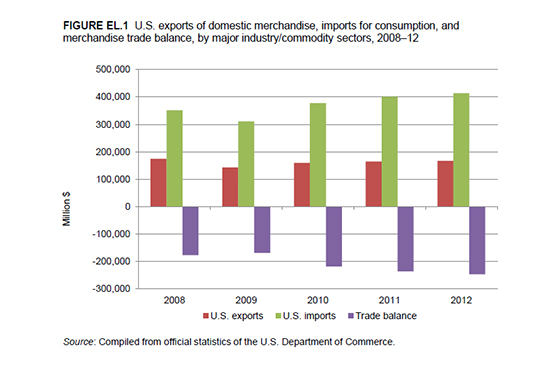

Change in 2012 from 2011:

- U.S. trade deficit: Increased by $10.7 billion (5 percent) to $246.8 billion

- U.S. exports: Increased by $2.5 billion (2 percent) to $167.0 billion

- U.S. imports: Increased by $13.2 billion (3 percent) to $413.8 billion

In 2012, the U.S. trade deficit for electronic products increased as import growth (by value) exceeded export growth by $10.7 billion (figure EL.1). Domestic import growth reflected strong consumer demand for imported smartphones and mobile computing devices, in particular. The United States imported $2.50 in electronics products for every dollar that U.S. companies exported during 2012.

China remained the United States' largest supplier of electronic products, accounting for the largest share (65 percent) of the U.S. trade deficit in electronics in 2012. Meanwhile, U.S. exports of electronic products to its largest trading partners within this sector — Mexico, Canada, Japan, and China, respectively — all increased, reflecting increased demand for U.S. measurement equipment and medical devices, in particular, within these key markets.

U.S. Exports

Increased U.S. exports of electronic products, which rose by 1.5 percent to $167 billion in 2012, were principally fueled by export growth in the measuring, testing, and controlling instruments and medical goods subsectors. Nearly 22 percent of U.S. exports of domestically produced electronic products went to Mexico ($18.9 billion) and Canada ($18.5 billion).

U.S. exports of measuring, testing, and controlling instruments recorded the single largest shift, expanding by $1.8 billion. Canada, China, and Mexico remained the three largest U.S. export markets for this commodity group, accounting for 75 percent of the increase in exports in 2012. Increased economic activity in these markets, coupled with growing demand from end-use industries for more precision and computer embedded systems (that is, computers for use in mechanical or electrical systems) created demand for U.S. products in this subgroup.

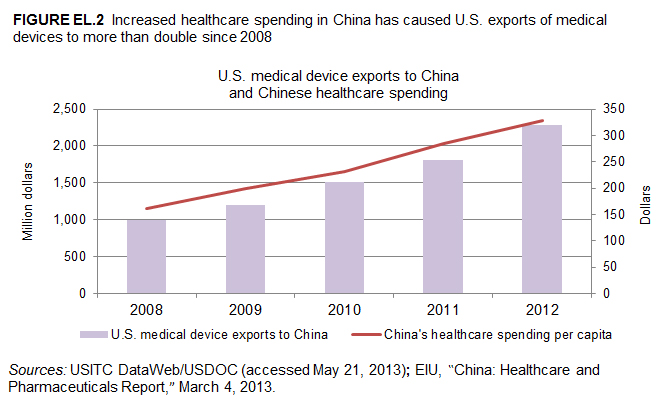

The $1.2 billion expansion of U.S. medical goods exports in 2012 was principally driven by increased exports to China, which accounted for 40 percent ($475 million) of this subgroup's growth. China has one of the world's lowest fertility rates and, as a result, an aging population, which has translated into increased demand for orthopedic devices in particular. U.S. exports of these devices to China increased by nearly 80 percent to $286 million in 2012. Further, over the past year, China's healthcare sector spending increased by an estimated $61 billion, with much of this funding being directed towards acquiring medical devices, the majority of which are produced in the United States (figure EL.2).

The largest decrease in U.S. exports of electronic products in 2012 was in semiconductors and integrated circuits (exports declined by 9.4 percent to $26.4 billion). Reduced demand for finished products containing DRAM memories — PCs, laptops, and netbooks — were a factor in declining exports. Taiwan, Korea, Singapore, and China, which are the top four export markets for U.S.-produced memory devices and leading computer producers, decreased their purchases of memory products by 50 percent (by value), and the average selling price also decreased slightly. The remaining decrease in exports of semiconductors and integrated circuits resulted from large inventories held by chip suppliers, which dampened the need for additional semiconductor products.

U.S. Imports

U.S. imports of electronic products increased for the third consecutive year, to a record $413.8 billion in 2012. Computers remained by far the largest subgroup of U.S. imports ($123 billion), but increased by only 1.6 percent in 2012. The subgroups with notable import shifts in 2012 were telecommunications equipment (increased by $4.1 billion or 5 percent); measuring, testing, and controlling instruments (increased by $1.5 billion or 7 percent); and circuit apparatus assemblies (increased by $1.3 billion or 20 percent).

U.S. telecommunications imports increased, in large part, because U.S. consumers continued to purchase internet-enabled "smart" cellular telephones. For instance, Apple released the iPhone 5 in September 2012, reportedly selling more than five million in the three days following the launch. Other companies, including Samsung, Nokia, Motorola, and LG also imported and launched new U.S. smart phone models. More than half ($43.7 billion) of the $83.3 billion in telecommunications equipment imports are comprised of cellular phones. China was the largest single source of imports of telecommunications equipment, accounting for 60 percent of U.S. imports. The value of U.S. telecommunications imports from China increased $12 billion, a 32 percent change, reaching $49 billion in 2012.

U.S. imports of measuring, testing, and controlling instruments increased to a record high of $23.1 billion in 2012. Imports from Mexico, China, Germany, Japan, and Singapore increased by a collective $1.2 billion (10 percent) to $12.9 billion, accounting for 81 percent of this subgroup's increased imports. The growth in U.S. imports in this subgroup resulted primarily from a general increase in demand from U.S. manufacturing, utilities, and mining firms — major markets for this sector — and the globalization of the industry. Intra-company transfers by major U.S. companies and large global producers with facilities in the U.S. market that have manufacturing operations in Mexico, Germany, China, Japan, and Singapore contributed to the rise in U.S. imports for this sector in 2012.

U.S. imports of circuit apparatus assemblies increased by 20 percent in 2012, reaching $7.5 billion. Mexico, China, Germany, Canada, and Japan accounted for three-quarters of these imports. More than 85 percent of the imports in this subgroup include equipment for electric control or the distribution of electricity, such as switchgear for use in wind towers and other electric grid control systems, and also smaller systems (i.e., home appliances). Increased imports in this category were likely driven by the supply chain needs of U.S. manufacturers of appliances and industrial equipment, who are sourcing components globally, as they increase domestic activity to meet demand.