ECONOMICS WORKING PAPER SERIES

THE EFFECT OF REDUCING INVESTMENT BARRIERS IN CHINA’S CONSTRUCTION AND FINANCIAL SERVICES SECTORS ON THE CHINESE ECONOMY:

A GTAP-FDI MODEL PERSPECTIVE

Wen Jin "Jean" Yuan

Working Paper 2016-12-A

U.S. INTERNATIONAL TRADE COMMISSION

500 E Street SW

Washington, DC 20436

December 2016

Office of Economics working papers are the result of ongoing professional research of USITC Staff and are solely meant to represent the opinions and professional research of individual authors. These papers are not meant to represent in any way the views of the U.S. International Trade Commission or any of its individual Commissioners. Working papers are circulated to promote the active exchange of ideas between USITC Staff and recognized experts outside the USITC and to promote professional development of Office Staff by encouraging outside professional critique of staff research.

The Effect of Reducing Investment Barriers in China’s Construction and Financial Services Sectors on the Chinese Economy

Wen Jin “Jean” Yuan

Office of Economics Working Paper 2016-12-A

December 2016

ABSTRACT

This paper analyzes the economy-wide impact of China opening up its construction and financial services sector to all non-Chinese foreign investors, using the GTAP-FDI model developed by Lakatos and Fukui (2014). The GTAP-FDI model is a newly developed computable general equilibrium model that incorporates the global foreign direct investment (FDI) stock and foreign affiliate sales data. This paper finds that the reduction of investment barriers in China’s construction and financial services sectors towards foreign investors will benefit the Chinese economy overall. It will also increase the overall output in China's construction and financial services sectors. However, the simulation results also indicate that liberalizing China's construction and financial services sectors will hurt Chinese domestic construction companies, and Chinese domestic financial services firms, respectively. It will also negatively affect employment in Chinese-owned construction and financial services firms in China.

Wen Jin "Jean" Yuan

U.S. International Trade Commission

Introduction

This paper uses an extended GTAP model to quantify the economy-wide effects on inward FDI and foreign affiliate sales in China that might accrue if it reduces policy barriers to foreign investment in its construction and financial services sectors. China has the most restrictive policies towards FDI of any of the countries included in the FDI Restrictiveness Index published by the Organization for Economic Co-operation and Development (OECD) (Dollar, 2015). However, in recent years China has taken steps to gradually liberalize its foreign investment policy, particularly towards inward foreign direct investment (FDI) flows. For example, in the past three years the Chinese government has established four free trade zones (FTZs) in different Chinese cities, namely, Shanghai, Fujian, Guangdong and Tianjin, on the way to more general liberalization. Before October 2016, China’s FDI policy required all inward foreign investments to apply for government approval on a case-by-case basis. However, for investments into the FTZs (Shanghai FTZ as from late 2013, and then also the other three FTZs as from May 2015), a more liberalizing “negative list” approach was adopted; i.e. only investments into sectors classified as “restricted” or “prohibited” needed to be reviewed and approved by the government in order to go forward. As a result, in the FTZs, lower barriers to foreign investment prevailed for all industries except those on the “negative list” of restricted sectors (Deloitte, 2015).[1] This liberalization was included in the 2015 draft Foreign Investment Law for investments across China (not just in the FTZs), but in the event it was not implemented. In October 2016, NDRC and MOFCOM clarified that special administrative measures would still apply to foreign investments into both restricted or prohibited industries and into encouraged industries, as outlined in the Catalogue of Industries for Guiding Foreign Investment (2015 Revision) (Foreign Investment Catalogue) (Norton Rose, 2016).

Given the theoretical and policy significance of this topic, this paper uses an extended GTAP model (GTAP-FDI model), which was development by Lakatos and Fukui (2014) to quantify the effect of reducing FDI restrictions in China’s service sectors, in particular China’s construction and financial services sectors. The rest of the paper is organized as follows: the paper first reviews some of the existing literature that uses computable general equilibrium models to quantify the effect of FDI in general. The paper then describes in detail the GTAP-FDI modelling framework used in this analysis as well as the dataset used to calibrate the model. The next section offers details of the design of different simulations as well as providing the economy-wide/sectoral results of China reducing its investment barriers in its construction/financial services sectors. The final section concludes.

Literature Review

The Petri (1997) model was the first CGE model that considers foreign commercial presence (Lakatos and Fukui, 2014). The model uses the Armington assumption of national product differentiation, and distinguishes among different products by both the firm location and firm ownership. Moreover, Petri's model allocates a given investment budget across different sectors and countries, and defines investor preferences as a nested imperfect transformation function (Lakatos and Fukui, 2014). Another example of CGE models that incorporates the FDI is FTAP (Hanslow, Phamduc & Verikios, 2000). The FTAP model is a version of the standard GTAP model that incorporates the FDI using Petri's assumption. The major difference between the FTAP model and Petri's model is that the FTAP model assumes that foreign affiliates located in a given region are closer substitutes for domestic firms located in that region than they are for their respective parent firms, while Petri's model implicitly assumes that foreign affiliates and their parent companies are closer substitutes regardless of where they are located.

Lakatos and Fukui (2014) developed a newer version of the GTAP model that incorporates FDI and foreign affiliate sales into the model. One major difference between this model and the FTAP model is that this model represents the heterogeneous production technologies for firms differentiated by the region of ownership (Lakatos and Fukui, 2014). With this feature, this model is able to differentiate between domestic and foreign firms by ownership. Lakatos and Fukui (2014) use this model to analyze the reduction of investment barriers in India's retail services sector, and this paper uses the same model to analyze the reduction of investment barriers in China's two different services sectors.

Structure of the GTAP-FDI Model

The standard GTAP model without foreign affiliate sales data incorporated is a comparative static, multiregional and multisector computable general equilibrium model. On the supply side, land and capital stock are assumed to be fixed at the national level. Firms are assumed to be perfectly competitive on the market, substituting between capital and labor according to a constant elasticity of substitution (CES) function, while using intermediate inputs in fixed proportions to the valuedadded composite. Imported products from different regions are assumed to be imperfect substitutes, and so do the domestic produced and imported commodities in each country/region. Firms then allocate expenditure between domestically produced and imported commodities. On the demand side, a representative regional household receives all income generated in the region and allocates it among private consumption, government consumption, and savings.

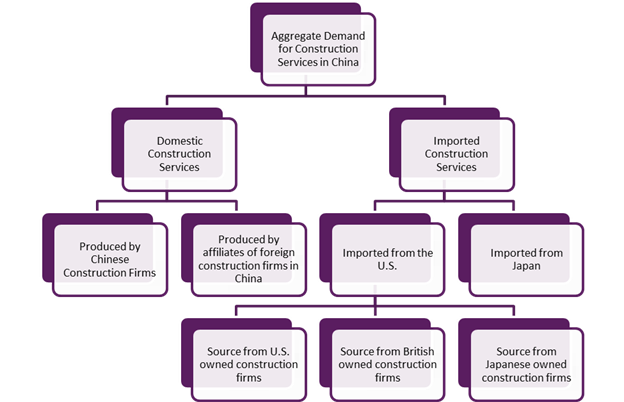

As an extension of the standard GTAP model, the major difference between the GTAP-FDI model and the standard GTAP model is that the former incorporates an additional level of nesting representing the region of ownership figure 1 portrays the structure of China's aggregate demand for its construction services sector as an example. In the first stage, consumers allocate expenditure between domestically produced and imported construction services. Then, in the second stage, there is an additional nesting in the sense that domestically produced construction services are further divided by either produced by Chinese domestic construction companies or by foreign-owned construction firms. Meanwhile, expenditure on imported construction services is allocated across different importing regions, and finally allocated across ownership categories to various multinational companies in these importing regions, respectively.

Figure 1:

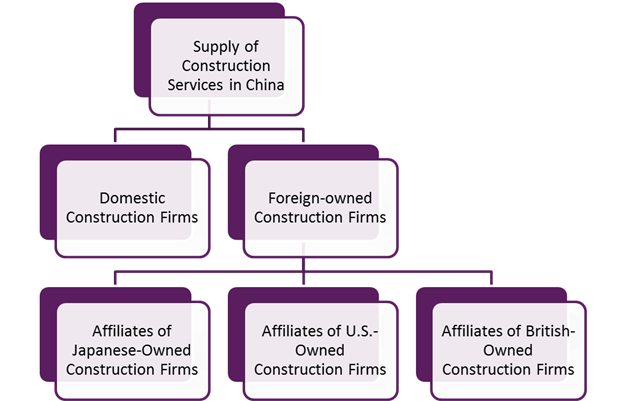

On the supply side, compared to the standard GTAP model, the GTAP-FDI model differentiates between domestic firms and foreign-owned affiliates of multinational companies (Lakatos and Fukui, 2014). As can be seen in figure 2, using the domestic supply of construction services in China as an example, it is composed of output of both domestic Chinese construction firms (such as the China State Construction Engineering Corporation) and foreign-owned construction firms located in China. Foreign-owned firms located in China are then further differentiated by country of ownership. Furthermore, each of these firms combines value-added and intermediate inputs using a Leontief technology to produce final goods, which implies that intermediate inputs, as well as final demand, are differentiated by not only the regions of firm location, but by regions of firm ownership as well (Lakatos and Fukui, 2014).

Figure 2:

Meanwhile, this paper also changes the fixed labor supply assumption in the GTAP-FDI model into a flexible labor supply. Under the fixed labor supply assumption, the aggregate labor supply in each country remains unchanged, which implies that workers do not work more (either by working longer hours or by joining the labor force) in response to an increase in wages. However, reduction in investment barriers in China's construction and financial services sectors is expected to affect labor supply in these two sectors in China accordingly. In order to accurately measure the employment effects, this paper therefore alters the aggregate labor supply elasticity in the model to reflect the flexible labor supply assumption. Under the flexible labor supply assumption, the aggregate labor supply elasticity is greater than zero, which implies that the labor supply will expand in response to a rise in wages. A labor supply elasticity of 0.4 was used for advanced economies and 0.44 for developing countries in the model.[2] This elasticity implies that, for every 1 percent rise in wages in China, workers in China will increase their supply of labor by 0.44 percent.

Simulation Methodology

To simulate the effects of reducing investment barriers in China’s construction and financial services sectors, this paper uses the GTAP version 9 dataset (with a 2011 baseline), with the foreign affiliate sales and FDI stock data incorporated into the model.[3] The current GTAP version 9 database, which is composed of 140 regions, is aggregated into 26 regions.

Using the baseline year of 2011, two simulations were conducted to calculate the effects on the Chinese economy when removing the investment barriers in China’s construction and financial services industries:

Simulation 1: China unilaterally reduces its investment barriers in its construction sector by 50 percent, towards all non-Chinese foreign affiliates

Simulation 2: China unilaterally reduces its investment barriers in its financial services sector by 50 percent, towards all non-Chinese foreign affiliates[4]

The analysis here uses the GTAP-FDI model to present a counterfactual picture of what the Chinese economy would look like if investment barriers in China’s construction/financial services sectors were reduced by half, assuming other conditions in the 2011 economy remains the same. The 50 percent removal of investment barriers in China's construction and financial services sectors takes into account the fact that if China were to gradually liberalize its construction and financial services sectors, it will most likely be a gradual liberalization and not all barriers will be lifted.

With respect to the computation of inputs for the FDI simulations, the OECD publishes an FDI Restrictiveness Index that measures restrictions on FDI by country/sector over time. The OECD FDI Restrictiveness Index covers four types of barriers to FDI: 1) Foreign equity limitations; 2) Screening or approval mechanisms; 3) Restrictions on the employment of foreigners as key personnel; and 4) Operational restrictions, e.g. restrictions on branching and on capital repatriation or on land ownership (OECD, 2016). Values for this index range from 0 to 1, with 0 indicating that a sector within an economy is fully open with no FDI restrictions, and 1 indicating the highest level of FDI restrictiveness. Table 1 presents the 2014 OECD FDI Regulatory Restrictiveness Indexes (RRI) in the construction sector in major economies in the world:

Table 1: 2014 OECD FDI RRI in the Construction Sector

|

Country |

2014 value |

|---|---|

|

Australia |

0.08 |

|

Canada |

0.11 |

|

Japan |

0 |

|

United States |

0 |

|

OECD-Average |

0.02 |

|

Non-OECD Member Economies |

0.14 |

|

Brazil |

0.03 |

|

China |

0.35 |

|

Russia |

0.05 |

|

South Africa |

0.01 |

|

India |

0.12 |

Source: OECD.org (accessed June 15, 2016)

As can be seen from Table 1 above, China's 2014 OECD FDI RRI in its construction sector was 0.35, and is the highest among major OECD and developing economies shown in Table 1. While the OECD FDI RRI offers a measure of the relative FDI restrictiveness of different countries/sectors, this paper needs to develop ad-valorem equivalent of the investment barriers as an input into the GTAP-FDI model.

USITC (2014) conducted an econometrics analysis estimating the effect of FDI restrictions (using the OECD FDI restrictiveness index) on foreign affiliate sales (FAS), using a gravity model specification. The coefficient on the FDI restrictiveness index can be interpreted as the change in foreign affiliate sales for each unit change in FDI policy. The results from the aforementioned econometric analysis predict an increase of 1.8 percent in FAS for every 0.01 decrease in the OECD FDI RRI, holding all else constant. This association is used to estimate FAS changes in this paper for each sector, host country, and owner country due to changes in the OECD FDI RRI. For instance, for the first simulation when reducing the investment barriers in China's construction sector by half the OECD FDI RRI for China's construction sector would reduce by 0.175, which means that FAS in China's construction sector would increase by 37.1 percent for all non-Chinese foreign affiliates.[5] The change in FAS in China's construction sector is then represented as a shock to the productivity of FAS in the sector in China to calculate the corresponding economy-wide impact for China.

Economy-Wide Impacts of the Reduction of Investment Barriers in China's Construction Sector

Descriptive Statistics of China's Construction Sector

The construction sector plays a crucial role in the Chinese economy, with its 2011 overall output accounting for 24 percent of China's GDP, according to the 2011 baseline data from the GTAP-FDI model. Given the important role of the construction sector in the Chinese economy, reduction in the investment barrier in China's construction sector is expected to significantly impact upstream and downstream suppliers, as well as overall welfare and cross-border trade flows. Table 2 gives the sales (output) data in China's construction sector. As can be seen from table 2 below, China's construction sector is mainly composed of domestic Chinese state-owned and private construction companies, with the output of Chinese domestic companies accounting for 86.8 percent of the overall output in China's construction sector. With respect to output of foreign affiliates, Hong Kong, the United States, and EU are the major foreign affiliates presenting in China, with their output accounting for 3.3 percent, 3.2 percent and 2.0 percent of the overall output in China's construction sector.

Table 2: Sales in China's Construction Sector (in billion dollars)

|

Country |

Sales |

Share of Total |

|---|---|---|

|

China |

1507.1 |

86.8% |

|

Hong Kong |

57.1 |

3.3% |

|

United States |

55.4 |

3.2% |

|

EU28 |

34.1 |

2.0% |

|

Taiwan |

10.4 |

0.6% |

|

Japan |

9.6 |

0.6% |

|

Singapore |

9.3 |

0.5% |

|

Australia |

7.1 |

0.4% |

|

Republic of Korea |

6.2 |

0.4% |

|

Russia |

5.8 |

0.3% |

|

Canada |

5.6 |

0.3% |

|

Rest of the World |

28.6 |

1.6% |

|

Total |

1736.3 |

100.0% |

Source: baseline 2011 data from the GTAP-FDI model

Estimated Change in Welfare

Within the simulation model, the most relevant summary measure of the economywide effects of trade agreements is the simulated change in economic welfare. The change in economic welfare provides a measure of the comprehensive effect of the reduction of investment barriers in China's construction sector.[6] It summarizes the benefits to consumers, as well as the effects on households in their roles as providers of labor, owners of capital, and taxpayers (USITC, 2007). The results from simulation 1 indicate that compared to the baseline, Chinese welfare increases by $40.3 billion. That is, when investment barriers faced by all non-Chinese foreign affiliates in China's construction sector are reduced by 50 percent, the annual benefits (i.e. in terms of purchasing power) to Chinese consumers would increase by $40.3 billion in the economy of 2011. This represents about 0.56 percent of Chinese GDP in that year. The analysis also decomposes the change in welfare into changes resulting from efficiency gains or losses, changes in the price of capital goods, and changes resulting from the relative price of imports and exports.[7] The analysis finds that the welfare gains are driven mainly by term-of-trade effects and an increase in the value of capital goods (CGDS), with value of capital goods increasing by 1.2 percent ($39.3 billion) as a result of the 50 percent reduction of investment barriers in China's construction sector.

Estimated Changes in Output, Trade Flows and Employment

This paper also examines the contributions of the reduction in investment barriers in China's construction sector to output, trade flows, and employment. The results show that overall output in China’s construction sector increases by 1.2 percent ($20.5 billion). Foreign affiliate sales in China’s construction sector increases by 37.1 percent, while output in domestic Chinese construction firms declines by 4.0 percent, as domestic Chinese construction firms face more competition from foreign affiliates. The overall output expansion in China's construction sector is likely due to the large investment liberalization, which pulls away resources from other sectors into the construction sector. In the meantime, other upstream and downstream sectors related to the construction sector benefit from the overall expansion of the construction sector: output of Chinese motor vehicles and parts[8], other government services and other businesses services (real estate, renting and other business activities) sectors increase by $3.2 billion, $3.1 billion and $1.9 billion, respectively.

As foreign affiliate sales in China's construction sector increases significantly, labor force employed in foreign-owned construction firms in China reaps the benefit table 3 shows that employment in foreign-owned construction firms increases by around one-third, while employment in domestic Chinese construction firms declines by 4.7 percent, most likely due to the decreasing output in domestic Chinese construction firms.

Table 3: Percent Change in Employment (Simulation 1)

|

Type of Firms |

In percentage |

|---|---|

|

U.S-Owned Construction Firms |

32.6 |

|

Canadian-Owned Construction Firms |

35.3 |

|

Chinese-Owned Construction Firms |

-4.7 |

|

Korean-Owned Construction Firms |

29.0 |

|

Russian-Owned Construction Firms |

29.2 |

|

EU Construction Firms |

30.9 |

Source: Author's simulations

When it comes to the change in cross-border services trade flows, Chinese cross-border imports of construction services decline by 1.6 percent ($63 million), while Chinese cross-border exports of construction services increase by 3.7 percent ($247 million), as a result of the 50 percent reduction in investment barriers on foreign affiliate sales in China's construction sector. The increase in Chinese cross-border exports of construction services is likely due to the overall expansion of China's construction sector. Table 4 gives the change of bilateral Chinese exports of construction services before and after simulation 1. As can be seen from table 4 below, Chinese cross-border exports of construction services mainly goes to the European Union, and the reduction of investment barriers will result in Chinese exports of construction services to the EU increasing by $101 million.[9]

Table 4: Bilateral Chinese Exports of Construction Services (in million dollars)

|

Country Pre-Simulation Post-Simulation Change in Value Change in Percentage |

||||

|---|---|---|---|---|

|

EU28 |

2692 |

2793 |

101 |

3.8% |

|

Russia |

673 |

697 |

24 |

3.6% |

|

USA |

343 |

355 |

12 |

3.5% |

|

Japan |

338 |

351 |

13 |

3.8% |

|

Korea |

127 |

131 |

4 |

3.1% |

|

Taiwan |

85 |

89 |

3 |

3.8% |

|

Hong Kong |

67 |

69 |

2 |

3.6% |

|

Canada |

60 |

62 |

2 |

3.7% |

|

Indonesia |

59 |

61 |

2 |

3.8% |

|

Rest of the World |

2151 |

2232 |

81 |

3.8% |

|

Total |

6592 |

6839 |

247 |

3.7% |

Source: Author's simulations

Economy-Wide Effect of the Liberalization of China's Financial Services Sector

Descriptive Statistics of China's Financial Services Sector

Compared to China's construction sector, China's financial services sector is smaller the sales (output) of China's financial services sector accounts for around 5.7 percent of Chinese GDP in 2011. As can be seen from table 5 below, output in China's financial services sector is mainly contributed by domestic Chinese financial services firms, and foreign affiliate sales in China's financial services sector comes predominately from the European Union.

Table 5: Sales in China's Financial Services Sector (in billion dollars)

|

Country Sales |

Share of Total |

|

|---|---|---|

|

China |

356.5 |

86.8% |

|

EU28 |

50.5 |

12.3% |

|

USA |

1.2 |

0.3% |

|

Hong Kong |

1.0 |

0.2% |

|

Rest of the World |

1.5 |

0.4% |

|

Total |

410.7 |

100.0% |

Source: baseline 2011 data from the GTAP-FDI model

Estimated Changes in Welfare, Output, Trade Flows and Employment

Simulation 2 reduces the investment barriers in China's financial services sector by 50 percent. As a result, foreign affiliate sales in China's financial services sector increase by 57.9 percent. The results from simulation 2 indicates that Chinese welfare (measured in EV) will increase by $23.4 billion (0.32 percent of GDP), compared to the baseline. The reason why the welfare gain from liberalizing China's financial services sector is smaller than liberalizing China's construction sector is most likely due to the fact that the size of China's financial services sector is smaller than China's construction sector.

With respect to output, overall output in China’s financial services sector increases by 0.8 percent ($3.2 billion). Meanwhile, the increase of foreign affiliate sales in China's financial services sector crowds out Chinese domestic financial services firms output in domestic Chinese financial services firms declines by 7.3 percent. When it comes to cross-border trade flows, the results from simulation 2 indicates that Chinese exports of financial services to the rest of the world increase by 19.8 percent ($492 million), while Chinese imports of financial services decline by 8.2 percent ($270 million). Meanwhile, Chinese imports of insurance services and other business activities (real estate, renting and other business services) also decline slightly (0.07 percent and 0.04 percent, respectively), probably due to the fact that insurance and other business services are downstream sectors of financial services and both use financial services as important inputs.

The significant increase of foreign affiliate sales in China's financial services sector results in the expansion of employment in foreign-owned financial services firms in China as can be seen from table 6 below, employment in foreign-owned financial services firms would increase by around 40 percent, while employment in domestic Chinese financial services firms would decline by 11.1 percent, mainly as a result of the shrinkage of output in Chinese domestic financial services firms.

Table 6: Percent Change in Employment (Simulation 2)

|

Country |

In percentage |

|---|---|

|

USA |

40.7 |

|

Japan |

38.7 |

|

China |

-11.1 |

|

Hong Kong |

38.6 |

|

EU28 |

39.3 |

Source: Authors' simulations

Conclusions

This paper sheds some light on the economy-wide effects of China opening up its construction and financial services sector to all non-Chinese foreign investors, using the GTAP-FDI model developed by Lakatos and Fukui (2014). This paper finds that the reduction of investment barriers in China’s construction and financial services sectors towards foreign investors would benefit the Chinese economy overall. It would also increase the overall output in China's construction and financial services sectors.

However, the simulation results also indicate that liberalizing China's construction and financial services sectors would adversely affect Chinese domestic construction companies, and Chinese domestic financial services firms, respectively. It would also negatively affect employment in the Chinese-owned construction and financial services firms, respectively, which probably explains, at least partially, why the Chinese government to date has been very cautious about liberalizing its construction and financial service sectors.

Bibliography

Deloitte, “China's Pilot FTZs: New Negative List further relaxes foreign investment sectors,” May, 2015. https://www2.deloitte.com/cn/en/pages/tax/articles/cpftz21-new-negative-list-further-relaxes-foreign-investment-sectors.html.

Dollar, David, “United States-China Two-way Direct Investment: Opportunities and Challenges,” Brookings Institute, January 2015. https://www.brookings.edu/~/media/research/files/papers/2015/02/23-us-china-two-way-direct-investment-dollar/us-china-two-way-direct-investment-dollar.pdf.

Hanslow, Kevin, Phamduc, T., & Verikios, George, "The Structure of the FTAP Model," Conference Paper presented at the Third Annual Conference on Global Economic Analysis, June, 2000. https://www.copsmodels.com/2000gtapconf/12hanslow.pdf.

Lakatos, Csilla, and Tani Fukui. “The Liberalization of Retail Services in India”, World Development, Vol 59, pp. 327340, 2014.

Norton Rose Fulbright, “A new era for China’s foreign investment regime: the official launch of the filing regime,” October 2016. https://www.nortonrosefulbright.com/knowledge/publications/143364/a-new-era-for-chinas-foreign-investment-regime-the-official-launch-of-the-filing-regime.

The Organisation for Economic Co-operation and Development (OECD), "FDI Regulatory Restrictiveness Index," n.d. (accessed June 15, 2016). https://www.oecd.org/investment/fdiindex.htm.

Petri, Peter. "Foreign Direct Investment in a Computable General Equilibrium framework," In Conference, Making APEC work: Economic challenges and policy alternatives, 1997.

U.S. International Trade Commission, “Trade, Investment, and Industrial Policies in India: Effects on the U.S. Economy,” USITC Publication 4501. Washington, DC: USITC, 2014. https://www.usitc.gov/publications/332/pub4501_2.pdf.

., "U.S.-Korea Free Trade Agreement: Potential Economy-wide and Selected Sectoral Effects," USITC Publication 3949, Washington, DC: USITC, 2007. https://www.usitc.gov/publications/332/pub3949.pdf.