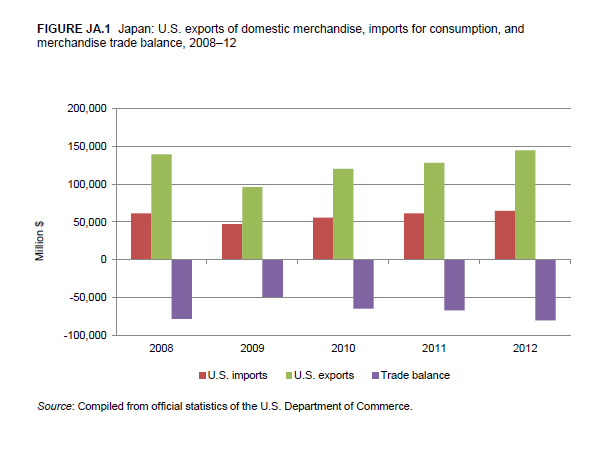

Change in 2012 from 2011:

- U.S. trade deficit: Increased by $13.4 billion (20 percent) to $79.9 billion

- U.S. exports: Increased by $3.2 billion (5 percent) to $64.6 billion

- U.S. imports: Increased by $16.6 billion (13 percent) to $144.5 billion

The U.S. trade deficit with Japan widened in 2012 as the growth in U.S. imports exceeded export growth by $13.4 billion (figure JA.1). Growth in U.S. demand for transportation, in particular, translated into a $16.6 billion increase in U.S. imports from Japan in 2012. In addition, Japanese production, which was disrupted in 2011 due to the Tohoku earthquake and other factors,1 not only recovered in 2012 but actually increased over its previous level.

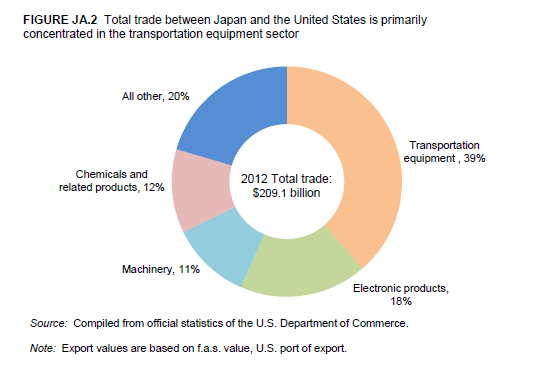

Growth in U.S. exports to Japan was led by strong Japanese demand for medical devices, pharmaceuticals, and aircraft. However, this export growth was undercut by a $693 million reduction in agricultural exports, arising from the drought in the United States during 2012. Export growth was also hobbled by economic stagnation and weak demand in Japan after the first quarter of 2012. Nevertheless, Japan remained the United States' fourth-largest trading partner in 2012, with total trade between the two countries primarily composed of transportation equipment.

U.S. Exports

U.S. exports to Japan increased by $3.2 billion in 2012 to $64.6 billion a five-year high. This expansion was largely due to heightened exports of transportation equipment (up $3.7 billion to $11.5 billion), electronic products (up $632 million to $11.3 billion), and chemicals (up $592 million to $12.2 billion).

Within the transportation equipment sector, U.S. exports of aircraft, spacecraft, and related equipment (up $3.4 billion to $8.1 billion) were the largest component of U.S. export growth to Japan. This was primarily due to sharply increased deliveries of the new Boeing 787 Dreamliner. The two largest airlines in Japan, All Nippon Airways (ANA) and Japan Airlines (JAL), accepted delivery of 21 Boeing 787s in 2012, up from three the previous year. Overall, deliveries of Boeing aircraft of all types to ANA and JAL increased from 21 in 2011 to 35 in 2012. In addition, U.S. exports to Japan of used or rebuilt military aircraft weighing more than 15,000 kg increased from zero in 2011 to $317 million in 2012.

The second leading U.S. export sector to Japan was electronic products, which expanded by $632 million (or 5.9 percent) in 2012. Export growth in this sector was driven by a $178 million increase in of U.S. exports of medical goods to Japan. Japan has the world's second largest global medical device market and has faced an acute need for high-value medical technologies including various imaging technologies and surgical instruments to address the various healthcare needs of the country's significantly aging population. Increased medical device exports between 2011 and 2012 reflect an ongoing trend, as U.S. exports of these goods have increased in each of the previous four years.

Similarly, the $592 million increase in U.S. exports of chemicals and related products, which rose to $12.2 billion total in 2012, resulted from greater Japanese demand for medicinal chemicals. The increased exports of these goods also reflected efforts by U.S. companies to increase sales; regulatory changes in Japan, including faster review times for new drug approvals; a pilot program which maintains higher prices on patented drugs; and attempts to encourage the sale of more generic drugs.

As mentioned earlier, overall increases in U.S. exports to Japan in these sectors were partially offset by a $693 million decline in agricultural exports. U.S. exports of cereals to Japan in 2012 declined by $1.2 billion (or 22.1 percent), primarily reflecting an $851 million decrease in corn exports and a $313 million reduction of U.S. exports of wheat and meslin. The 2012 drought in the United States led to a significant fall in corn production and an increase in prices, pushing Japanese purchasers to buy corn from other sources and switch to alternative crops. The U.S. share of Japan's corn imports decreased from 90 percent, by volume, in 2011 to 75 percent in 2012. In 2011, the value of Japan's global wheat imports remained fairly stable, reaching its third highest level, for the 2003-12 decade. However, the value of U.S. wheat exports to Japan was down due to a decrease in prices, a small decrease in Japanese imports from the prior year, and a smaller share of Japanese imports being sourced from U.S. producers.

U.S. Imports

U.S. imports from Japan increased in eight of the nine sectors discussed in this report, with transportation equipment representing $13.7 billion of the $16.6 billion increase in U.S. imports. The sectors with the largest import growth after transportation equipment were machinery (up $1.4 billion, or 8 percent) and minerals and metals (up $1.1 billion, or 16 percent).

Growth of U.S. transportation equipment imports primarily reflects an increase in U.S. imports of motor vehicles (up $7.9 billion to $39.7 billion) and certain motor vehicle parts (up $2.0 billion to $9.4 billion). U.S. motor vehicle sales substantially increased in 2012, rising from 13.0 million vehicles to 14.8 million (a 13 percent increase). Further, Japanese motor vehicle exports to the United States had declined in 2011 due to production disruptions resulting from the Tohoku earthquake and tsunami and, to a lesser extent, flooding in Thailand in the fall of 2011. The recovery of Japanese production following these disruptions was a major factor contributing to the increase in imports.

Additionally, within the transportation equipment sector, U.S. imports of construction and mining equipment from Japan continued their four-year growth trend, registering a $1.5 billion (51 percent) increase in 2012. This growth was due, in part, to an increase in U.S. construction; the annual value of U.S. construction is estimated to have grown by $76.3 billion (nearly 10 percent) in 2012.

In addition, rental companies, which are a major component of construction equipment manufacturers' customer base, are reported to have re-fleeted their construction and mining equipment lines in 2012. Accounting for an estimated 52 percent of the U.S. construction and mining machinery market, these companies shifted their fleets to incorporate more earthmoving equipment, including hydraulic excavators which make up the majority of U.S. imports from Japan. Many construction and mining equipment users rented equipment in 2012 rather than purchasing because of perceived economic uncertainty as well as the implementation of the U.S. Environmental Protection Agency (EPA) Tier IV interim emissions regulations for diesel engines. Tier IV equipment, much of which includes construction and mining equipment, is perceived to cost more to purchase and operate than Tier III equipment.

Two commodity groups each experienced import declines of at least $500 million in 2012 computers, peripherals, and parts, and semiconductor manufacturing equipment. The decline in U.S. imports of computer, peripherals, and parts reflects drops in Japanese imports of a number of products, including computer parts and accessories, notebook computers, and printers and parts of printing equipment. This trend was driven by a number of factors, including declining demand for computers and related products. U.S. imports of semiconductor manufacturing equipment from Japan declined by $611 million (11 percent) as U.S. companies reduced spending on equipment. Companies in North America invested heavily in semiconductor equipment in 2011, spending more than any other region, and in 2012 North American investment decreased by about $1 billion (more than 10 percent) from 2011.