THE EFFECTS OF TARIFFS ON EMPLOYMENT

IN GLOBAL VALUE CHAINS

Andre Barbe

David Riker

ECONOMICS WORKING PAPER SERIES

Working Paper 2017-07-A

U.S. INTERNATIONAL TRADE COMMISSION

500 E Street SW

Washington, DC 20436

April 2017

The authors

are grateful to Dan Kim and James Stamps for helpful comments and suggestions.

Office of

Economics working papers are the result of ongoing professional research of

USITC Staff and are solely meant to represent the opinions and professional

research of individual authors. These papers are not meant to represent in any

way the views of the U.S. International Trade Commission or any of its

individual Commissioners. Working papers are circulated to promote the active

exchange of ideas between USITC Staff and recognized experts outside the USITC

and to promote professional development of Office Staff by encouraging outside

professional critique of staff research.

The Effects of

Tariffs on Employment in Global Value Chains

Andre Barbe and David Riker

Office of Economics Working Paper 2017-07-A

July 2017

ABSTRACT

We

develop a two-country model of international trade and domestic employment in

an industry with firm heterogeneity and global value chains. The model can be

used to simulate the changes in trade and employment that would result from a

tariff or other barrier to trade that increases the price of imports. We also

identify the data that is needed to apply the model to a specific industry. As

an example application, we use the model to simulate the effects of a

hypothetical import barrier that raises the price of imports by 10 percent. We

find that the import barrier would have a positive effect on domestic

employment in the part of the industry that sells final products in the

domestic market because it limits import competition. On the other hand, the

import barrier would have a negative effect on employment in the part of the

domestic industry that exports intermediate products for further manufacture

before returning to the domestic market. The net effect on domestic employment whether it increases or decreases depends on many economic attributes of the

industry, including its pattern of global value chains.

Keywords:

global value, chains, global supply chains, offshoring, employment,

international trade

JEL

Codes: F16, F12, F23

Andre

Barbe

Office of Economic, Research Division

Andre.Barbe@usitc.gov

David

Riker

Office

of Economics, Research Division

David.Riker@usitc.gov

1

Introduction

Several manufacturing industries are well-known for their

global value chains, including the motor vehicles, textiles and apparel, and

electronics industries. In these industries, it is possible to split the

production process into different stages and locate these production stages in

different countries. Generally, the more technically advanced and

capital-intensive production processes are located in advanced countries, while

the more labor-intensive production processes and assembly are located in lower

wage, developing countries. This pattern of linked, multinational production is

often called offshoring.

In this paper, we analyze how tariffs or other barriers to the

imports of an advanced country like the United States can interrupt these

back-and-forth trade flows and thus affect employment within the global value chains.

First and foremost, a tariff on the imports of the advanced country will have a

positive effect on domestic employment in the import-competing part of the

industry that sells the final product, because the tariff limits import

competition. This positive effect on domestic employment provides the traditional

motivation for protecting domestic industries by restricting imports. On the

other hand, the tariff will also have a negative effect on domestic employment

in the part of the industry that exports intermediate products. Since the

demand for the advanced country’s exports of intermediate products is linked to

the country’s demand for imports of further processed versions of these products,

a barrier to one link in the supply chain can have a ripple effect throughout

the chain. However, is this second effect large enough to offset the

traditional positive employment effects of protecting a domestic industry?

To address this question, we developed a theoretical model of

trade in intermediate and final products with firm heterogeneity and global value

chains. We show how the model can be used to estimate the change in industry employment

that would result from a barrier to imports of the final product into the

market of the advanced country.

Then we identify the data that are needed to apply the model

to a specific industry. The goal of our analysis is to highlight the attributes

of the industry’s global value chain that are determinants of the magnitude,

and even the direction, of the changes in industry employment in the advanced

country. These data inputs include the share of domestic shipments that are competing

with imports, the share of exports that return to the advanced country rather

than serving foreign markets, and the substitutability between domestic and

foreign products in the domestic market.

Our paper contributes to the economics literature that models

the effects of global value chains and trade in intermediate goods (sometimes called

offshoring) on labor markets. Our paper incorporates recent theoretical

innovations in this area. Grossman and

Rossi-Hansberg (2008) develop a theoretical model of international trade in

tasks. Firms are able to split their production process into a continuum of

distinct tasks and then decide where to locate each task, based on costs of

trade and costs of multinational production. Grossman and Rossi-Hansberg use

their model to predict how changes in trade costs affect the feasibility of

offshoring and the wages of workers at different skill levels in different

countries. They find that increased offshoring can lead to productivity

benefits and higher labor demand in the Home country, especially less skilled

workers.

Feenstra (2008, 2016) provides excellent summaries of this theoretical

literature. In

addition, the analysis of multinational production in Helpman, Melitz, and

Yeaple (2004) provides modeling structure that we are able to incorporate in

our paper, though Helpman, Melitz, and Yeaple focus on foreign affiliates

placed for proximity to the foreign market (horizontal FDI), while our model

focuses on global value chains (vertical FDI).

The rest of our paper is organized into four parts. Section 2

presents the structure and assumptions of our modeling framework. Section 3 estimates

the net employment effects for a wide range of potential data inputs. Section 4

discusses the data needed to apply the model to a specific industry. Section 5 offers

concluding remarks.

2

Model

Description

We have developed a modeling framework for estimating the changes

in domestic employment if a tariff or other barrier were imposed on imports. The

framework is based on the models of trade with firm heterogeneity in Melitz

(2003) and Helpman, Melitz, and Yeaple (2004) and the model of offshoring in

Grossman and Rossi-Hansberg (2008). In this section, we describe the

assumptions of our model and the equations that characterize the market

equilibrium. Then we derive how trade flows and industry employment would

change in response to an increase in barriers to imports.

2.1

General Setup of the Model

The model focuses on a vertically integrated manufacturing

industry. Firms in the industry produce differentiated final products. Labor is

the only factor of production in the model, and producers

vary in their unit labor requirements. The model includes two regions,

Home and Foreign, indicated by subscripts and .

These two regions are distinct consumer markets and also potential production sites.

There are two stages of production in the model, manufacturing of intermediate products

and then manufacturing of the final products. The final products are then

consumed by households in each region. Each firm chooses the location of each

stage of its production process and the location of its final market based on

relative production and trade costs.

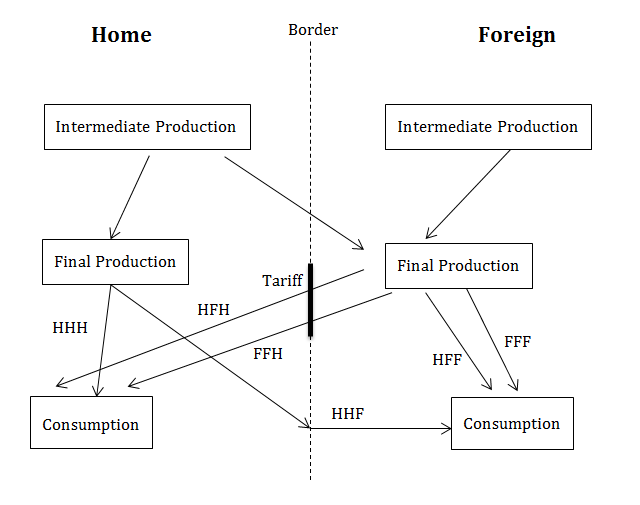

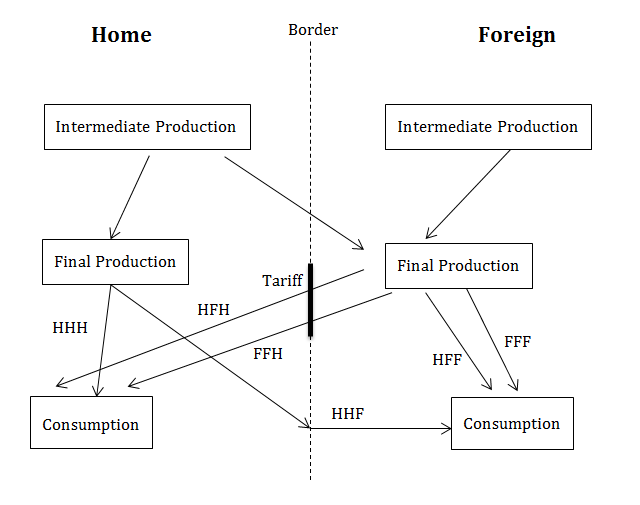

In the model, the two potential regions for intermediate

production, final production, and consumption define eight possible supply

chains. We refer to each supply chain by a three-letter label, with the first letter

indicating the location of intermediate production, the second the location of final

production, and the third the location of consumption. However, some of these

supply chains may not exist in particular industries. For example, we assume

that FHH and FHF are not profitable alternatives in the industry. This would be

the case, for example, if it were not cost effective to locate final production

in Home unless the entire vertically integrated production process and the

consumer are in Home. In this case, imports to Home are all final products and

most exports from Home to Foreign are intermediate products. Based on this

assumption, we omit the FHH and FHF supply chains from our model, leaving the

six relevant supply chains in Figure 1.

Figure

1: Six Different Supply Chains

A new barrier to Home imports would impede the last link in

the FFH and HFH supply chains. The reduction in HFH imports would reduce the

demand for intermediate exports from Home. The reductions in FFH and HFH imports

would increase the demand for domestic shipments (the HHH supply chain).

We assume that there are potential Home producers and potential Foreign producers in the industry.

Each firm produces a single variety of the good.

We assume that consumers have CES preferences between the varieties within the

industry, and a unit elastic demand for the products of the industry in

aggregate. The parameter is the elasticity of substitution between the different

varieties. The firms that produce the differentiated varieties engage in monopolistic

competition.

2.2

Costs and Pricing

The costs of supplying each national market depend on the location

of production. The unit labor requirement of each producer, ,

is drawn from a Pareto distribution with cumulative distribution function ,

following Helpman, Melitz, and Yeaple (2004). In addition to the variable

costs of production, there are variable costs of importing into Home and

Foreign, represented by the gross trade cost factors and .

The trade cost factors could include tariffs and non-tariff measures as well as

international transport costs. There are also fixed costs of establishing

production in each region and fixed costs of trading intermediate and final

products. The total fixed costs for each of the supply chains, summing all of

the fixed cost components, are represented by ,

,

,

,

,

and .

For example, includes the fixed costs of producing the

intermediate products in Home, the fixed costs of exporting the intermediate

products to Foreign, the fixed costs of final production in Foreign, and

finally the fixed costs of exporting the final products to Home. We assume that

the fixed costs and the variable trade costs use a combination of materials and

labor from outside of the industry and non-production workers within the

industry, but do not employ production workers within the industry.

Production requires labor inputs in multiple stages. We

simplify the model by only including two stages of production that are combined

in fixed proportions.

Equation (1) represents the marginal cost of locating intermediate production

in region and final production in region for a firm with unit labor requirement in the first stage of production and unit

labor requirement in the second stage, and then delivering the

final product to region .

(1)

The variables and are the wage rates in the two regions. Equation (2) represents the demand for this product in region .

(2)

The variable represents the aggregate expenditure level in

Home, is the CES price index for the industry in

Home, and is the expenditure share on the products of

the industry. The model assumes that the industry or sector receives a constant

share of aggregate expenditures, corresponding to Cobb-Douglas preferences

across the products of the different sectors of the economy. This is a common

assumption in multi-sector models of international trade. It implies that the

price elasticity of the composite product of the industry is equal to minus

one.

The firms in the industry set prices to

maximize profits, taking the industry price index as given. The CES

demand and monopolistic competition imply the constant mark-up pricing in

equation (3).

(3)

2.3

Firm Revenue and Profits

Similar to costs, firms have different revenues and profits

depending on which supply chain they use. Equation (4) represents the revenue in

the Home market of a domestic firm with unit labor requirement and completely domestic production (an HHH

supply chain), and equation (5) represents the firm’s profits from this revenue

stream.

(4)

(5)

Equations (6) through (10) are the profits associated with

the other five supply chains in Figure 1.

(6)

(7)

. (8)

(9)

(10)

2.4

Productivity Cutoffs

Different firms will serve different supply chains,

depending on whether their productivity is above or below certain productivity

cutoffs. All firms in Home with unit labor requirements below supply the Home market, either through completely

domestic production (an HHH supply chain) or by offshoring the final stage of

production (an HFH supply chain). The cutoff unit labor requirement for a firm

to supply the Home market is implicitly defined in equation (11).

(11)

Equations (5) and (11) imply the equilibrium cutoff level in equation (12).

(12)

Firms with unit labor requirements below a second

cutoff ,

defined in equations (13) and (14), supply Home by offshoring the final stage

of production.

(13)

(14)

We assume that is less than ,

since offshoring incurs additional fixed costs, and therefore is less than .

The most productive firms offshore their final production stage.

Equations (15) and (16) define the cutoff unit labor

requirements for Foreign firms to export to Home.

(15)

(16)

Likewise, equations (17) through (22) define the cutoff unit

labor requirements for supplying Foreign through each of the alternative supply

chains.

(17)

(18)

(19)

(20)

(21)

(22)

We assume that is less than , since

offshoring incurs additional fixed costs, and therefore is less than . Again,

the most productive firms offshore their final production stage.

2.5

Sales and Prices

The equilibrium value of sales (trade flows) for each supply

chain and the overall price indices can be expressed in 3 different ways, depending

on which variables you prefer it to be a function of.

2.5.1

Sales and Prices as a Function of Unit Labor

Requirements and the Distribution of Productivities

Equations (23) through (25) represent the equilibrium values

of sales in Home for each of the supply chains that serve that market, as a

function of the cutoff unit labor requirements above and the distribution of

unit labor requirements .

(23)

(24)

(25)

Equation (26) represents the corresponding CES price index

in Home.

(26)

Equations (27) through (29) represent the equilibrium values

of sales in Foreign for each of the alternative supply chains that serve that

market.

(27)

(28)

(29)

Equation (30) represents the CES price index in Foreign.

(30)

2.5.2

Sales and Prices as a Function of Unit Labor

Requirements and the Distribution of Productivities’ Shape Parameter

Assuming that the unit labor requirements for individual varieties

have a Pareto distribution with shape parameter ,

we can rewrite equations (23) through (30) as follows:

(31)

(32)

(33)

(34)

(35)

(36)

(37)

(38)

2.5.3

Sales and Prices as a Function of Unit Labor

Requirements, the Distribution of Productivities’ Shape Parameter, and Z

Next, we can rewrite equations (31) through (38) in terms of

the ratio of the cutoff unit labor requirements for the different supply chains

and relative wages, using common terms and to simplify the notation.

(39)

(40)

(41)

(42)

(43)

(44)

(45)

(46)

2.6

Effect of Import Costs on the Value of Trade

Flows

Finally, we use the equilibrium conditions in equations (39)

through (46) to calculate the percentage changes in economic outcomes in

response to the increase in import costs in Home. For this calculation, we

assume that wages and aggregate expenditure levels do not change with the industry-specific increase in import costs.

Producer prices also do not change, since they are at a constant mark-up over

marginal costs. This partial equilibrium approach is an appropriate simplifying

assumption for an industry that is small relative to the aggregate national economies.

In this case, and assuming that there is no change in the costs of importing

into Foreign ( ), there is no change in the global chains

that supply Foreign.

(47)

On the other hand, there are adjustments in the global value

chains that supply Home, represented in percentage changes in equations (48)

through (53). To simplify the notation, we define Home market shares for regions and ,

and the ratios of the cutoff unit labor requirements for supplying Home .

(48)

(49)

(50)

(51)

The cutoff unit labor requirements in equation (12), (14),

and (16) imply the following changes in and in response to the increase in import costs:

(52)

(53)

The increase in import costs can lead to significant

restructuring of the global value chains of the industry, including a change in

whether some firms offshore. In the terminology of the literature on trade with

firm heterogeneity, there are adjustments on the extensive margin of trade as

well as the intensive margin of trade.

2.7

Effect on the Employment of Production Workers

in Home

The increase in import costs does not change the value of

sales in Foreign ( and ) in the partial equilibrium

analysis, but it does change the value of sales in Home ( and ). In the model, the labor income

of production workers in the HHH supply chain is a fixed fraction of ,

given the fixed mark-up of price over wages.

(54)

Equation (54) implies the following equation for Home

employment of production workers in this purely domestic supply chain:

(55)

Therefore, the percentage change in Home employment of

production workers in the HHH supply chain is equal to the percentage change in

,

since wages do not adjust in the partial equilibrium analysis.

(56)

Likewise, the labor income of Home

production workers in the HFH supply chain is a fixed fraction of revenue in that

supply chain, given the fixed mark-ups and the assumption that there are fixed factor

proportions in production:

(57)

Equation (57) implies the following equation for Home

employment of production workers in the HFH supply chain:

(58)

Therefore, the percentage change in Home employment of

production workers in the HFH supply chain is equal to the percentage change in

minus the percent change in .

(59)

According to the accounting identity in equation (60), the

percentage change in total employment of production workers in Home is a share-weighted

average of the percentage changes in the production workers employed in the two

affected supply chains.

(60)

Equation (61) substitutes equations (56) and (59) into equation (60).

(61)

Finally, we approximate the employment shares in equation (61) using the

status quo values of several industry statistics.

(62)

The parameter represents the share of Home’s domestic

shipments (non-exports) that are competing directly with imports in the Home

market, and the parameter represents the share of Home production that

is exported. Our default assumption is that is equal to and all Home production is import-competing. However,

we consider alternative assumptions in our sensitivity analysis of the model. The

parameter represents the share of exports from Home that

are intermediate inputs into production within the same industry, and the

parameter represents the share of these exported intermediate

products that return Home after further manufacturing in Foreign.

The net employment effect

in equation (62) combines a positive effect on Home employment due to the increased

demand for domestic shipments and a negative effect on Home employment due to

the reduced demand for Home exports for further manufacture in Foreign and shipment

back to the Home market.

3

Model Results

The model shows that the tariff has different effects on

different supply chains. The increased import costs lead consumers to

substitute to purely domestic producers, increasing employment in that supply

chain. When a tariff is imposed ( ), the model predicts that there will be an

increase in domestic shipments ( ) and associated labor demand ( ). However, the tariff increases

costs in supply chains that involve offshoring, and this has a negative effect

on Home employment. More formally, the tariff leads to a reduction in

exports of intermediates for reimport ( ) and associated labor demand ( ).

3.1

Example Simulation of the Model

We use simple numerical simulations to illustrate the

magnitudes of the net employment effects for different values of the industry

data that are inputs of the model. As a benchmark case, we assume that ,

, , , , , , , , , , , and .

The tariff has different effects on different supply chains.

These effects are summarized in table 1. The tariff increases costs in the HFH

and FFH supply chains. The sales of the competing HHH supply chain increase.

This leads to an increase in the number of Home production workers in HHH and a

decrease in the number of U.S. production workers in HFH. There is no Home

employment in FFH, so there would be no impact there.

Table

1: Effect of the Tariff on

Different Supply Chains

|

Supply

Chain

|

Location of

Intermediate Production

|

Location of

Final Production

|

Location of Consumption

|

Supply Chain

in the Model?

|

Change in

Costs

|

Change in Domestic

Employment

|

|

1 HHH

|

Home

|

Home

|

Home

|

Yes

|

None

|

Increase

|

|

2 HHF

|

Home

|

Home

|

Foreign

|

Yes

|

None

|

None

|

|

3 HFH

|

Home

|

Foreign

|

Home

|

Yes

|

Increase

|

Decrease

|

|

4 HFF

|

Home

|

Foreign

|

Foreign

|

Yes

|

None

|

None

|

|

5 FHH

|

Foreign

|

Home

|

Home

|

No

|

None

|

None

|

|

6 FHF

|

Foreign

|

Home

|

Foreign

|

No

|

None

|

None

|

|

7 FFH

|

Foreign

|

Foreign

|

Home

|

Yes

|

Increase

|

None

|

|

8 FFF

|

Foreign

|

Foreign

|

Foreign

|

Yes

|

None

|

None

|

If (a 5% increase in import prices), then there

is a 21 percent increase in the domestic shipments of Home producers ( ) and an 11 percent increase in associated

production workers ( ). There is a 13 percent decline in imports from

offshored final production ( ) and a 2 percent decline in associated

production workers ( ). There is an almost 9 percent net increase in

the total number of production workers in the industry in Home ( .)

If all Home exports were final products that did not return

to the Home market, then we would have only the positive effect from the

increase in domestic shipments. However, since there is significant trade in

intermediate products and offshoring in the example, then there is also a

negative effect of the increase in import costs on the number of Home production workers.

3.2

Sensitivity Analysis

The values of different parameters affect the net change in

industry employment. Table 2 lists the effects of each of the model’s

parameters on net employment changes in the industry.

Table 2: Effects of

the Model Parameters

|

Symbol

|

Baseline Value

|

Description

|

Effect of an Increase in the Parameter

on the Net Employment Change

|

|

|

0.50

|

Home export share

|

Decrease

|

|

|

1/3

|

Domestic market share of supply chain HHH

|

Decrease

|

|

|

1/3

|

Domestic market share of supply chain HFH

|

Increase

|

|

|

1/3

|

Domestic market share of supply chain FFH

|

Increase

|

|

|

0.9

|

Share of exports that are used as intermediate inputs

|

Decrease

|

|

|

0.25

|

Share of Foreign production that re-enters the Home

market

|

Decrease

|

|

|

5

|

Pareto shape parameter

|

Increase

|

|

|

5

|

Consumer elasticity of substitution between each

firms’ variety

|

Decrease

|

|

λ

|

0.5

|

Relative unit labor requirement in the final

production stage

|

Decrease

|

|

|

0.5

|

Ratio of wages in Foreign and Home

|

Increase

|

|

|

1

|

Share of Home’s domestic

shipments that are import-competing

|

Increase

|

There is a specific reason why each of the parameters

affects employment impacts in the manner it does. The net effect on Home

employment in the industry is greater if its export share ( ) is small, because the negative effect on

exports accounts for a small share of total industry employment. It is also greater

if the import penetration ratios ( and ) are large or the domestic share is small ( ,

because the tariff provides more protection for the domestic industry, and this

has a positive impact on industry employment. The net effect is greater if the

share of exports that are used as intermediate inputs ( ) and the share of these exports

that returns to Home ( ) are small, because the negative employment effect

from the reduction in exports is less important. The net effect is greater if the

Pareto shape parameter of the productivity distribution ( ) is large and the elasticity of substitution

( ) is small, because trade flows are more

sensitive to prices. It is greater if the relative unit labor requirement in

the final stage of production (λ)

is small or the ratio of the wage in Foreign to wage in Home ( ) is large, because under either of those

conditions, the role for offshoring final production is less important. Finally,

the net effect on industry employment is greater if the share of Home’s

domestic shipments that are import-competing ( ) is large, because this magnifies the

positive effect of protection on employment from domestic shipments.

The net change in industry employment also depends on the

time period being examined. The model addresses the firms’ decisions about

whether to participate in different markets and where to locate the various

stages of production. However, these adjustments on the extensive margins of

trade do not occur immediately, and so the model can be best described as a

model of long-run effects. However, the model can be easily converted to one of

short-run effects, by assuming that there are no adjustments on the extensive

margins and that there are no changes in the relative cut-off rules in equations

(52) and (53). Omitting adjustments on the extensive margin reduces the

absolute value of the modeled percentage net changes in industry employment. This

implies that the net changes in employment are magnified by the adjustments on the extensive margins.

4

Data

Requirements

Applying the model to a specific industry requires the

following industry data:

·

Market shares in the Home market

·

Share of Home production that is exported

·

Share of Home domestic shipments that are

substitutes for the imported products

·

Share of exports that are intermediate inputs

subject to further processing

·

Share of exports of intermediate inputs that

return to Home

·

Magnitude of initial variable trade costs

·

Relative unit labor requirements of final

production

·

Wage in Foreign relative to the wage in Home

·

Elasticity parameters and

5

Conclusions

In this paper, we have developed an economic model of barriers

to international trade in an industry with global value chains. We have derived

from the model a relatively simple formula for employment effects that

incorporates industry data on trade and production shares. The model

demonstrates that there are positive and negative employment effects of

impeding trade in global value chain, even within the same industry. The

magnitudes of these effects, and even the sign of the net effect, will vary

industry-by-industry depending on the data, and specifically the pattern of

global value chains.

While the model focuses on employment effects, it can also

be used to estimate the impact on the profitability of firms in the industry,

for example to determine which firms are likely to gain or lose from the

tariff. The sensitivity of each firm’s profits to the tariff depends on the

firm’s global value chain, and specifically on the shares of ,

,

and in its global sales, since the firm’s variable

profits are proportional to its revenue in the model. If the firm supplies the

Home market from all domestic production (an HHH supply chain), then it would

unambiguously gain from the increase in import costs. On the other hand, if the

firm supplies the Home market by offshoring some of its production (HFH and FFH

supply chains), then it would generally lose from the increase in import costs.

If the firm utilizes a mix of these three supply chains, then gains or losses will

depend on the weights in the mix.

Extensions of the model that include additional countries

and stages of production could be especially useful for evaluating the economic

effects of changes in industry-specific rules of origin in trade agreements or for

looking at industries which complex value chains that cross international

borders many times before reaching consumers.

References

Antras, P. and E. Helpman (2004): “Global Sourcing.” Journal of Political Economy 112(3):

552-80.

Di Giovanni, J., A.A. Levchenko, and R. Rancière (2011):

“Power Laws in Firm Size and Openness to Trade: Measurement and Implications.” Journal of International Economics 85:

42-52.

Feenstra,

R.C. and G. Hanson (1999): “The Impact of Outsourcing and High-Technology

Capital on Wages: Estimates for the U.S., 1979-1990” Quarterly Journal of Economics 114(3): 907-940.

Feenstra, R. C. (2008): “Offshoring in the Global Economy.”

Ohlin Lecture at the Stockholm School of

Economics.

Feenstra, R.C. (2016): Advanced

International Trade, 2nd Edition. Princeton, NJ: Princeton

University Press.

Grossman, G.M. and E. Helpman (2005): “Outsourcing in a

Global Economy.” Review of Economic

Studies 72(1): 135-59.

Grossman, G.M. and E. Rossi-Hansberg (2008): “Trading

Tasks: A Simple Theory of Offshoring.” American

Economic Review 98 (5): 1978-97.

Helpman, E., M.J. Melitz, and S.R. Yeaple (2004): “Export

Versus FDI with Heterogeneous Firms.” American

Economic Review 94(1): 300-316.

Melitz, M. J. (2003): “The Impact of Trade on Aggregate

Industry Productivity and Intra-Industry Reallocations.” Econometrica 71: 1695-1725.

Wright, G. (2014): “Revisiting the Employment Impact of Offshoring.”

European Economic Review 66: 63-83.