What is the classification for a good I am trying to import or what is the duty for the good I’m importing?

Product classification begins with finding the correct classification for your product in the Harmonized Tariff Schedule of the United States (HTS or HTSUS) maintained by the USITC. The HTS is accessible at https://hts.usitc.gov/. If you are new to using the HTS or want a refresher, the USITC developed an online tutorial to assist users in understanding how to use the HTS that you may find helpful: https://learning.usitc.gov/hts-guide/index.html. The HTS is maintained by the Office of Tariff Affairs and Trade Agreements https://www.usitc.gov/offices/tata.

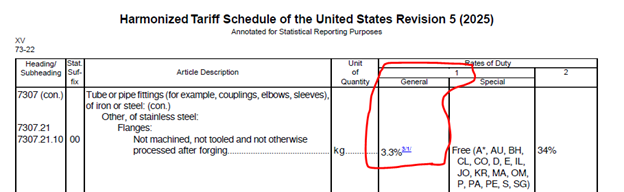

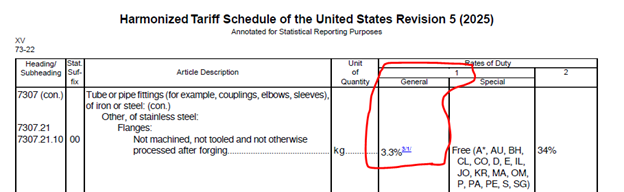

Duty rates are listed for most U.S. trading partners under the column 1 “General” (normal trade relations, previously referred to as most favored nation, rate), highlighted in red below. Some U.S. trading partners may have access to lower or eliminated duty rates based on trade preference programs (e.g., GSP, AGOA) or free trade agreements (e.g., USMCA, Korea-US FTA), those are shown under column 1 “Special”. A handful of countries are not eligible for normal trade relations rates of duties (currently North Korea, Cuba, Russia, and Belarus) and imports from these countries would be subject to the column 2 rates of duty. Additional duties or import restraints (quotas) may also be applicable depending on the product / country of origin based on other statutory authorities (e.g., 232 aluminum and steel tariffs, 301 China specific duties), all of which are laid out in Chapter 99 of the HTSUS.

It should be noted, however, that the USITC is not authorized to provide legally binding interpretation on how to classify goods according to the Harmonized Tariff Schedule of the United States and, thus, is unable to confirm to the public what the final duty rates for their imports will be. That authority resides with the U.S. Customs and Border Protection (CBP) agency of the Department of Homeland Security. Only CBP can issue legally binding rulings or advice on the tariff classification of imports. You can submit an inquiry to CBP at: https://www.cbp.gov/contact.