ECONOMICS

WORKING PAPER SERIES

FIRM

HETEROGENEITY AND EXPORT PRICING IN INDIA

Michael A. Anderson

Martin H. Davies

José E. Signoret

Stephen L. S. Smith

Working Paper 2016-09-B

U.S. INTERNATIONAL

TRADE COMMISSION

500 E Street SW

Washington, DC 20436

September 2016

We thank participants at the Spring 2015 Midwest

International Economics Group, the 2014 Southern Economics Association

meetings, especially Tom Prusa, and at the USITC Trade Seminar for helpful

comments. We also thank Dylan Carlson, Chris Handy, Sommer Ireland, Richard

Marmorstein, Daniel Molon, George Nurisso, Matthew Reardon, Daniel

Rodriguez-Segura, Nathanael Snow, and Ricky Ubee for indefatigable research

assistance.

Office of Economics working papers are the result of ongoing professional

research of USITC Staff and are solely meant to represent the opinions and

professional research of individual authors. These papers are not meant to

represent in any way the views of the U.S. International Trade Commission or

any of its individual Commissioners. Working papers are circulated to promote

the active exchange of ideas between USITC Staff and recognized experts outside

the USITC and to promote professional development of Office Staff by

encouraging outside professional critique of staff research.

Firm Heterogeneity and Export Pricing in India

Michael A. Anderson, Martin H. Davies, José E. Signoret, and Stephen L. S.

Smith

Office of Economics Working Paper 2016-09-B

September 2016

ABSTRACT

We examine the export pricing behavior of Indian manufacturing firms in the

early 2000s using a unique data set that matches detailed firm characteristics

with product and destination-level trade data. We find, in contrast to evidence

for other countries, that firm productivity is negatively associated with

export prices, and that export prices are negatively associated with distance,

and positively associated with remoteness. We suggest that it is the higher

cost of innovation in India, driving down the scope for quality

differentiation, which leads to the negative association between productivity

and prices. We use the framework of Antoniades (2015) to place our results

(heterogeneous goods, homogeneous markets) relative to two other groups

identified in the literature: (homogeneous goods, homogeneous markets) and

(heterogeneous goods, heterogeneous market). To our knowledge this is the first

empirical evidence consistent with this particular theoretical possibility.

Michael A. Anderson

Washington and Lee University

AndersonM@wlu.edu

Martin H. Davies

Washington and Lee University

Center for Applied Macroeconomic Analysis, Australian National University

DaviesM@wlu.edu

José E. Signoret

U.S. International Trade Commission

Jose.Signoret@usitc.gov

Stephen L. S. Smith

Hope College

slssmith@hope.edu

I. Introduction

Our paper contributes to the

literature on firm heterogeneity and export pricing by analyzing the behavior

of Indian manufacturing firms. We construct and exploit a new data set for

India containing firm export transactions matched to firm characteristics to

determine the sources of exporting success. This allows us to ask the question:

in comparison to exporters in other countries examined thus far, do Indian

firms behave differently?

We

make two primary contributions. We are the first to examine the pricing

behavior of Indian exporters. Second, we find a negative association between

firm productivity and the prices firms charge in destination markets. This

result, combined with a finding that prices are negatively associated with

distance to destination market, and positively associated with remoteness, is

in contrast to findings for exporters in other countries.

We

contribute to a small, but burgeoning, literature which examines the pricing

behavior of exporters in China (Manova and Zhang, 2012), the United States

(Harrigan, Ma, and Shlychkov, 2015), and Europe (Portugal: Bastos and Silva, 2010;

Hungary: Görg, Halpern, and Muraközy, 2010; France: Martin, 2012; and Colombia:

Kugler and Verhoogen, 2012). These papers all find similar results, namely that

more productive firms charge higher prices in export markets, and that prices

increase with distance. Further, Manova and Zhang and Harrigan, et al. also find that prices fall with

remoteness. These results suggest that more productive firms are quality

upgrading.

Our

results stand in contrast to this body of literature. We find that for Indian

exporters, more productive firms charge lower prices, and that prices fall with

distance and rise with remoteness. Further, these results are robust across

industries.

While

different from those for other exporting countries studied, our results are

consistent with recent heterogeneous firm models that incorporate endogenous

quality upgrading. Antoniades (2015) provides a framework which shows that the

relationship between prices and productivity may be positive or negative

depending on whether the scope for quality differentiation is high or low. The

scope for quality differentiation, which reflects a firm’s ability to recover

the innovation cost of quality upgrades, depends on market size, the degree of

differentiation between varieties of goods, and the cost of innovation.

When

the cost of innovation is high, firms producing heterogeneous goods will face a

lower scope for quality differentiation (quality ladders are shorter), in

which case quality upgrades for more productive firms become smaller and the

relationship between firm productivity and prices may be negative. As India is

a developing country, Indian firms face a higher cost of innovation than firms

in the developed countries noted above, and we suggest that our empirical

results for India arise because quality ladders there are short (markets are

homogeneous). China, also a developing and rapidly emerging economy, is commonly

contrasted to India. Relative

to India, firms in China face larger markets and a lower cost of innovation,

leading to a higher scope for quality differentiation and the observed positive

relationship between productivity and price.

Based

on the characteristics of goods (homogeneous or heterogeneous) and markets

(homogeneous or heterogeneous), we divide the current empirical literature into

two groups: (homogeneous goods, homogeneous markets) and (heterogeneous goods,

heterogeneous markets). We place our result in a third group, (heterogeneous

goods, homogeneous markets). To our knowledge we are the first to find

empirically this result.

The

paper proceeds as follows. Section II reviews the literature and Section III

discusses the new data. Section IV presents our results in two parts:

descriptive statistics on successful exporters’ pricing patterns and regression

results that relate individual product price decisions to firm and destination

market characteristics. Section V discusses our results and Section VI

concludes.

II. Literature Review

The theoretical literature is

instructive in highlighting the contrast in the behavior of Indian firms

relative to the firms in other countries examined thus far. Melitz (2003)

introduces firm level marginal cost heterogeneity into a model with beachhead

costs and monopolistic competition. Because goods are homogeneous, firms

compete only on price and, since mark-ups are constant, more productive firms

charge lower prices. Since the lowest priced goods are the most competitive,

prices are decreasing in the distance from the export market and increasing in

remoteness.

These

predictions run counter to the empirical studies mentioned above, which find a

positive correlation between productivity and price. The common explanation is

that firms in these countries compete both on quality and price. Baldwin and

Harrigan (2011) modify Melitz (2003) to include a quality dimension. In their

model, firms with higher unit costs produce higher quality goods and, because

quality is increasing in cost at a sufficient rate, while they charge higher

prices, their goods are more competitive because the price per unit of quality

is less than for lower cost firms. This quality-adjusted heterogeneous-firms

model predicts that export prices are increasing in distance and decreasing in

remoteness, which fits the empirical evidence collected thus far.

The

sample of firms we examine is drawn from a range of differentiated goods

manufacturing sectors within which there are variations in quality. Antoniades

(2015) provides a framework which helps illuminate the position of our result

within the literature. His paper extends the model of Melitz and Ottaviano

(2008), which includes a linear demand system in a model of monopolistic competition,

to incorporate endogenous quality choice by firms. Lower cost firms choose

higher quality and have higher mark-ups, which is a feature both of producing a

variety of higher quality which increases demand and facing a lower elasticity

of demand. Since marginal costs and mark-ups move in opposite directions, it is

possible that the relationship between price and productivity may be positive

or negative.

Whether

it is positive or negative depends on the scope for quality differentiation,

which in turn depends on the factors which influence a firm’s ability to

recover the

innovation costs of quality upgrading: on market size (L), the degree of differentiation between varieties (1/γ), and the cost of innovation (θ). The sign of this relationship depends

on

where

1/c is productivity, β is a taste parameter which measures the appreciation of quality, δ measures the cost of upgrading

quality, and λ is the scope for

quality differentiation.

When then the scope for quality differentiation is

low and dp(c)/dc > 0, and prices and productivity

are negatively correlated. When the scope for quality differentiation is high,

or when quality ladders are long, then and

the relationship

between productivity and price is positive and prices are a good proxy for

quality (Khandelwal, 2010). This is known as the heterogeneous markets case. There

are two possibilities when the scope for differentiation is low ( )

and quality ladders are short, which is the alternative homogenous markets

case. First, when goods are homogenous, firms find no purpose in quality

upgrading and the relationship between prices and productivity is negative, as

in Melitz and Ottaviano (2008). The alternative is when goods are heterogeneous

and the scope for quality differentiation is low. Here firms will engage in

quality upgrading, but while higher productivity firms choose higher quality

and mark-ups are larger, they do not rise at a rate sufficient to offset their

lower costs. Thus, more productive firms charge lower prices.

We

now briefly summarize the empirical literature. Using 2005 Chinese firm and

product data at the HS 8-digit level, Manova and Zhang (2012) find that

successful exporters earn more revenue in part by charging higher unit prices

and by exporting to more destinations than less successful exporters. Even

within narrowly-defined product categories, firms charge higher unit prices to

more distant, higher income, and less remote markets. Manova and Zhang argue

that firms’ product quality is as important as production efficiency in

determining these outcomes.[4] Harrigan,

et al. (2015), using 2002 U.S. data

at the HS 10-digit level, make a similar finding: U.S. firms charge higher

prices for products shipped to larger, higher income markets, and to countries

more distant than Canada and Mexico, a result they attribute to higher quality.

Harrigan, et al. also find that

firms’ ability to raise unit prices is positively affected by their

productivity and the skill-intensity of production. On their face, the results

relating to distance and number of markets appear consistent with the

hypothesis first advanced by Alchian and Allen (1964), and developed by Hummels

and Skiba (2004), that “per unit” transport costs raises relative demand for

high quality goods (the “shipping the good apples out” hypothesis).

Bastos

and Silva (2009) examine Portuguese firm-level data on exports by product and

destination market. They find strong support that within-product unit values

increase with distance; doubling distance increases unit values by nine percent

(their distance elasticity is 0.05). Firm productivity is positively associated

with firm prices; in addition they find that firm productivity “magnifies the

positive effect of distance on within-product unit values,” which suggests that

high-quality products from high-productivity firms are more successful in

difficult markets. Likewise, Görg, et al.

(2010), with Hungarian firm-level data on exports by product and destination

market, find a substantial positive distance effect on unit values. They report

distance elasticities consistently in the 0.080.10

range; Hungarian export unit values are 2530

percent higher in the United States than in the EU. This effect holds most

strongly for differentiated goods. They also report that unit values rise with

firm productivity and with destination market income per capita, which they

call “quality-to-market” effects.

Martin

(2012) examines French exporting firms in 2003. Here again prices are positively

associated with distance. The author finds that doubling distance increases

prices by 3.5 percent (the elasticity of f.o.b. prices to distance is 0.05), an

effect that is weakened for the Euro area subsample. The author attributes the

latter point to incomplete exchange rate pass-through and the absence of

country-specific tariffs for goods. The author also find evidence that the more

differentiated is the good, the larger is the effect of distance on prices (a

result obtained by interacting distance with the good’s elasticity of

substitution).

Syverson

(2007) investigates price dispersion in the ready-mix concrete industry in the

United States. His model has heterogeneous firms (differing marginal costs) competing

in a homogenous goods market with very high transport costs (so high that 348

markets consisting of contiguous counties are assumed to exist in the United

States). The price data support the heterogeneous-firm model by showing a

negative correlation between price dispersion, and upper-bound prices, and

producer density. This stands in contrast to the predictions found in

homogenous producer (with homogeneous goods) models.

Foster,

Haltiwanger, and Syverson (2008) examine a small set of assumed homogenous

goods manufacturers (of goods such as ice, concrete, sugar, boxes, oak

flooring). Their data allows them to disentangle physical productivity (units

of output) from revenue productivity, the latter being the measure typically used

to measure firm efficiency. The authors find greater dispersion of physical

productivity compared to revenue productivity; the former is negatively

correlated with establishment-level prices while revenue productivity is

positively associated with prices.

Using

data from the Census of U.S. Manufactures over the period 19631987,

Roberts and Supina (1996, 2000) undertake two studies to examine how the

patterns of prices and mark-ups vary with plant size. They choose products that

are clearly homogeneous to remove other sources of heterogeneity. In Roberts

and Supina (1996) they examine six homogeneous manufactured goods (white pan

bread, coffee, tin cans, corrugated boxes, concrete, and gasoline). They find

that output prices decline with plant size in five of six products (for

gasoline there is no correlation), and that mark-ups decline in three and rise

in two, with no relationship for gasoline. Roberts and Supina (2000) look at

thirteen homogenous manufactured products and examine, in addition to the

questions above, the persistence of prices over time, and find there is more

persistence than would be generated by random movements. They also find that

for all products, except gasoline and newsprint, large producers charge lower

prices; that marginal costs are decreasing for most producers; and that

mark-ups increase in six products, decrease in four, and have no relationship

in two (gasoline and newsprint).

Using

data from the Colombian manufacturing census, Kugler and Verhoogen (2012) find

a positive correlation between both output and input prices and plant size;

this positive correlation is also evident for export status. Using advertising and research

and development (R&D) intensity as measures of the scope for quality

differentiation they find a positive relationship between output prices and

plant size, and input prices and plant size, which is stronger for sectors in

which the scope for quality differentiation is higher. They match these empirical

findings to a modification of the Melitz (2003) model which

incorporates endogenous choice of output and input quality, which predicts the

matching of more capable producers and higher quality inputs to produce higher

quality outputs.

III. Data

Our detailed firm-level price, good,

destination and firm characteristics dataset is assembled from several sources.

We have detailed firm-level daily transactions data for Indian exporters in

TIPS, a database collected by Indian Customs. TIPS contains detailed export

data including the identity of the exporter, the date of transaction, the

product type by 8-digit HS code, destination country, exit and destination

port, and the quantity and the value of the export. We have useable data for

four full fiscal years, 2000-2003, which cover the transactions at eleven major

Indian seaports and airports.[5] For

the purpose of our analysis we aggregate the data to fiscal-year average prices

by firm.

The

firm-product-destination data have quantity units attached. Wherever possible

we “harmonize,” or standardize, the quantity units, adjusting the associated

transaction value as required. For example, we convert metric tons and pounds

to kilos, and we converted yards and feet into meters. For each product we keep

only those observations in the “dominant” unit, the quantity unit with the

largest share of that product’s exports. This

step is required as our model predicts prices (unit values) based upon firm and

destination characteristics, and we cannot explain why a product has a certain

price when measured in kilos, and why the price differs when measured in boxes.

It

is possible that our quantity harmonization introduces selection bias into our

sample if firms that ship in the dominant unit differ from the other firms in

the sample. Alternatively the choice of unit may be related in some way to the

destination country. By keeping only dominant units we reduce our sample from

27,403 to 21,385 observations, a 22 percent reduction, and the total value of

exports in the sample falls by 8 percent.

To

examine this possibility we run a probit where the binary dependent variable

equals 1 if the firm-product-destination observation is measured in the

dominant unit, 0 otherwise. We look for correlation with our vectors of firm and

destination characteristics. Results are presented in Appendix Table A.1. We

find one of two results across the variables: either a variable is

statistically insignificant, suggesting that selection is not happening on that

characteristic; or the marginal effect of the variable is small, suggesting

that our sample does not suffer from severe selection bias. See the discussion

in the Appendix for further details.

The

TIPS data, once harmonized across quantity units, are matched with detailed

firm-level data from Prowess, a proprietary database of Indian firm

characteristics.[7] The

dataset contains time series information back to 1989 on approximately 23,000

large- and medium-sized firms in India, and includes all companies traded on

India’s major stock exchanges as well as other firms, including the central

public sector enterprises. Its broad swath of Indian firms pay around 75

percent of all corporate taxes and over 95 percent of excise duties collected. From

Prowess we derive information on employment, labor and capital use, expenses on

intermediates, and other firm-level variables for manufacturing firms (our

sector of interest). While Prowess contains information on overall foreign

sales, it lacks information as to the products exported, their destination

markets, and their export unit prices. Matching firms between TIPS and Prowess brings

these additional dimensions.[8] The

results in this paper are based on a matched dataset on 1,018 manufacturing firms.[9]

Finally,

we use country characteristic data (income, population, and distance from

India) from the publicly available CEPII Gravity database (Head, Mayer, and

Ries, 2010).

We

measure export prices as unit values: export revenue by product category

divided by the number of units exported in that category. The TIPS data are

reported at an HS 8-digit level of detail, though our data allows us to

ultimately define a “product” at a much finer detail than that, a level we

refer to as “HS 8-plus.”[10] At

this fine level of differentiation, the rich detail of the TIPS side of our

merged data allows us to distinguish a firm’s patterns of prices for an

identical good across different destination countries.

Tables

1 and 2 offer an initial view of the export behavior of the firms in our working

sample. The picture that emerges is a familiar one, though with some differences

from the United States. The most successful firms in export value terms

dominate the export sector in many dimensions. The top ten percent of the firms

account for approximately 80 percent of exports by value (Table 1). This is

less concentrated than the behavior of U.S. exporters in 2000, for which the

top ten percent account for 95 percent of the value of all exports.

Table 1. Distribution of Export Values by Firm, Percent

Shares

|

Year

|

Top

1 percent

|

Top

5 percent

|

Top

10 percent

|

Top

20 percent

|

Bottom

80 percent

|

|

2000

|

32.1

|

60.1

|

73.6

|

87.7

|

12.3

|

|

2001

|

44.4

|

68.9

|

79.5

|

89.1

|

10.9

|

|

2002

|

43.6

|

67.6

|

79.7

|

89.1

|

10.9

|

|

2003

|

40.6

|

70.1

|

83.3

|

93.5

|

6.5

|

Source: Authors’ calculations from estimating

sample

A

small group of successful exporters sell far more products per firm, and to far

more destinations per firm, than do other exporters (Table 2): 13.5 percent of

our sample sold 10 or more goods to 10 or more destinations in 2003. The modal

Indian firm in our sample exports between 2 and 5 products to between 2 and 5

markets (21.2 percent of all firms). If one considers the proportion of firms

that export to one market only, the figure in our sample is 26 percent versus

65 percent for the United States in 2000.[11]

Table 2. Cross-Tabulation of Firm Export Destinations and Product

Diversification, 2003

|

Percent of firms

|

1

Destination

|

2-5 Destinations

|

6-10 Destinations

|

>10 Destinations

|

Total

|

|

1

Product

|

17.8

|

3.4

|

3.0

|

0.2

|

21.7

|

|

2-5

Products

|

6.7

|

21.2

|

3.3

|

0.7

|

31.7

|

|

6-10

Products

|

0.8

|

9.0

|

6.8

|

2.6

|

19.2

|

|

>10

Products

|

0.7

|

4.9

|

8.2

|

13.5

|

27.2

|

|

Total

|

25.9

|

38.6

|

18.6

|

16.9

|

100.0

|

Source: Authors’ calculations from estimating sample.

Note: Products are defined at HS 8-plus level discussed in text.

IV. Results

We offer two sets of results. The first consists of descriptive findings about

Indian exporters’ pricing behavior. The evidence here suggests that Indian

firms may be increasing export revenue through quantity increases rather than

through price increases. In the second set of results, we estimate the relation

between prices and destination market characteristics and firm characteristics.

We are particularly interested in the relationship between firm productivity

and export prices, and our finding is that firm productivity is associated with

lower prices, a result that stands in contrast to other results in the

literature.

IV.A. Indian Export Price Patterns

Between 2000 and 2003 Indian export

revenue (in our sample) grew by a factor of more than 3.5. Remarkably, for

products and markets with continuing sales, revenue increases were achieved by

rising volumes in the face of falling prices.

Individual

exporters’ overall revenue changes are the net effect of revenue changes on

their intensive and extensive margins. Price and quantity changes on shipments

to existing markets (continuing goods and destinations) generate “intensive

margin” changes, while revenues from new markets (new goods and destinations)

constitute the extensive margin.

We

adopt a simple approach to assess the price and quantity components of revenue

growth on the intensive margin combined with a broad definition of the

intensive margin. [12] We

calculate, at the firm-product level, the weighted annual rates of change in

price and quantity over all the continuing destination markets to which the

given firm exports the given product, using destination market revenue as

weights.

We

restrict ourselves to firm-product-destination combinations that can be thought

of as plausibly “continuing.” So, for instance, when a firm exports a product

to a given set of destination markets in consecutive years, the

destination-weighted rates of price, quantity and revenue change can be

calculated. Further, we include all such observations with one- or two-year

gaps (two years being the maximum possible gap in our four-year sample). For

example, a firm that exports a particular good to a given destination only in 2000

and 2003 is considered to be “continuing.” In an environment with high exit

rates, these continuing firm-product-destination combinations represent the

behavior of some of India’s most successful exporters. In our sample, 48

percent of total export revenue comes from continuing exports defined in this

fashion. The remaining 52 percent of export revenues come from shipments which

represent one-time sales by a firm of a given product to a given destination

(at least in our sample).

We adopt a simple decomposition,

as follows, where f, p, and d (d = 1, 2, …D) subscript firms, products and

destination markets (and D is the

total number of a firm’s destinations for any given product p). Define Pfpd and Qfpd

to be the unit value and quantity of firm f’s

shipment of product p to destination d. Suppressing time subscripts, in any

given year the firm’s revenue from exporting a product, Yfp, is the sum of revenue earned across all D destinations:

(1)

Taking

the total differential of Yfp

with respect to Pfpd and Qfpd, and defining to be the firm’s product p revenue share attributable to sales in destination d, we can decompose intensive margin

export revenue growth for product p (

) into the (destination-weighted average)

contributions of price and quantity changes across destinations:

(2)

and represent the rate of change in unit value and

quantity, for destination d. The

revenue-weighted averages, across destinations, of price and quantity changes

give us the intensive margin’s price change ( and quantity change ( )

for each firm-product (f-p) observation.

(For observations with gaps between appearances, we calculate price, quantity

and revenue rates of change over the entire period and attribute that change to

the final year.) All calculations are made at the HS 8-plus level. Note that

each f-p observation with continuing

destinations allows calculation of price- and quantity-change observations as

long as there is a previous year of data, regardless of the number of

destinations to which the firm ships the product.

Results are summarized in Table 3.

There are 1,419 unique firm-product-year observations over fiscal years

2001-2003 (keeping in mind that 2000 is dropped in calculating the rates of

change). The table reports medians of the price, quantity and revenue variables

calculated for each observation. Revenue changes appear to be dominated by

quantity changes (line 1). The median firm-product annual revenue change was

4.1 percent, while the median price change was -1.1 percent and the median quantity

change was 12.1 percent. When we restrict the sample to firm-product

observations with positive revenue change only (line 2), the median annual

revenue change rises to 154.0 percent, while the median price change is 0.1

percent (and of quantity, 151.5 percent). Clearly,

many “successful” exportersthose with revenue increasesgained those revenue increases by

large quantity increases in the face of flat or falling unit prices.

Table 3. Median Destination-Weighted Price, Quantity and Revenue Changes,

2001-2003

|

All Continuing Firm-Product Observations

|

%Δ

Price

|

%Δ

Quantity

|

%Δ

Revenue

|

|

|

|

|

|

|

All Continuing Firm-Product

Observations (n = 1,419)

|

-1.1

|

12.1

|

4.1

|

|

|

|

|

|

|

All Continuing Firm-Product

Observations with Positive Revenue Growth (n = 726)

|

0.1

|

151.5

|

154.0

|

Source: Authors’ calculations from estimating sample.

Note: Products defined at HS 8-plus, using all continuing firm-product

observations as defined in text. Figures presented are the medians by variable.

Cross-tabulations of the price and

quantity changes (Table 4) confirm this: 49.0 percent of firm-product

observations with positive revenue growth experienced lower prices (that is,

356 out of 726 firm-product combinations). Clearly, Indian exporters, at least in

this period, experienced price decreases in their shipments as measured at a HS

8-plus level.

Table 4.Cross-Tabulation of Destination-Weighted Price and

Quantity Changes,

For all Continuing Firm-Product Observations

|

4A. All Continuing Firm-Product Observations (n = 1,419)

|

|

Percent (number)

|

%Δ Quantity≤ 0

|

%Δ Quantity> 0

|

Total

|

|

%Δ Price ≤ 0

|

20.7

(295)

|

33.3

(472)

|

54.1

(767)

|

|

%Δ Price >0

|

23.0

(326)

|

23.0

(326)

|

45.9

(652)

|

|

Total

|

43.8

(621)

|

56.2

(798)

|

100.0

(1,419)

|

|

4B. Continuing Firm-Product Observations With Positive

Revenue Growth (n = 726)

|

|

Percent (number)

|

%Δ Quantity≤ 0

|

%Δ Quantity>0

|

Total

|

|

%Δ Price ≤ 0

|

0.0

(0)

|

49.0

(356)

|

49.0

(356)

|

|

%Δ Price >0

|

7.6

(55)

|

43.4

(315)

|

51.0

(370)

|

|

Total

|

7.6

(55)

|

92.4

(671)

|

100.0

(726)

|

IV.B. Controlling for Destination Market

and Firm Characteristics

We now examine how firm prices are

associated with a range of firm and destination characteristics. Firm

characteristics include the capital to labor ratio, labor usage (which we take

as a proxy for size), and total factor productivity (TFP);[15] destination-market

characteristics consist of distance, remoteness, GDP, and GDP per capita.

As

in Harrigan, et al. (2015), we

consider the possibility of selection bias because firm prices are only

observed if firms choose to export to particular destinations, and we implement

their three-stage estimator, itself an extension of Wooldridge (1995). The

first stage is a Probit of entry (of a firm in a particular destination in a

particular year) on all exogenous export-market characteristics (Xd), firm characteristics (Xf ), and a year-specific intercept . Omitting time subscripts we have:

(3)

Equation (3) is estimated over an

expanded sample of all possible firm-destination-year combinations; that is, it

is applied to a “rectangularized” data set with zeros added. The inverse Mills

ratio is then included in the second stage

which explains observed (i.e., positive) firm-product-destination revenue based

upon export-market and firm characteristics and product fixed effects ( ):

(4)

Quasi-residuals, formed as the

actuals residuals plus the estimate term for the inverse Mills ratio, ,

from this second stage are then entered as a selection control in the price

regression:

(5)

This approach is more flexible than the

two-step Tobit approach proposed by Wooldridge (1995) in that the estimated effects

on entry, the ’s in equation (3), are allowed to

differ from the effects on export intensity, the ’s in equation (4).[17]

While the rich data used in Harrigan, et

al. (2015), allows them to estimate regressions (3) and (4) product by

product, the limited number of firms in our sample makes this approach

unpractical, since in many instances it would entail estimation with very few

data points. Thus, we initially estimate these regressions over the whole

sample and then relax this treatment by conducting the analysis by subsamples

based on broad industries (e.g., textiles and textile articles).

Descriptive

statistics on the estimating sample are presented in Table 5, and regression

results are presented in Table 6. The dependent variable in every case is the

unit value of a firm’s exports at the product-destination-year level, and all

regressions use product fixed effects and destination standard-error clusters. Note

that compared to the previous descriptive analysis we have many more

observations because the data are in levels (not rates of change) and are not

aggregated across destinations.

Table 5A. Descriptive Statistics from Estimating

Sample (Table 6, Column 1), in levels,

n = 20,850

|

Variable names

|

Mean

|

Std.

Dev.

|

Min

|

Max

|

|

price (USD)

|

1,005

|

19,689

|

0.0000004

|

2,299,543

|

|

gdppc (USD)

|

13,573

|

12,299

|

86

|

50,987

|

|

gdp (USD millions)

|

1,291,664

|

2,805,356

|

147

|

10,400,000

|

|

dist (km)

|

5,928

|

3,586

|

683

|

16,937

|

|

remote

|

0.00015

|

0.00009

|

0.00003

|

0.00037

|

|

tfp

|

126

|

85

|

22

|

444

|

|

klabor (USD thousands)

|

14

|

20

|

0.27

|

338

|

|

labor (USD thousands)

|

211

|

449

|

0.10

|

10,997

|

Table 5B. Descriptive Statistics from Estimating

Sample (Table 6, Column 1), in logs,

n = 20,850

|

Variable names

|

Mean

|

Std.

Dev.

|

Min

|

Max

|

|

price (USD)

|

1.65

|

3.04

|

-16.98

|

14.65

|

|

gdppc (USD)

|

8.66

|

1.63

|

4.45

|

10.84

|

|

gdp (USD millions)

|

11.96

|

2.23

|

4.99

|

16.16

|

|

dist (km)

|

8.51

|

0.61

|

6.53

|

9.74

|

|

remote

|

-8.99

|

0.70

|

-10.44

|

-7.90

|

|

tfp

|

4.64

|

0.63

|

3.10

|

6.10

|

|

klabor (USD thousands)

|

2.16

|

0.90

|

-1.31

|

5.82

|

|

labor (USD thousands)

|

4.23

|

1.57

|

-2.30

|

9.31

|

Column

(1) is a regression on all firm-product-destination observations in our sample,

with no selection correction. Column (2) presents the results for the same

sample as column (1) with the three-stage selection correction.[18] Subsequent

columns present results for products in particular 2-digit HS chapters:

textiles and textile articles (columns 3 and 4); machinery, appliances and

electrical equipment (columns 5 and 6); and the rest of the two-digit HS

chapters (columns 7 and 8). For each break-out the first column shows the

uncorrected results; the second column shows the results with the selection

correction.

These

results are drawn from a sample that has been trimmed based upon the 5th

and 95th percentiles of the distribution of the TFP variable. This

variable has some extreme values, possibly related to data reporting errors for

the firms in the sample. We observe the outliers for firms in particular years,

and not typically by firms across all four years, which increases our doubts

about the validity of the outliers. In results not reported here we estimated

our equation across two other trim thresholds (90/10, 80/20) and on the entire

sample. The results are robust to the various trims, with the exception that

TFP is no longer significant in the entire sample.

Column

(2) is our baseline regression on all firm-product-destination observations

with a selection correction. We find a positive association between unit values

and destination GDP, GDP per capita, and remoteness. The capital to labor ratio

and our measure of labor size both have positive and significant coefficients.

Overall our model performs well; R-squared values are about 87 percent.

In

contrast to the literature we find a negative association between TFP and

export prices; more productive firms on average charge lower prices. We also

find, in contrast to the literature, a negative association between distance

and prices, and a positive association between remoteness and prices.

In

subsequent columns we examine the same model of firm prices applied to

particular 2-digit HS chapters. In this discussion we focus only on the result

with the sample correction (columns 4, 6, and 8). Across the three breakouts

our results are similar, both firm TFP and distance have a negative association

with prices, and remoteness bears a positive coefficient.[19]

Consider

the TFP variable. The coefficient ranges from -0.14 to -0.21 in three of the

four regressions (and is -0.57 for the machinery category). At -0.16 it

suggests firms with a ten percent higher productivity than other firms, all

else equal, charge about 2 percent lower prices. A firm that raises its

productivity by one standard deviation above the mean of all firms would be

predicted to reduce prices by about 11 percent. We

note that our negative coefficient on productivity is robust to how this

variable is measured. When we use value-added per worker as a measure of firm

productivity we again obtain a consistently negative (and statistically

significant) association with firm prices.[21]

IV.C. Robustness Checks

We perform several robustness

checks. To examine stability of coefficient estimates we reestimate the sample-corrected

results (Table 6 column 2) this time with either only the firm variables, or

only the destination variables. Also, we reestimate Table 6 column 2 using only

those firms that, over the 4 year time period, export to more than one

destination. This provides a robustness check on the coefficients on the

destination variables; it could be argued that these coefficients should be

determined only with firms that export to multiple destinations. The results

are found in Table 7.

Table 7. Robustness

Checks, log price as the dependent variable

|

Variables

|

(1)

|

(2)

|

(3)

|

|

loggdppc

|

0.170***

|

|

0.168***

|

|

(0.0272)

|

|

(0.0282)

|

|

loggdp

|

0.248***

|

|

0.254***

|

|

(0.0528)

|

|

(0.0513)

|

|

logdist

|

-0.341***

|

|

-0.348***

|

|

(0.0659)

|

|

(0.0645)

|

|

logremote

|

0.334***

|

|

0.332***

|

|

|

(0.0748)

|

|

(0.0755)

|

|

logtfp

|

|

-0.185**

|

-0.149*

|

|

|

|

(0.0884)

|

(0.0880)

|

|

logklabor

|

|

0.0961

|

0.0935

|

|

|

|

(0.0594)

|

(0.0638)

|

|

loglabor

|

|

0.0895***

|

0.183***

|

|

|

|

(0.0323)

|

(0.0342)

|

|

selection

|

0.193***

|

0.0769**

|

0.208***

|

|

|

(0.0454)

|

(0.0308)

|

(0.0469)

|

|

Observations

|

20,850

|

20,850

|

20,265

|

|

R-squared

|

0.869

|

0.862

|

0.871

|

|

Fixed effects

|

Prod

|

Prod

|

Prod

|

|

SE clusters

|

Country

|

Country

|

Country

|

Robust standard errors in

parentheses,

Selection corrections use firm and destination variables

*** p<0.01, ** p<0.05, * p<0.1

Columns

1 and 2 report respectively the destination-variables-only and firm-variables-only

regressions. Both panels of results are broadly comparable to the main results

(Table 6 column (2)) where both destination and firm variables are both

included. The exception (column 2) is that the capital-labor ratio is no longer

statistically significant. When we reestimate our model using only those firms

that export to more than one destination (column 3) the results are very

similar to those from the entire sample. The coefficients on both the

destination and the firm variables are little changed.

V. Discussion

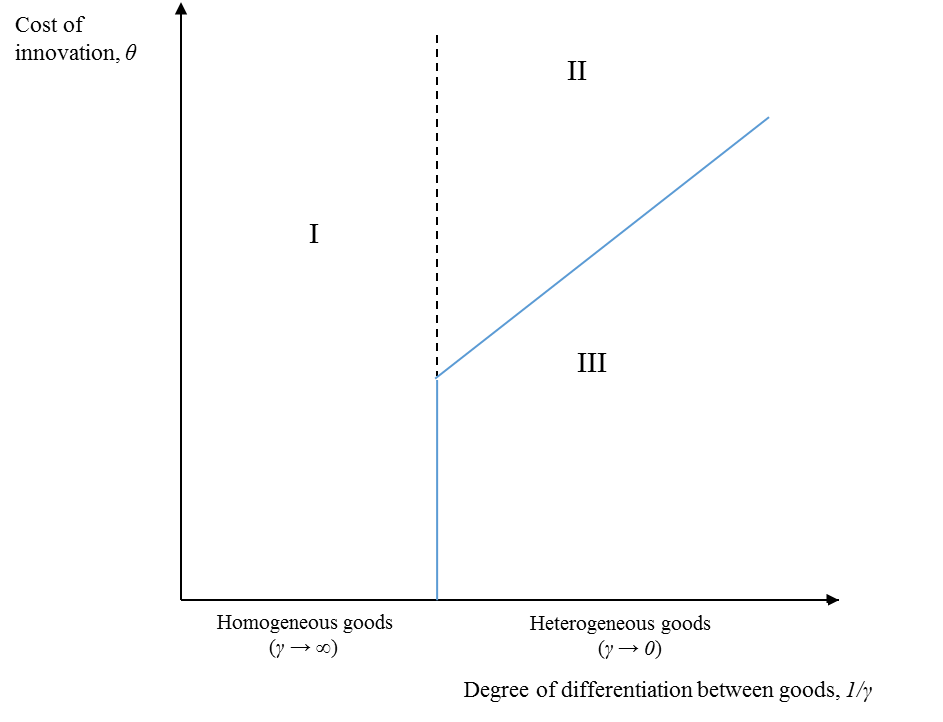

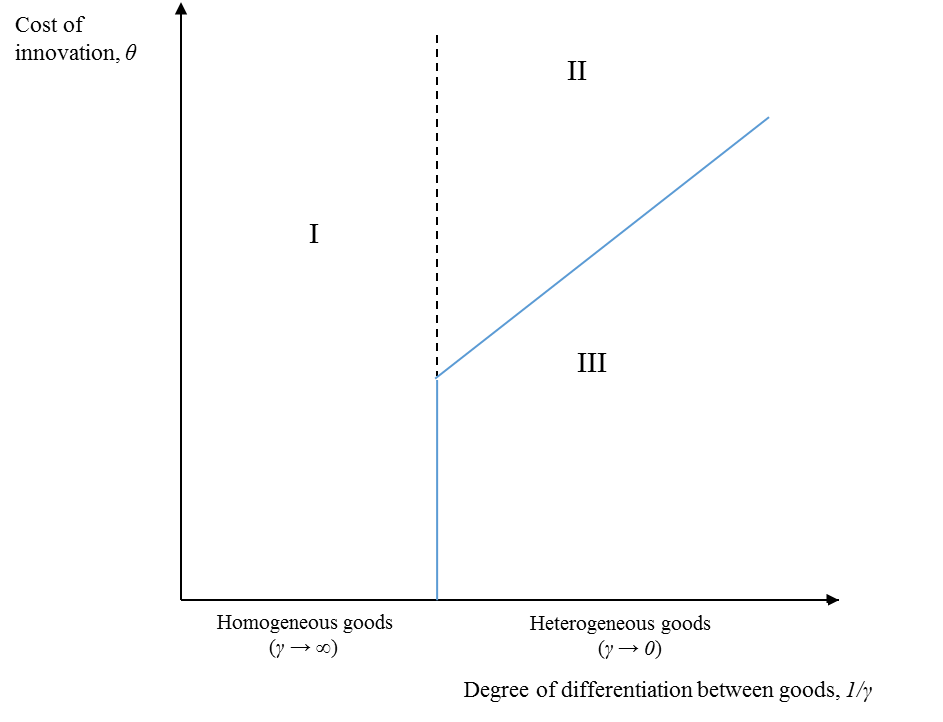

As noted in the literature review,

there are three cases to consider distinguished first by whether goods are

heterogeneous or homogenous, and then for the heterogeneous goods case, by

whether the scope for quality differentiation is high or low, and thus whether

markets are heterogeneous or homogeneous. We present these three cases in

Figure 1, which is drawn holding market size constant. Zone I is the

homogeneous goods case for which the correlation between prices and

productivity is negative. Since firms producing homogeneous goods are

unconcerned with quality, whether the cost of innovation is high or low is

irrelevant. Firm-level studies which align with zone I, which is classified as (homogeneous

goods, homogeneous markets), are Roberts and Supina (1996, 2000), Syverson

(2007), and Foster, et al. (2008). In

zone III goods are heterogeneous and the cost of innovation is low. This leads

to heterogeneous markets (or long quality ladders) and prices are a good proxy

for quality. Bastos and Silva (2010), Görg,

et al. (2010), Kugler and Verhoogen (2012), Manova and Zhang (2012), Martin

(2012), and Harrigan, et al.(2015)

are all placed in zone III, which is classified as (heterogeneous goods,

heterogeneous markets). Finally zone II, classified as (heterogeneous goods,

homogeneous markets), is the case where goods are heterogeneous and the cost of

innovation is high. In this zone, the correlation between prices and

productivity is negative and, although goods are heterogeneous, this is

classified as homogeneous markets because of the negative correlation. Our findings

suggest that, on average, Indian manufacturing firms belong in this zone. The upward sloping boundary

between zones II and III is the boundary between the scope for quality

differentiation being low (zone II) or high (zone III). Along the boundary, the

scope for quality differentiation is constant, and thus as the degree of

differentiation between goods increases, the cost of innovation must also

increase.

Figure 1: Placement

of Empirical Results

Zones

I. (Homogeneous goods, homogeneous

markets): Roberts and Supina (1996, 2000); Syverson (2007); Foster, et al. (2008)

II. (Heterogeneous goods,

homogeneous markets): this paper.

III. (Heterogeneous goods,

heterogeneous markets): Bastos and Silva (2010); Görg, et al. (2010); Kugler and Verhoogen (2012); Manova and Zhang

(2012); Martin (2012); Harrigan, et al. (2015).

There

is clear evidence that the cost of innovation is lower in developed relative to

developing countries (Trefler, 1993; Hall and Jones, 1999; Harrigan, 1999; Acemoglu

and Zilibotti, 2001). As noted by Antoniades (2015), in less developed

countries where the cost of innovation is higher, the scope for quality

differentiation is lower, and the correlation between prices and productivity

may become negative. We

argue that the cost of innovation is the key factor driving the difference in

export pricing behavior between firms in the developed countries noted above

relative to India. A more detailed comparison between China and India is necessary

given the similarity of these countries in terms of development and the observed

opposing signs between these countries in the relationship between export prices

and productivity.

To begin, we note that we are

examining the countries over roughly the same time period (20002003 for India against 20032005 for China, which is the

range of Manova and Zhang’s, 2012, sample). Since we are concerned with the

scope of quality differentiation, we compare the countries on market size and

cost of innovation. There is no way to make judgements about whether the sample

of goods examined in one country is more or less differentiated than that for the

other.

Over this period, Chinese firms

faced larger markets, both at the domestic and global levels. The Chinese

domestic market was larger (a larger populace with higher income) and less

segmented than in India, which has a large number of different language groups

and a poorer transport infrastructure. China began to follow a strategy of

export-led growth in the late 1970s, and as a result Chinese firms in the early

2000s had an awareness of, and were more fully equipped to exploit, export

opportunities in the global market. On the other hand, Indian firms were less

exported oriented. As evidence, in 2003, merchandise exports in China were 26.6

percent of GDP and 9.3 percent in India.

This was, in part, because the impediments to exporting were high. For example,

Roy (2002) found than an India exporter had to obtain 258 signatures and make

119 copies in order to export a product.

Since the late 1960s, India had in

place policies which restricted the scale of enterprises, preventing in

particular the development of large scale labor-intensive manufacturing. This

began to be dismantled in the late 1990s, however it was still partially in

place in 2007. Further, labor laws were (and continue to be) highly

restrictive: for firms of over 100 workers it was almost impossible to fire

workers, or to reassign them from one task to another. It was (and still is)

difficult to close an ailing firm, with a highly inefficient set of bankruptcy

procedures taking, on average, 10 years to complete (Panagariya, 2008, p. 294).

Goldberg, Khandelwal, Pavcnik, and Topalova (2010a) find that product churn is

low amongst Indian firms, with adjustments of product mix in multi-product

firms limited almost entirely to product additions, without the shedding of

existing products. They suggest that, given the restrictions mentioned above,

it is difficult for firms to adjust their product mix to more efficiently

allocate resources, leading to a lack of creative destruction along product

lines. Dougherty (2007) also notes that regulations in India impede both the

expansion of successful firms and the closing of unsuccessful ones.

The restrictions on scale and the

difficulty of deploying, or redeploying, resources towards, or away from,

innovative activity are evidence of costly hurdles that firms must overcome and

which add to the cost of innovation. Finally,

China had a relative, and absolute, abundance of human capital, a key input

into R&D, as evidenced by the secondary school enrolment rate in China in

2003 at 60 per cent, versus 51 percent for India, or the literacy rate (90

percent China in 2000 versus 61 percent in India in 2001).

While there is no direct data on

the cost of innovation in China and India during this period there is

information on R&D activity in each country, which we use to make an

inference about the ability of each country to undertake innovative activity.

From two separate sources we compare R&D expenditure in manufacturing as a

share of manufacturing output in China relative to India over the years 20082010. We find that China’s share

is 7.5 times that of India. Using

World Bank KAM data Dahlman (2007) finds that in 2004 the number of R&D

researchers per million of population is six times larger in China than India

(708 to 119). In the same year the proportion of GDP spent on R&D in China

was 1.44 in comparison to 0.85 in India, and royalty and license fee payments

per million of population were 10 times higher in China. Finally using phones

(fixed or mobile) and internet usage, both per unit population, as a proxy

measures for the level of the information technology infrastructure, a key

input into innovative activity, the level in China was nearly 6 times that in

India in 2004 for phones, and more than double for internet usage.

To

determine what is driving our results, and to make the case that more productive

firms producing heterogeneous goods are charging lower prices, we divide our

sample along two lines. Firstly by the ternary Rauch categories (homogeneous,

reference-priced, and differentiated), and secondly into the industry groups

described in Table 6. We make this second distinction because the majority of

our observations fall into the former two categories (textiles and textile

articles at 14.0 percent; and machinery, appliances, and electrical equipment

at 20.3 percent). We compare our results, examining both the unconditioned and

conditioned correlations, with others in the literature, and in particular

Kugler and Verhoogen (2012) and Manova and Zhang (2012).

Following

Sutton (1998), Kugler and Verhoogen (2012) use R&D and advertising

intensity as a measure of the scope for quality differentiation. They find that

the correlation between prices and firm size is increasing in the scope for

quality differentiation. Similarly, using Rauch categories to measure the scope

for quality differentiation, Manova and Zhang (2012) find that the correlation

between firm export prices and export sales increases as the scope for quality

differentiation increases. Using Rauch categories, we find that the correlation

between prices and firm size, proxied by either by firm’s total sales or labor

force, is negative for homogeneous goods and positive for reference-priced and

differentiated goods (see the estimated coefficients in Table 8).

Table 8. Correlation of Export Price with Firm Size

|

8A. Measuring size by sales: independent variable = ln(Sales)

|

|

Type of good

|

Coefficient

(1)

|

SE

(2)

|

t

(3)

|

P-val

(4)

|

|

Differentiated

|

0.168

|

0.019

|

8.78

|

0.000

|

|

Reference priced

|

0.289

|

0.022

|

13.06

|

0.000

|

|

Organized exchange

|

-0.106

|

0.033

|

-3.23

|

0.001

|

|

Reference priced and

organized exchange

|

0.239

|

0.02

|

12.06

|

0.000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8B. Measuring size by labor force: independent variable =

ln(Labor)

|

|

Type of good

|

Coefficient

(1)

|

SE

(2)

|

t

(3)

|

P-val

(4)

|

|

Differentiated

|

0.218

|

0.018

|

11.95

|

0.000

|

|

Reference priced

|

0.337

|

0.019

|

17.66

|

0.000

|

|

Organized exchange

|

-0.060

|

0.031

|

-1.93

|

0.054

|

|

Reference priced and

organized exchange

|

0.286

|

0.017

|

16.56

|

0.000

|

Since

we have measures of firm productivity, in contrast to Kugler and Verhoogen (2012)

and Manova and Zhang (2012), we can examine the correlations between export

prices and productivity. Dividing our sample into industry groups, we find that

the correlation between prices and productivity in the “machinery” group, where

goods are exclusively differentiated according to the Rauch categorization, is

significant and strongly negative (Table 6).[27]

The

empirical evidence suggests that the finding of a negative correlation between

productivity and export prices in our sample is not driven by firms producing

homogenous goods. Hence, although our result is classified as homogeneous markets

because of the negative correlation between prices and productivity, the firms

in our sample are in the majority producing heterogeneous goods. Further, our

result is, if anything, strongest (most negative) for firms in the “machinery”

group in which all goods are classified as differentiated. Given both that

these goods are clearly heterogeneous, and the findings of the papers located

in zone III, this is where one might expect the correlation to be most positive

relative to the two other groups. Our interpretation is that our results belong

in zone II, where goods are heterogeneous and the scope for quality

differentiation is low. While Antoniades (2015) points to the theoretical possibility

of this relationship, to our knowledge we are the first to find evidence

consistent with this result.

Finally

we provide a discussion of the relationship between export prices and distance

and remoteness. In Harrigan, et al. (2015)

and Manova and Zhang (2012), prices rise with distance and fall with

remoteness. We find that prices fall with distance and rise with remoteness. These

differences reflect the relationship between prices and quality: whether it is

increasing (prices are a good proxy for quality, quality ladders are steep) as

in Harrigan, et al. and Manova and Zhang,

or decreasing (quality ladders are short), as in this paper. When firms compete

on both price and quality, the most competitive goods are the ones with the

lowest prices per unit of quality. For the United States and China these goods

are the ones with the highest prices, and for India the lowest prices. Hence,

the Indian goods that make it to the most distant or competitive (least remote)

markets have the lowest prices.

VI. Conclusion

Using a unique dataset, we are the

first to examine the pricing behavior of Indian exporters. Our empirical

findings show a negative correlation between export prices and productivity, as

well as export prices and distance, and a positive correlation between export prices

and remoteness. The heterogeneous firms and export pricing literature, thus

far, finds the opposite sign for each of these relationships.

The

theoretical framework of Antoniades (2015) is useful in positioning our result,

which is classified as (heterogeneous goods, homogeneous markets) relative to

two other identified groups: (homogeneous goods, homogeneous markets) and (heterogeneous

goods, heterogeneous markets). To our knowledge this is the first empirical evidence

consistent with this particular theoretical possibility.

We

suggest that because Indian firms face a higher cost of innovation, the scope

for quality differentiation is low (quality ladders are short). Further, we

suggest that while Indian firms engage in quality upgrading, the markups of

higher-productivity firms are not large enough to offset their lower marginal

costs. As a result, prices fall as productivity rises.

Appendix:

Data

1. Data construction and “HS 8-plus”

level of product detail.

Our main analysis relies on a merged

dataset built by a firm-by-firm match of TIPS and Prowess data. TIPS data

required considerable preparation for this merge, over and above simply

aggregating its daily data to a fiscal year basis.

Consider

firm names, which are recorded by hand at the point of collection (ports) with

occasional spelling errors and frequent variants. We use two fuzzy-logic

routines, Levenshtein distance and bigram comparisons, to match firm names in

the sample. Some matches were done “by hand” based upon values in the

fuzzy-logic comparisons. Wholesalers are excluded for the sake of focusing on

the trading behavior of production firms, which requires several data-filtering

criteria. If the firm name contains “Exporter,” “Importer,” or other key words

it is removed from the sample.[28] In

addition, we exclude firms that export goods in more than nine two-digit HS

chapters.

Although

the TIPS data are reported at the 8-digit HS level, we use the firm’s own

product labels to obtain the actual product lines used in this study. For

example, to take a non-manufacturing example, instead of looking at the unit

value of 8-digit HS code 09101020 that includes a variety of spices, we are

able to use the product labels to obtain the unit value, or price, of “curry

powder” and “ginger” and other similar fine-grained prices. The result is

something much more detailed than 8-digit data.[29] When this process is

complete the mean number of individual product lines in an HS category is 11,

with a median of 3. We refer to this level of disaggregated data as HS 8-plus.

Finally,

inside of an HS8 or HS 8-plus code the quantity units can vary widely. This matters.

The dependent variable in our empirical work is the export product price,

defined as an export unit value and calculated as the relevant total value of

exports divided by quantity. So, for instance, a firm’s average price for

selling a particular product to the United States in any given year would be

the value of sales divided by, say, the metric tons sold. But in many of the

single firm-product-destination categories, export values are reported in

several different units, such as “buckles,” kilos, pounds and “boxes,” the sum

of which yields the total value of exports for that firm-product-destination

observation.

We

choose to aggregate and “harmonize” these values where there are

well-established conversion factors for the units. Therefore we convert pounds

to kilos, and tons to metric tons, and so on, prior to calculating unit values.

However, there remain thousands of lines of data where the conversion factors

are unknown, or for which the reporting of separate lines based on different

quantity measures strongly suggests that there are in fact underlying

differences between the goods reported in those lines (even when they are in

the same 8-digit HS category). It is not possible to make meaningful unit value

comparisons, or aggregations, across different units in these instances. (Is a

good sold to France at $2 per buckle earning a higher price than that same

8-digit HS good sold to France at $350 per ton?) Accordingly, for the analysis

reported here we keep only the dominant unit in each HS line, by value, and

drop the others.

As noted in the text, our

approach here has the potential to introduce selection bias into our regression

results. Firms that export in the dominant unit may differ from those who

export in other units. Alternatively, it may be the case that destinations that

receive goods in the dominant unit differ from those that receive exports in

other units. In Table A.1 we report the results of a linear-probability model

and a probit model where in each case where the binary dependent variable

equals 1 when the firm-product-destination observation is in the dominant unit,

and 0 when it is in another unit. The regressions include product fixed

effects. A large majority of observations are in the dominant unit; in the

linear-probability model 78 percent of the observations are 1’s.

Across the two models most of the

firm and destination variables are statistically insignificant. The exceptions

are distance, TFP, and labor (the wage bill, a measure of firm size). For these

three variables the marginal effect of a standard deviation increase in the

variable, with other variables at means, is quite small. The largest clinical

effect is for loglabor in the linear-probability models, where a one-standard

deviation change is predicted to change the probability of moving from a 0 to a

1 by 2.61 percent, a small change. A complete table of clinical effects is

available from the authors.

Merging the TIPS and Prowess

databases presents further technical problems in matching firm names. But after

this merge and a final merge with CEPII destination market characteristics we

have a data set with 20,850 individual firm-product-destination-year-firm

characteristic observations over 2000-2003. The merged data used as the

estimating sample contains 1,018 unique manufacturing firms. Although we were

able to match more firms, several were dropped from the sample because they

were not manufacturing firms (e.g., wholesalers), had incomplete information

(e.g., missing input information in Prowess or TIPs), or did not survive our

procedures to clean the data as described in the text and in this appendix.

Appendix Table A.1: Probability of Dominant Unit

Observations

A.1.A. Linear Probability Model Estimation

|

Independent Variable

|

Coef.

|

Robust

Std. Err.

|

t

|

P>|t|

|

|

loggdppc

|

0.003

|

0.003

|

0.82

|

0.415

|

|

loggdp

|

0.000

|

0.003

|

0.13

|

0.893

|

|

logdist

|

0.013

|

0.006

|

2.01

|

0.045

|

|

logremote

|

-0.004

|

0.007

|

-0.60

|

0.548

|

|

logtfp

|

-0.021

|

0.010

|

-2.09

|

0.036

|

|

logklabor

|

-0.001

|

0.008

|

-0.14

|

0.893

|

|

loglabor

|

0.012

|

0.004

|

2.69

|

0.007

|

|

constant

|

0.778

|

0.091

|

8.55

|

0.000

|

|

n

|

26,903

|

|

|

|

|

R2

|

0.4809

|

|

|

|

|

Root MSE

|

0.36642

|

|

|

|

A.1.B. Probit Estimation

|

Independent Variable

|

Coef.

|

Robust

Std. Err.

|

t

|

P>|t|

|

|

loggdppc

|

0.015

|

0.013

|

1.14

|

0.254

|

|

loggdp

|

0.001

|

0.010

|

0.09

|

0.931

|

|

logdist

|

0.065

|

0.026

|

2.51

|

0.012

|

|

logremote

|

-0.022

|

0.031

|

-0.72

|

0.471

|

|

logtfp

|

-0.082

|

0.033

|

-2.52

|

0.012

|

|

logklabor

|

-0.007

|

0.023

|

-0.31

|

0.759

|

|

loglabor

|

0.047

|

0.014

|

3.29

|

0.001

|

|

constant

|

-0.681

|

0.950

|

-0.72

|

0.473

|

|

n

|

13,073

|

|

|

|

|

Pseudo-R2

|

0.1726

|

|

|

|

Dependent Variable = 1 if a

firm-product-destination-year observation is measured in the dominant unit for

its product; 0 otherwise. Both regressions include product and year fixed

effects, not reported.

2.

Definition and construction of independent variables used in regressions.

We calculate TFP using the Stata

implementation of the Levisohn and Petrin (2003) technique, following Topolova

and Khandelwal’s (2011) approach (pp.998999)

to put each firm’s productivity into index form (which itself depends on Aw,

Chen and Roberts, 2001), which allows productivity comparisons within and

between industries. We measure firm output with value-added (Topolova and

Khandelwal use sales). Capital is measured as the size of each firm’s gross

fixed assets, and labor is proxied by the wage and salary bill (the number of

employees is not included in Prowess). Note that this is the measure of labor

used both in the TFP calculation and directly (in log form, “loglabor”) on the

right hand side of our regressions reported in Table 6; we also calculate the

capital/labor ratio used in the regressions (“logklabor”) from these capital

and labor variables.

We

estimate TFP at the 4-digit National Industrial Classification (NIC) code level

where possible, and at the 3-digit level when necessary due to a small number

of firms at the 4-digit level (less than 20). We use Prowess data on firms’

spending on raw materials and electric power as the proxy for productivity

shocks. All variables are expressed in real terms: output is deflated by

two-digit industry-level wholesale prices indices from Ahsan (2013); capital

expenditures are deflated by a capital goods wholesale price index we construct

from several sub-industry wholesale price indices (including machine tools,

electric machinery, and other capital goods); materials and power are likewise

deflated with separate materials and power wholesale price indices we

construct; and finally the wage and salary bill is deflated by the Economist

Intelligence Unit’s Indian labor cost index.

We calculate remoteness as in

Harrigan, et al. (2015): the

GDP-weighted distance of an export partner from all other export partners. So,

for example, when we observe a transaction with the Philippines we sum the

GDP-weighted distances between the Philippines and India’s other export

partners. Therefore , where Rd

is the remoteness of country d, Y0

is the GDP of country 0, a member of the set of India’s trading partners,

and distod is the distance

between d and a given country 0.

References

Acemoglu,

D. and F. Zilibotti. 2001. “Productivity Differences.” Quarterly Journal of Economics, 116, 563606.

Ahsan,

R. 2013. “Input Tariffs, Speed of Contract Enforcement, and the Productivity of

Firms in India.” Journal of International

Economics, 90(1), 181192.

Alchian,

A. and W. Allen. 1964. University

Economics. Belmont, CA: Wadsworth.

Antoniades,

A. 2015. “Heterogeneous Firms, Quality, and Trade.” Journal of International Economics, 95(2), 263273.

Aw,

B., X. Chen, and M. Roberts. 2001. “Firm Level Evidence on Productivity

Differentials and Turnover in Taiwanese Manufacturing.” Journal of Development Economics, 66(1), 6186.

Baldwin,

R. and J. Harrigan. 2011. “Zeros, Quality, and

Space: Trade Theory and Trade Evidence.” American Economic Journal:

Microeconomics, 3(2), 6088.

Bardhan,

P. 2010. Awakening Giants, Feet of Clay:

Assessing the Economic Rise of China and India. Princeton, NJ: Princeton

University Press.

Bastos,

P. and J. Silva. 2010. “The Quality of a Firm’s Exports: Where You Export to

Matters.” Journal of International

Economics, 82(2), 99111.

Bernard,

A., B. Jensen, S. Redding, and P. Schott. 2007. “Firms in International Trade.”

Journal of Economic Perspectives,

21(3), 105130.

Besedes,

T. and T. Prusa. 2011. “The Role of Extensive and Intensive Margins and Export

Growth.” Journal of Development Economics,

96, 371379.

Dahlman, Carl J. 2007. “China and India:

Emerging Technological Powers.” Issues in Science and Technology, 23(3).

Dougherty,

Sean. 2007. “India and China: Making Sense of Innovation and Growth.” OECD Observer No. 264/265, December 2007-January 2008.

Eaton, J., M. Eslava, M. Kugler, and J. Tybout. 2008. “Export

Dynamics in Colombia: Firm-Level Evidence.” In E. Helpman, D. Marin and T.

Verdier (ed.), The Organization of Firms

in a Global Economy, Cambridge, MA: Harvard University Press.

Foster,

L., J. Haltiwanger, and C. Syverson. 2008. “Reallocation, Firm Turnover and

Efficiency: Selection on Productivity or Profitability?” American Economic Review, 98, 394425.

Goldberg,

P., A. Khandelwal, N. Pavcnik, and P. Topalova. 2010a. “Multiproduct Firms and

Product Turnover in the Developing World: Evidence from India.” Review of Economics and Statistics, 92(4),

10421049.

Goldberg,

P., A. Khandelwal, N. Pavcnik, and P. Topalova. 2010b. “Trade Liberalization

and New Imported Inputs.” American Economic

Review: Papers & Proceedings, 99(2), 494500.

Görg,

H., H. Laszlo, and B. Muraközy. 2010. “Why Do Within Firm-Product Export Prices

Differ Across Markets?” Kiel Institute for the World Economy, Working Paper

1596 (February).

Hall, R. and C. Jones. 1999. “Why

Do Some Countries Produce So Much More Output per Worker than Others?” Quarterly Journal of Economics, 114, 83116.

Harrigan,

J. 1999. “Estimation of Cross-Country Differences in Industry Production Functions.”

Journal of International Economics,

47, 267294.

Harrigan,

J., X. Ma and V. Shlychkov. 2015. “Export Prices of U.S. Firms.” Journal of International Economics. Available

online 14 May. doi:10.1016/j.jinteco.2015.04.007.

Head,

K., T. Mayer, and J. Ries. 2010. “The Erosion of Colonial Trade Linkages After

Independence.” Journal of International

Economics, 81(1), 114.

Hummels,

D. and A. Skiba. 2004. “Shipping the Good Apples Out? An Empirical Confirmation

of the Alchian-Allen Conjecture.” Journal

of Political Economy, 112(6), 13841402.

Khandelwal,

A. 2010, “The Long and Short (of) Quality Ladders,” Review of Economic

Studies, 77, 14501476.

Kugler, M. and E. Verhoogen. 2012. “Prices, Plant Size, and

Product Quality.” Review of Economic

Studies, 79, 307339.

Levinsohn,

J. and A. Petrin. 2003. “Estimating Production Functions Using Inputs to

Control for Unobservables.” Review of

Economic Studies, 70, 317341.

Manova,

K. and Z. Zhang. 2012. “Export Prices Across Firms and Destinations.” The Quarterly Journal of Economics, 127,

379436.

Martin,

J. 2012. “Markups, Quality and Transport Costs.” European Economic Review, 56, 777791.

Melitz,

M. 2003. “The Impact of Trade on Intra-Industry Reallocations and Aggregate

Industry Productivity.” Econometrica,

71(6), 16951725.

Melitz, M. and G. Ottaviano. 2008. “Market Size, Trade, and

Productivity.” Review of Economic Studies, 75, 295316.

Panagariya, A. 2008. India:

The Emerging Giant. New York: Oxford University Press.

Rauch, J. 1999. “Networks versus Markets in International

Trade.” Journal of International Economics, 48, 735.

Roberts, M. and D. Supina. 1996. “Output Price, Markups, and

Producer Size.” European Economic Review,

40, 909921.

Roberts, M. and D. Supina. 2000. “Output Price and Markup

Dispersion in Micro Data: The Roles of Producer Heterogeneity and Noise.” In

Baye, M. (ed.), Advances in Applied

Microeconomics, 9, 136.

Amsterdam: JAI.

Roy, J. 2002. “Towards

International Norms for Indirect Taxes and Trade Facilitation in India.”

Background paper prepared for the Task Force on Indirect Taxes, Government of

India, New Delhi.

Roy, J. and S. Bagai. 2005. “Key

Issues in Trade Facilitation: Summary of World Bank/EU Workshops in Dhaka and

Shanghai in 2004.” World Bank Policy Research Working Paper No. 3703.